The financial media have been all over the recent Galleon insider trading case (WSJ, ClusterStock, Fortune, HuffPo, etc). I’m actually a little surprised we don’t see more insider trading allegations – most of the hedge fund industry is built around information arbitrage. I remember reading one of Cramer’s first books and thinking, wait, isn’t how he makes most of his money simply insider trading? There is a TON of grey areas here, and entire businesses built around expert networks to deliver that info.

Anyways, investing in hedge funds is increasingly becoming a headache – just ask all of the investors stuck in Galleon’s funds (that are rumored to be shutting down this Friday). We track Galleon over at AlphaClone, and interestingly enough, it is a horrible fund to track through 13Fs. The main reason is the massive turnover, about 70% PER QUARTER. It is very clear that this fund is not engaging in long term fundamental analysis, but rather shorter term information arbitrage, ie is AAPL going to beat estimates, is GOOG making an acquisition, etc. We now know that information arbitrage was simply insider info by another name.

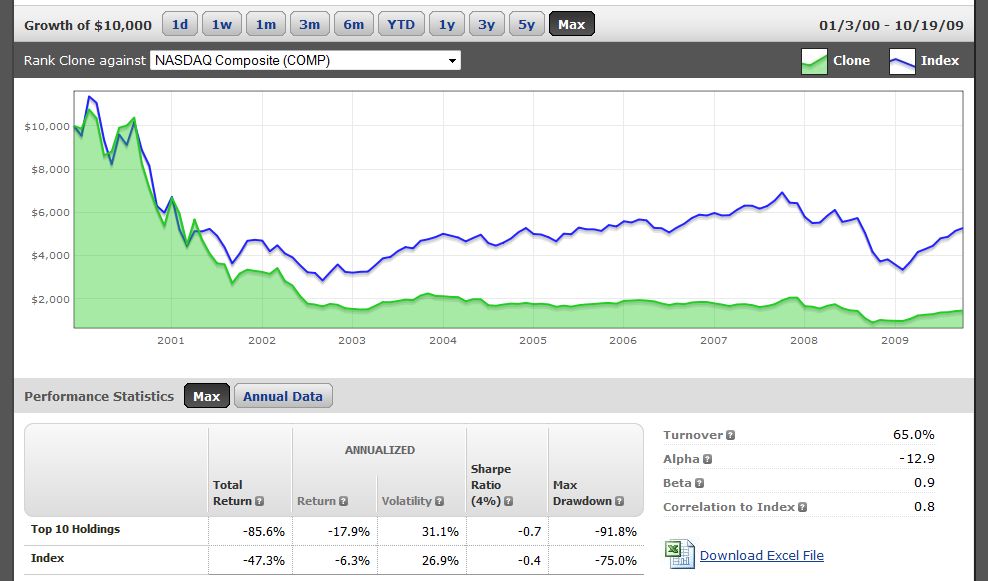

Below is an equity curve of following Galleon since 2000, top 10 holdings, equal weighted and rebalanced quarterly when the filings become publicly available. The clone underperforms the benchmark Nasdaq Comp (Galleon is mostly tech oriented) by a whopping 9% a year.

So, even if you invested in Galleon’s holdings (although you wouldn’t because of the turnover and underperformance), you could liquidate them immediately, and not get hammered with your 30 day redemption as the other hedge funds short the life out of your stocks. The top 50 holdings are at the end of the article.

Galleon Clone equity curve:

Source: AlphaClone

Benefits and drawbacks to using 13F filings instead of direct investing in a hedge fund.

Some potential benefits of the 13F strategy versus allocating to fund managers include:

- Fees – most hedge funds charge 2% and 20% (and a FOF layers on another 1% and 10%). The FOF investor would have to return 7% of alpha just to deliver a 10% to the end investor.

- Access – many of the best hedge funds are not open to new investment capital.

- Fraud & Transparency – risk is eliminated (Madoff, Galleon).

- Tax Management – hedge funds are typically run without regard to tax implications, while the 13F investor can manage the positions in accordance with his tax status.

Potential drawbacks of the 13F strategy versus allocating to a hedge fund manager include:

- Expertise in portfolio management – The investor does not have access to the timing and portfolio trading capabilities of the manager (could also be a benefit).

- Exact holdings – Crafty hedge fund managers have some tricks to avoid revealing their holdings on 13Fs – shorting against the box and moving positions off their books at the end of the quarter are two of them. The lack of short sales, international holdings, and futures reporting means that the results will differ from the hedge fund results.

- Forty-five-day delay in reporting – The delay in reporting will affect the portfolio in various amounts for different funds due to turnover. At worst, an investor could own a position the hedge fund manager sold out of 45 days ago.

- High turnover strategies – Managers who employ pairs trading or strategies that trade futures are poor candidates for 13F replication.

- Arbitrage strategies – 13F filings may show that a manager is long a stock, when in reality he is using it in an arbitrage strategy. The short hedge will not show up on the 13F.

There are numerous other ways an investor can utilize SEC 13F filings from top managers to generate ideas and alpha. Portfolios can be created with static or dynamic hedging, as well as focusing on specific sectors and market capitalization tranches.

Galleon top 50 holdings:

| Name | Ticker | |

| 1 | EBAY INC | EBAY |

| 2 | GOOGLE INC | GOOG |

| 3 | APPLE INC | AAPL |

| 4 | OSI PHARMACEUTICALS… | OSIP |

| 5 | BANK OF AMERICA COR… | BAC |

| 6 | JP MORGAN CHASE & CO | JPM |

| 7 | CISCO SYS INC | CSCO |

| 8 | SPDR S&P 500 | SPY |

| 9 | DELL INC | DELL |

| 10 | NVIDIA CORP | NVDA |

| 11 | E M C CORP MASS | EMC |

| 12 | WYETH | WYE |

| 13 | PEPSI BOTTLING GROU… | PBG |

| 14 | MEMC ELECTR MATLS INC | WFR |

| 15 | First Solar Inc | FSLR |

| 16 | VERISIGN INC | VRSN |

| 17 | YAHOO INC | YHOO |

| 18 | ELECTRONIC ARTS INC | ERTS |

| 19 | SPDR Gold | GLD |

| 20 | INTEL CORP | INTC |

| 21 | QUALCOMM INC | QCOM |

| 22 | COGNIZANT TECHNOLOG… | CTSH |

| 23 | FORD MTR CO DEL | F |

| 24 | NATIONAL SEMICONDUC… | NSM |

| 25 | NETEASE COM INC | NTES |

| 26 | SUNTRUST BKS INC | STI |

| 27 | TYCO INTERNATIONAL LTD | TYC |

| 28 | TERADYNE INC | TER |

| 29 | RESEARCH IN MOTION LTD | RIMM |

| 30 | ALCON INC | ACL |

| 31 | HEWLETT PACKARD CO | HPQ |

| 32 | VISA INC | V |

| 33 | AMAZON COM INC | AMZN |

| 34 | BIOGEN IDEC INC | BIIB |

| 35 | NOVELLUS SYS INC | NVLS |

| 36 | ANADARKO PETE CORP | APC |

| 37 | COMMSCOPE INC | CTV |

| 38 | FTI CONSULTING INC | FCN |

| 39 | PEPSICO INC | PEP |

| 40 | ABERCROMBIE & FITCH CO | ANF |

| 41 | F5 NETWORKS INC | FFIV |

| 42 | LAM RESEARCH CORP | LRCX |

| 43 | LEXMARK INTL NEW | LXK |

| 44 | GAP INC DEL | GPS |

| 45 | Seagate Tech | STX |

| 46 | YINGLI GREEN ENERGY… | YGE |

| 47 | RADIOSHACK CORP | RSH |

| 48 | KLA-TENCOR CORP | KLAC |

| 49 | FIDELITY NATIONAL F… | FNF |

| 50 | ALLERGAN INC | AGN |