Think a market has corrected long enough? Jumping into the market too early can be hazardous to your health. . .

I use both mean reverting and trendfollowing (momentum) techniques. One of the problem with mean reversion is that markets can continue in one direction for a loong time (just ask LTCM). One of the studies I researched last year was what happened to asset classes after negative years. Actually losing money is much more painful than simply underperforming. (Link to original posts here, here, and here.)

The only 4 countries that had negative returns two or three years ago at the beginning of 2007 were (and subsequent 2007 returns):

Iran (2005) 10.22%

Peru (2004, just barely) 90%

Thailand (2004, and 2006) 36.63%

Venezuela (2005) -33.8%

Average: 25.76

vs. EAFE 11.6% and EEM 39%

Countries with negative years 2 or 3 years ago at the beginning of 2008 are:

Iran (2005)

Japan (2006)

Jordan (2006)

Latvia (2006)

Israel (2006)

Thailand (2006)

Venezuela (2005)

Japan is looking great in 2009 after down years in 2006 and 2007. The median return from our study after down years two AND three years ago was 19% (vs ~12.66% for all observations). And if Japan has a down year this year, watch out in 2009 – the median return after three down years in a row was 25.78%! (Latvia is the only other country down both of those years.)

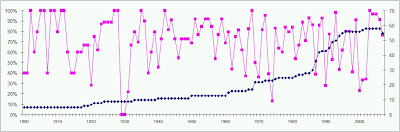

The % of the 50-60 stock markets (Blue line) I track around the globe that registered positive performance declined to around 75% from the back to back to back to back 90%+ years(Pink line).