There has been a lot of coverage in the media on the Harvard and Yale endowment returns for 2009 (Bloomberg, WSJ, Barron’s, NYTimes, Dealbook, CNBC, etc)

In an earlier post I examined the performance of the endowments (estimated) versus some publicly traded asset classes, allocations, and tactical models. Below I update the post with the final numbers, and then to expand a bit and see exactly what a difference this past year made.

Most commentators focus on the headline generating losses, but take note of the following observation – Harvard and Yale were in line with stocks for 2009 (-25.95%), and beat REITs (-40.62%), commodities (-59.68%), and foreign stocks (-30.96%). The trailed US government bonds (7.10%). Even after including 2009, Harvard and Yale have beaten stocks since 1985 by over 3% with less volatility.

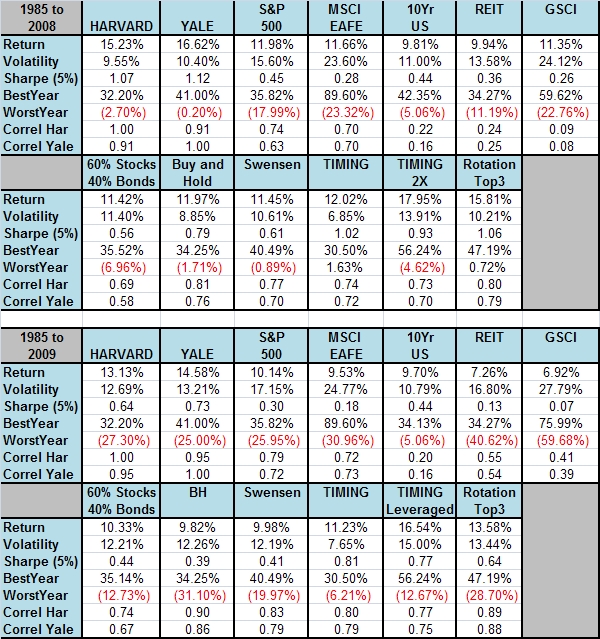

Below are some returns from the endowments from 1985-2008, followed by 1985-2009 (and remember these are for fiscal year ending June 30th!!):

(Data sources: Global Financial Data, Harvard and Yale Annual Reports)

US Stocks – S&P 500

Foreign Stocks – MSCI EAFE

Bonds – 10 Year US Govt

Commodities – GSCI

REITs – NAREIT

Buy and Hold is an equally-weighted, monthly rebalanced allocation to the above 5 asset classes

Harvard and Yale are announced returns for 2009

60/40 is the traditional 60% stocks, 40% bonds allocation

Timing model is from my 2007 paper, Rotation is from my 2009 book.

Some observations, 1985-2008:

-Harvard and Yale’s returns are highly correlated at .91, suggesting they follow similar strategies and allocations.

-Harvard and Yale beat any one asset class by roughly 3-5%.

-Harvard and Yale beat most indexed allocation models by 4-5% with similar volatility.

-Harvard and Yale are highly correlated to equity markets, as well as a diversified buy and hold including real assets.

Some observations, 1985-2009:

-Harvard and Yale’s returns are even more highly correlated at .95, suggesting they follow similar strategies and allocations.

-The bear markets of 2008/2009 knocked a full 2% off the compounded returns of the endowments.

-Harvard and Yale still beat any one asset class by roughly 3-5%.

-Harvard and Yale still beat most indexed allocation models by 3-4% with similar volatility.

– The endowments’ Sharpe Ratio took a heavy beating, knocking it down to the .6-.7 range from over 1.0. (A nice rule of thumb is that most asset classes have Sharpe Ratios of around .2, a diversified allocation is around .4, and momentum style models can get you up to .7 and .8.)

– The timing model now has a higher Sharpe Ratio than the endowments, largely due to avoiding the bear markets of 2008 and 2009. The leveraged timing model (at 2X at broker call rate) would have outperformed the endowments on an absolute and risk adjusted basis.

-The Buy and Hold allocation now has a whopping .9 correlation to the Harvard and Yale endowments.

Some comments:

What is some of the advice you give individual investors?

1. Diversify across equities, bonds, and real assets. More bonds the less risk you want.

2. Avoid taxes.

3. Avoid fees.

4. Index.

A simple portfolio we advised in the book was:

US Stocks: VTI, SPY

Foreign Stocks: VEU, EFA

Bonds: BND, AGG

Real Estate: VNQ, IYR

Commodities: GSG, DBC, LSC

We further split these allocations into 10 and 20 asset classes in the book. Next,

5. Use risk management (ie the timing model).

6. Seek alpha (via hedge-like mutual funds, AlphaClone, etc.)

Is the endowment model broken?

Just looking at the data, the endowment model has outperformed anything over the time period studied. The biggest criticism for the endowments is that they did not manage their risk, liquidity, and “tail-risk” enough. I think that is a fair criticism. But, in general, diversification works (most of the time).

There is a great paper coming out of a wealth management shop here in LA that deconstructs the Yale returns even further (ie adding value and small cap tilts, a little leverage, etc). They find that most of the outperformance is due to, surprise, the private equity allocation. As we mentioned in the book, is the PE game over now that there is so much competition? TBD.

Is buy and hold dead?

Anyone that makes this statement usually does not have a healthy respect for history if last year changed their opinion of buy and hold. EVERY asset class is great sometimes, and horrendous other times (gold, bonds, S&P 500, foreign currencies, and Argentinean stocks included). Buy and hold has never worked in periods of serious market stress. Just ask those Tulip/South Seas buy and holders.

With a diversified portfolio of world asset classes (or a 60/40 portfolio) I think you need to be able to accept a 50%+ drawdown. With a single asset class or security you need to be able to accept an 80-100% drawdown or total loss of capital. I think using risk management via a trendfollowing method fits me personally.

How is the model allocated now?

You can follow timing updates here.