There is a ton of good information in this quarterly report (link to PDF here, or in full at the bottom of this post). Goldman looks at 687 funds with $500 billion in long stock positions. Similar to a lot of what we do on AlphaClone.

They examine a few strategies that historically outperform the S&P500. The first is a strategy of buying the 20 most concentrated stocks (defined as hedge funds owning X% of the company). This has beaten the market by 14% a year since 2001. The 20 current stocks are:

SHLD

AN

AZO

CF

CBG

JAVA

NYT

AKS

MA

ETFC

CTL

SLM

AYE

GT

HAR

LIFE

WYE

ANF

MBI

CIEN

The highest concentration of stocks <$1billion market cap is:

FDML

LORL

ARII

RDEA

VIRL

AMV

AMAG

TSTR

CHRD

SUAI

Another strategy is the VIP list. This looks at the 50 stocks that most frequently appear among the largest 10 holdings of hedge funds with 10-200 holdings. This strategy has historically beaten the market by 2.8% a year since 2001. The top 10 are:

BAC

MSFT

AAPL

GOOG

JPM

PFE

QCOM

RIG

You can play around with these and many most similar strategies over on AlphaClone.

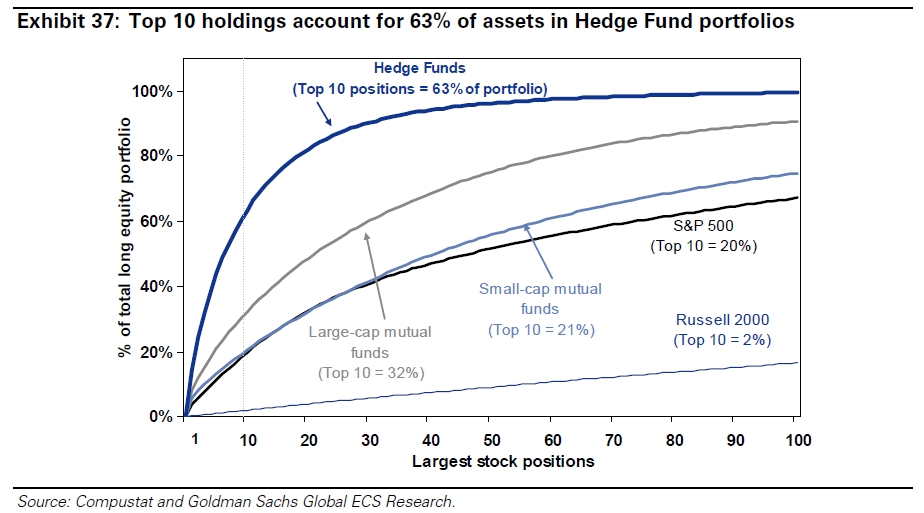

And probably my favorite graphic, here is the portfolio density of hedge funds vs. mutual funds. If you recall from the academic literature, you want the concentrated funds and not index huggers.

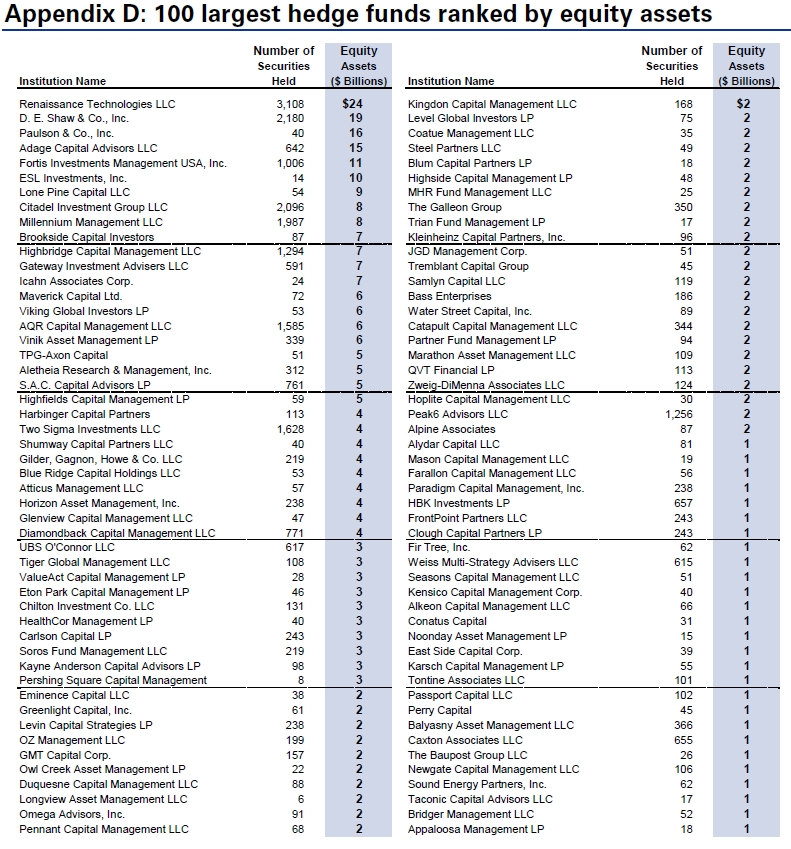

The 100 largest hedge funds by equity assets: