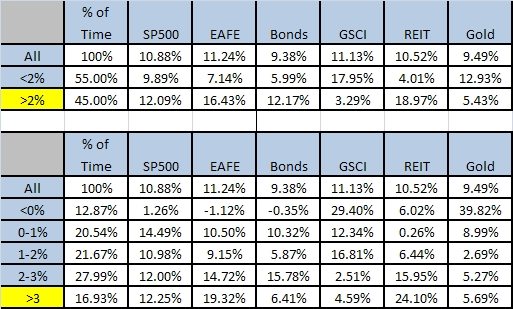

Here is an old post where we took at a look at investing based on the yield curve. I updated the charts here with more and less granularity. From the tables one could infer that stocks and especially REITs love a good ol steep yield curve like we have now. Annualized average monthly returns from 1973-2009 (although it is missing the last two months of 2009). Check out that commodity and gold performance when yield curve is negative.