There are lots of ways to (try and) reduce risk in a portfolio. Adding (truly) non-correlated asset classes, using risk management and tactical trading models, hedging with derivatives, etc are all possible solutions. In our newest paper we talked about a few different ways to mitigate risk other than just using the trendfollowing methods of the first paper.

However, there is one really simple way to reduce risk further, and that is to simply put less$ at risk in the first place.

That is, invest more in bonds or cash.

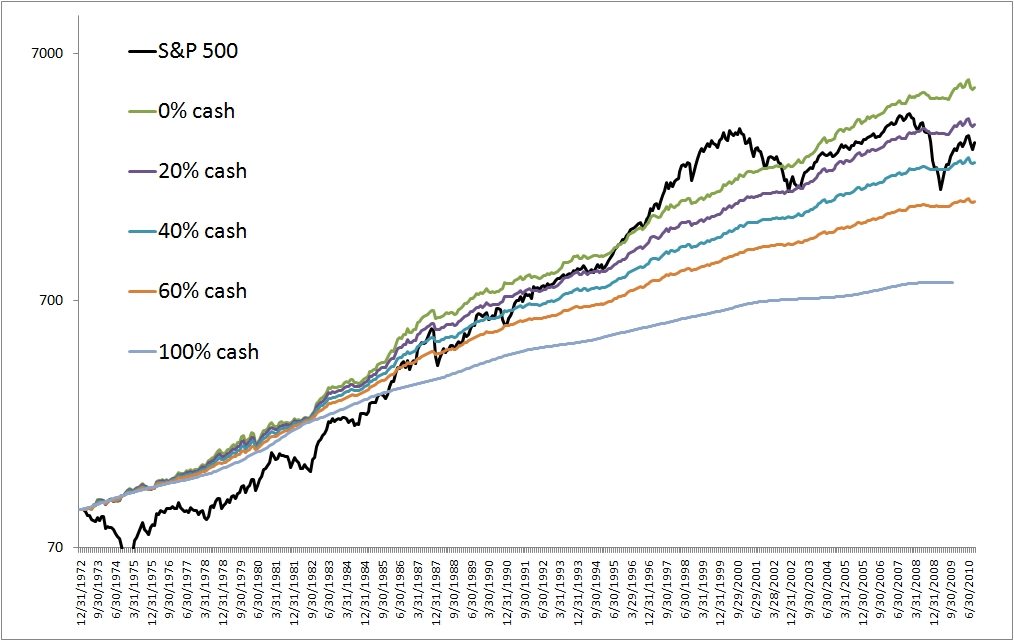

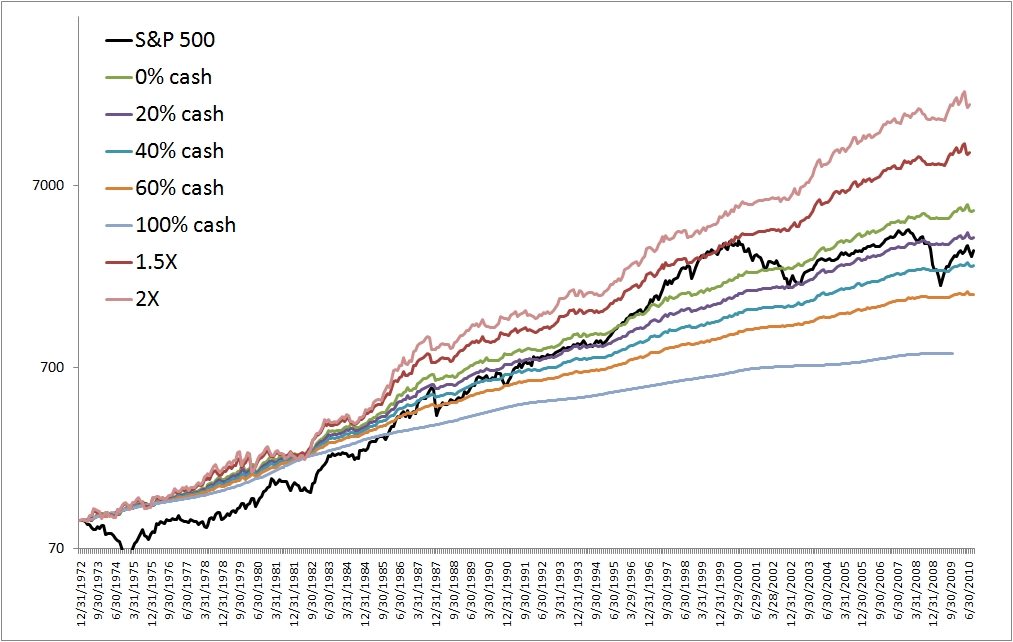

Below is the effect of placing part of your portoflio in the simple GTAA strategy with the rest in T-Bills (included in the chart is the effect of leveraging the GTAA strategy which has the opposite effect – much higher returns with increases in vol and maxdd).

As you can see the returns are reduced but the equity curve gets smoother and smoother as more cash is added. The 40% cash bucket still returns 9% compounded over the period (roughly in line with stocks) with 4% volatility and a maxDD of 5%. Not only that, investors willing to enact this strategy over long periods could have picked up some more yield by moving out the yield curve or holding a more diversified fixed income portfolio. Below is the added chart with leverage:

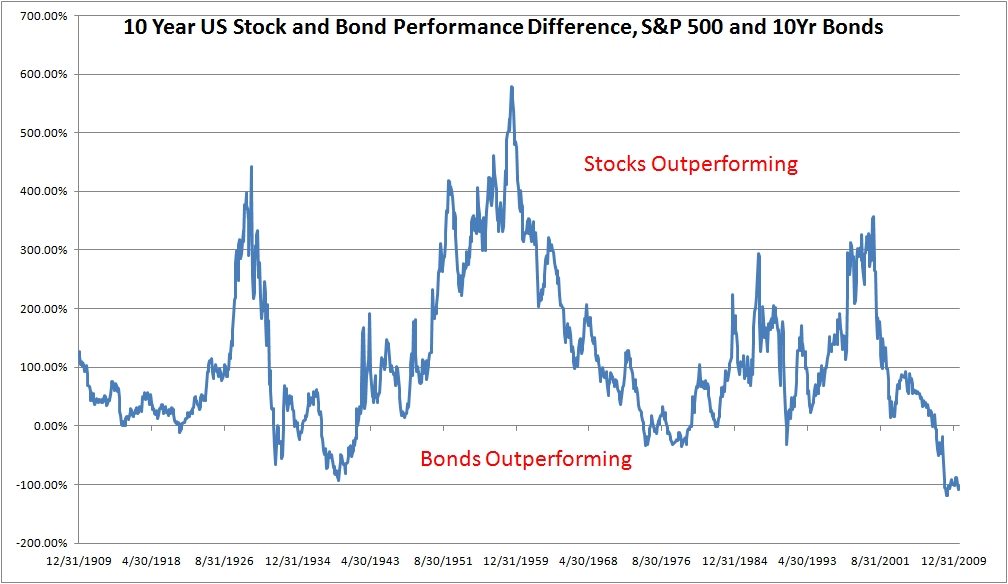

Now, one of the problems enacting that strategy right now (for those learning they now have too much risk in their portfolios) is that T-Bills yield next to nothing and stocks have been underperforming bonds mightily over the past decade. Below is a chart of the 10 year rolling total returns for US stocks and 10 year govt bonds:

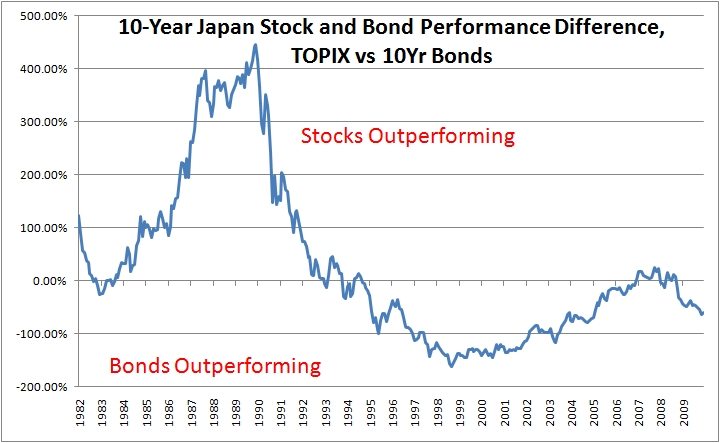

While that looks like everyone should short bonds and get long stocks, remember that these conditions can last for awhile…and in Japan’s case it did for nearly a decade: