One of the biggest casualties of the 2008/9 bear markets was investors who had portfolios that were not aligned with their timeframe. Many retirees went into the bear markets with portfolios with 50-100% in equity like assets when they had no reason to have any exposure to risk at all. At the same time many institutions ran into trouble because their long timeframes clashed with their short term liquidity needs.

Anyways, one of the biggest disservices at investor can do to their portfolio is to act on a timeframe that is not consistent with their objectives. People often ask me how they should allocate their assets to a new system or portfolio. I say it is totally and 100% situation specific, not only from a CAGR maximization standpoint but also from a psychological well being frame of mind. Simply avoiding the “I should haves” or “I’m brilliants” is important. While I always invest my assets immediately I think scaling into portfolios or allocations is completely reasonable. Pick your timeframe – scale in over X-months, quarters, years, whatever.

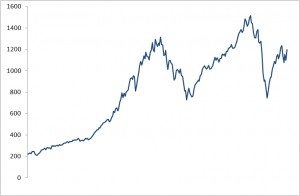

Anyways, below is the same market on four different timeframes. Notice how different the equity curves look as you move out (5 min, hourly, daily, weekly, and monthly bars).

Most of what we do operates at the timeframe of the last two charts.

(Also of interest may be these posts on long term equity valuations, pension funds and mismatched expectations, and poor timing.)