“You don’t want to be average; it’s not worth it, does nothing. In fact, it’s less that the market. The question is, ‘How do you get to be first quartile?’ If you can’t, it doesn’t matter what the optimizer says about asset allocation.” – Dr. Allan Bufferd, CIO of the MIT endowment in Foundation and Endowment Investing.

While Dr. Bufferd was talking about investing in private equity, the same applies to hedge funds as well. (We have two extensive chapters on the topic in my book.) I wanted to chat a bit about hedge funds, and then more specifically hedge fund clones. I have written a bunch of articles on hedge fund indexing and replication in the past, and there has been a lot of chatter recently about hedge fund clones:

Top Hedge Fund Clones Add to Fee Pressure

The Scourge of Hedge Funds: Attack of the Clones

Clones Should Have Hedge Funds Running Scared

and a couple recent white papers:

Performance of Passive Hedge Fund Replication Strategies

How do Hedge Fund Clones Manage the Real World

But, the biggest problem to me that all of these papers and articles miss is:

“Should we be cloning hedge funds in the first place?”

Meaning, to add an asset to a portfolio it needs to increase the risk-adjusted return. While hedge funds used to be seen as outperformance products, in many cases now they are seen as risk reduction products. 2008 SHOULD HAVE been their year to shine, espically FOFs, but they failed miserably (both down around 20%).

So, let’s be objective and take a look at the data. And remember, I love the hedge fund industry and especially individual hedge funds.

I wrote an article a couple years ago in the UK magazine The Technical Analyst making the case that the hedge fund indexes are not a good option for the diversified investor.

One of the problems with defining hedge fund performance is that there is no index like there is for other asset classes. Because a hedge fund is a private partnership, there is no requirement to report or disclose performance numbers. There are numerous firms that compile their versions of hedge fund indexes, each with different rules. They have different numbers of underlying funds (60 – 5,000), some collect the data themselves while some do not, some include managed futures and some do not. No one really knows how many funds are in existence.

A database is simply a collection of hedge funds and their returns, and very likely will be replete with survivorship and backfilling biases. In a recent study, PerTrac estimates the number of funds from 11 databases at 22,000 (although after ‘08 that has to be a lot less). The estimating is complicated by the fact that a single manager can manage several hedge funds. Very few funds report to more than two or three databases, and only one reported to all of them. Over half of the funds only reported to one database.

Some of the biases included in the databases are:

Selection—Manager can choose if and to what database he reports

performance.

Survivor—Hedge fund managers no longer in existence may be excluded from the database. This can include funds that blew up as well as funds that stopped reporting due to good performance.

Backfill—Database provider backfills performance history of hedge fund introduced into index.

Liquidation—Funds that go out of business stop reporting performance in advance of shutting their doors. They are still in the database but their last few months of bad performance are omitted.

Most studies have found that these biases add up to more than 4% in overstated returns. Add that to the fact that most databases only have data for 10 – 15 years, and you can see how these databases have lots of problems (Fung and Hsieh of the London Business School (2006), Malkiel and Saha (2005), Ibbotson and Chen (2005), and Van and Song (2004)).

In contrast to hedge fund databases, hedge fund indices calculate index returns on a going – forward basis, and any additions and deletions are reported in real time. Investable indices, if constructed properly, should be free from these aforementioned biases. When hedge funds are combined into a portfolio, many of the unique and desirable hedge fund features diversify away. Indices no longer resemble hedge funds, but are mainly composed of stock and bond risk.

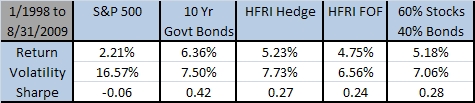

Hedge Fund Research, Inc. (HFRI) publishes indices that track the hedge fund universe back to 1990, and we will examine the relative performance here because it represents one of the longest histories for a hedge fund index. The HFRI Weighted Composite Index (HFRIFWI) is an equal – weighted index of more than 1,600 hedge funds, excluding fund of funds, and results in a very general picture of performance across the hedge fund industry. The HFRI Fund of Fund Composite Index (HFRIFOF) is a similar index with approximately 750 fund of funds included.

A couple of characteristics of the index methodology must be noted. Because the indices are equal – weighted and there is no required asset – size minimum for fund inclusion, the results will be biased to smaller fund returns. There will be some survivorship bias in the results due to poorly performing managers electing not to report their returns once the results turn negative.

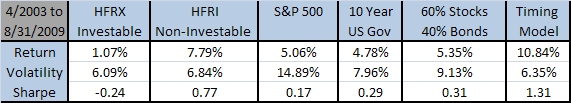

It is difficult to determine the effects of this bias, but a comparison of the HFRX indices (the investable version, available only since 2003) and the HFRI (a financially engineered time series) indices could give a clear view of any tracking error. An analysis we conducted found the effect to be over 4% for each substrategy — a very material difference.

A further examination by Greenwich Alternative Investments found similar results in most of the investable indices. (2007 press release, Johnson) The investable indices will not have the best hedge funds in them because these top performers are sufficiently capitalized and have closed the doors to new investors. One of the problems with the investable indices is that they are constructed with liquidity and investability in mind rather than representativeness of the industry.

Remember, these results must be taken with a grain of salt. With the understanding that the hedge fund indices returns will likely be overstated versus the investable versions, here is the year – by – year results of the HFRI and FOF indices below. (There will also be a slight diversification benefit from the index. It is like a FOF without the fees.)

The results of the HFRIFOF and the HFRIFWI are OK as standalone products. However, adding the HFRIFOF index to a buy and hold allocation does little to improve risk – adjusted returns. The reason is that the risk factors are very similar to a balanced portfolio.

Source: Hedge Fund Research

The investable versions are even worse!

So, why in the world would you want to be cloning these indexes??? Beats me. Anyways, we’ll look at some choices below.

There are three types of hedge fund replicators that try and replicate the hedge fund index returns through statistical or algo trading strategies. The advantages over the indexes are fees (around 1% vs. 2 and 20), liquidity, transparency (although some are getting more and more black box), and no fraud risk.

There are over 20 products being offered by 17 investment companies! The AlphaClone blog has a great examination of the performance of the investable clones here.

They are in my preference order of least to most useful:

Factor based – This type of replicator attempts to use a basket of common factors (US Dollar, stocks, bond spreads, etc) combined with linear or non-linear regressions to replicate the index. Jager and Wagner (2005) and Hasanhodzic and Lo (2007) have done a lot of work here. This is a backward looking exercise in data mining if you ask me

Distribution based (also called dynamic trading) – Kat and Palaro are the big names here, as well as a paper by Papageourgiou, Remillard, and Hocquard (2008). No longer looking to replicate the time-varying beta of the hedge fund indicies, these models attempt to replicate the distributional properties relative to a portfolio. It’s like you say you want X return, Y volatility, Z skew, and P kurtosis. It’s like an all moment optimizer. This, in my opinion, should be in a totally different class since you don’t really have to benchmark it to hedge funds at all (probably a good thing). I actually have no problem with these replicators. Wallerstein shows the top 2 performing funds are, no surprise, distribution based.

Rules based – This type of replicator is my favorite. In this strategy you simply attempt to replicate the hedge fund strategies with simple algos. This makes sense on a narrow level, ie merger arb (simply buying all the acquirees and shorting the aquirers Mitchell and Pulvino(2001)), managed futures (S&P DTI Index), convertible arb, fixed income arb (Durate, Longstaff, and Yu (2007)), etc. Bridgewater has a lot of good papers out on the subject including one here.

Again, at the end of the day you want the non-diversifiable attributes of hedge fund managers (alpha!!), or else you’re better off with a diversified strategic allocation.

That’s one of the reasons we founded AlphaClone, namely, you want to go after the alpha of the managers. AlphaClone represents an entirely new category of hedge fund replicator – holdings based. Versus traditional hedge fund replicators it has even more advantages (below). And check out the blog post here for a comparison of performance vs. some of the replicators…

| AlphaClone | HF Replicators | |

| Returns | Alpha based | Beta based |

| Fees | None | 1-2% / annum |

| Model Transparency | Fully transparent | Black box in many cases |

| Holdings Transparency | Fully transparent | Varies |

| Tax Effieciency | Can be tax managed / harvested | Active trading, not efficient |