There have been more and more hedge-like funds coming to market lately through either ETFs or mutual funds. I didn’t know that Altegris launched a managed futures offering until I was searching for another managed futures ETF (WisdomTree). Unlike some funds that are running the strategy internally (like AQR, AQMIX) Altegris is allocating to the underlying managers. The upside is that they have some top names in the space (Winton, Abraham, and QIM). The downside is that you are paying 2% fees (roughly, there are four share classes) on top of the roughly 1% and 20% the funds charge.

Hatteras also has a mutual fund (ALPHX) that allocates to hedge-like strategies (although the names are less well known). AlphaTitans and Chapwood are trying to do something similar (but was private placement to RIAs etc). There have been others that have not been successful (Geronimo).

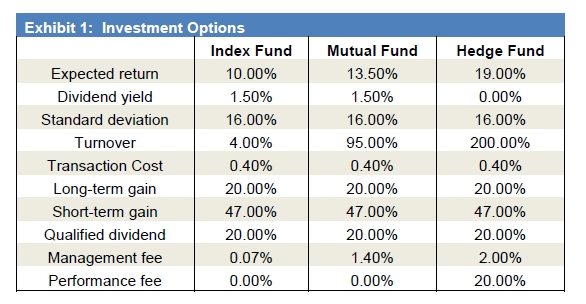

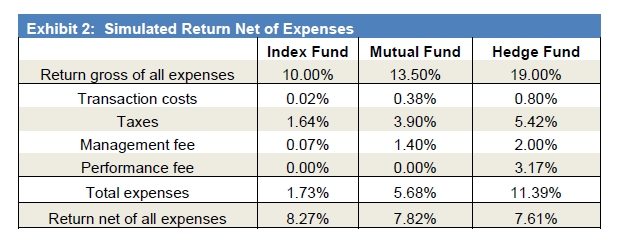

Again, at the end of the day it all comes down to returns after all fees, or, “returns you can eat”. At 2% and 20%, then another 2% management fee you need the underlying managers to return 17% after all trading costs to return a 10% return to the final manager. That is a lot of alpha that needs to be created just to get to 10%…(Not saying that it isn’t possible, just difficult.) BUT, overall I like the trend of more alternatives available to the investor.

Great paper “Rules of Prudence for Individual Investors” by Mark Kritzman of Windham Capital. Table below: