Just out from my friend Peter Mladina of Waterline is a fun paper coming out in the upcoming Journal of Wealth Management Summer Edition. He splits the Yale allocations into much more granularity than I did in my book (and also adds leverage and factor tilts) with some interesting results and conclusions.

I don’t see it up on the web or SSRN yet anywhere for free, but you can buy it here for (gulp) $45.

Abstract

In this article, the authors examine the underlying factors that drove the outsized performance of the Yale University Endowment over the past two decades. With the aid of the Endowment’s published asset allocation targets and their own “Proxy Portfolios” designed to replicate the Endowment’s exposure to common risk factors, they were able to delve fairly deeply into the drivers of the Endowment’s returns. As the authors observed the Endowment’s gradual transition from a conventional public markets strategy to one capitalizing on alternative investments—notably private equity, real assets, and hedge funds—it became apparent that much of the putative case for the Endowment’s performance, the skill of its active managers, was not entirely correct. This article suggests that heavy exposure to common equity risk factors and manager skill in private equity drove the Endowment’s sizable returns. These key findings have significant implications for investors who are seeking manager skill across asset classes.

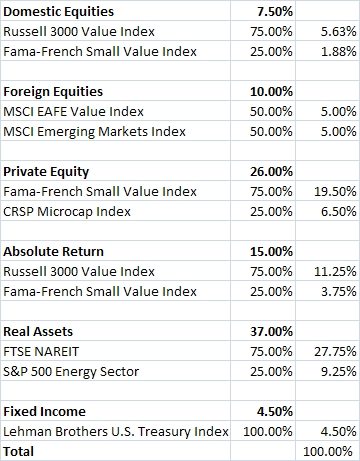

Below is a table with the suggested allocations, and the percentages those indexes would receive with the current Yale allocation.

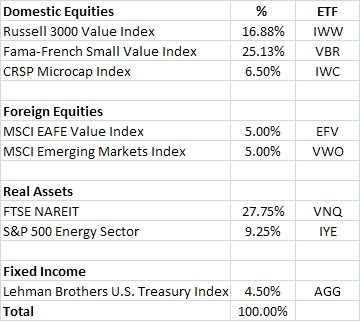

The second table sums a few of the repeats, then lays out some sample ETFs one could use. The big difference with my book is that I exclude Private Equity and Hedge Funds then normalize the allocation. The result is that Mladina’s allocation is higher in US equity and real estate, and lower in bonds, foreign equities, and energy. (He also applies some factor tilts to the portfolio.) I also added the .5% cash allocation into the bonds.