I was having dinner with a RIA in Malibu (David Kreinces of ETFPM) a couple weeks ago when the topic of fees came up. We agreed that investors should pay very little for buy and hold portfolios. In general, I think 25-50 bps is a fair fee especially if the advisor is tax harvesting the portfolio. David however told me something that I have never heard of in the industry – he charges nothing. His model is to manage core buy and hold portfolios for free, and to charge for his alpha portfolios. (I have no benefits to mentioning this other than I think it is interesting and unusual.)

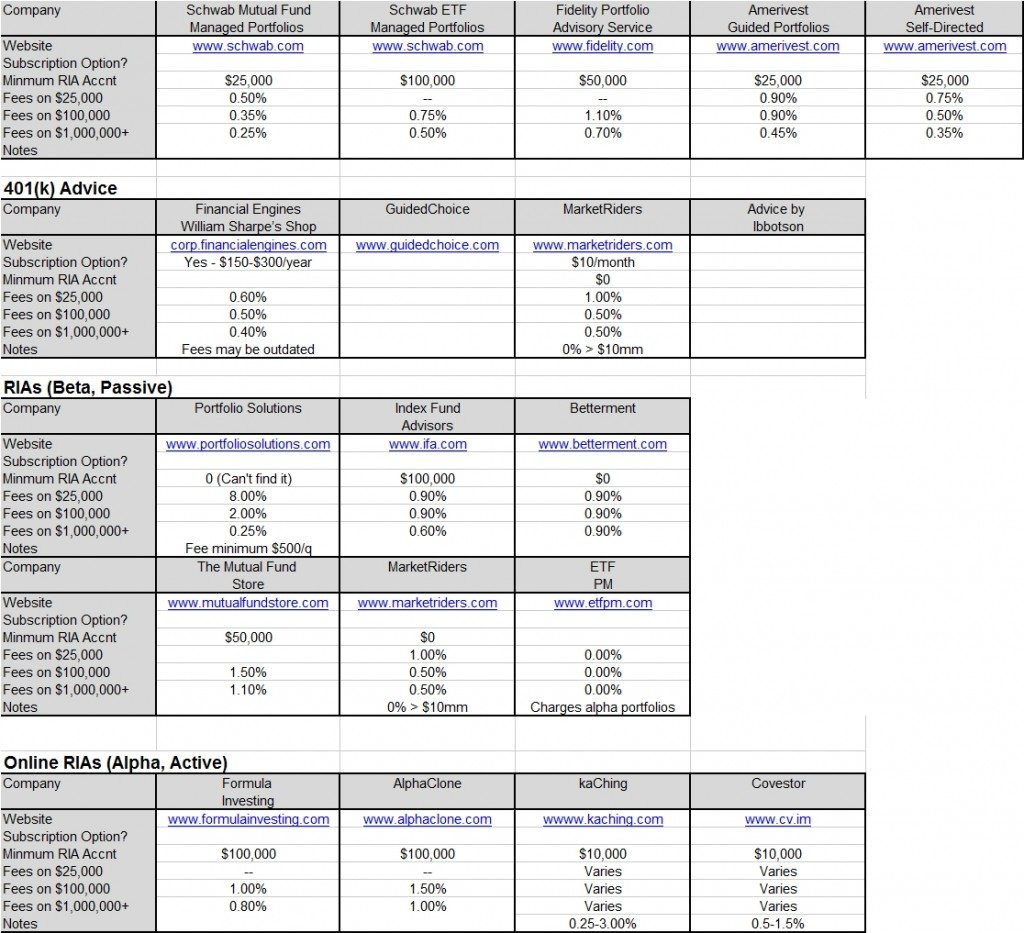

Having seen the new company Betterment get a ton of press for its new site (where it charges a whopping .9% fee for buy and hold accounts), I thought I would do a roundup of some of the buy and hold allocators out there and their fees. If I missed any, or the fields are incorrect, please let me know and I will update the tables. Pretty amazing the wide disparity, but the trend in general is – they charge too much!

(Note: Covestor just updated their business model today and I haven’t had a chance to review yet.)