Nice article out of Arends in the WSJ on Bruce Berkowitz’s Fairholme fund:

How is Bruce Berkowitz making your mutual fund managers look bad? Easy. By doing all the things they say can’t be done. Most fund companies say you can’t time the market. He has. They say you shouldn’t hold lots of cash in an equity fund. He does. They say you mustn’t put too much money into a few stocks. He does that, too.

It will be interesting to see if he can keep it up with $15b in AUM rather than just $1b….

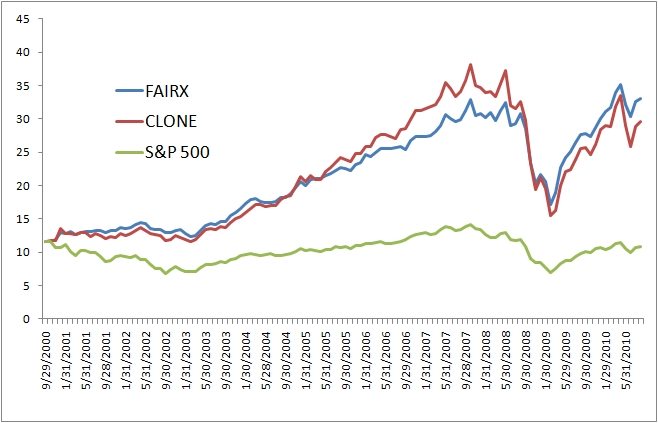

Below is some nice evidence of the efficacy of using AlphaClone to track value oriented managers. The equity curve below takes his top 10 holdings and rebalances them quarterly five days after the positions are disclosed publicly through 13Fs. As you can see it does a great job of tracking the underlying fund. (Start date is 9/2000 from Yahoo Finance.)