However, valuation is not a timing tool, and the odds of a creature as fickle as the stock market obliging our “rational” analysis are in truth fairly low…While valuations are blunt tools on a cyclical time horizon, they have the unusual property of becoming progressively finer and finer instruments as the time horizon is lengthened. The following study examines ten important valuation tools from the only perspective that should really count in evaluating such tools: Their ability to forecast longer-term stock market returns.

– Doug Ramsey, The Leuthold Group

This is a great quote from the good folks at The Leuthold Group. The take away is that most valuation models (whether in stock markets, currencies, or individual stocks) work well on longer time frames, but it is animal spirits that dominate in the short term. Most of the longish valuation models tend to be in the same ballpark on valuation readings, whether it is Price to Cash Flow, Tobin’s Q, Dividend Yield, or other.

I’ve written quite a bit about fundamental valuation models including the Shiller CAPE and the Hussman models here. Another great post by dShort and Butler Philbrick is here. (Note: the Hussman/CAPE variant is projecting 10 year returns of 5% per annum at future PEs of 15…)

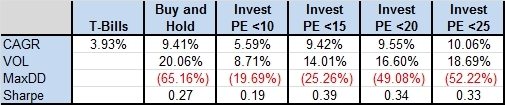

Here is a little experiment. How about we take a look at only investing when the PE is below a certain range? ie I want to be in the market only when the PE is < 15 (or 20, or 25 etc)…at all other times I’ll be sitting in the safety of cash. Sounds reasonable, doesn’t it? Below are the results updating on a monthly update level from 1900-2010.

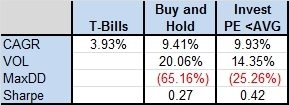

Uninspiring right? The problem is of course the timeframe. The CAPE works great on longer timeframes, and poorly on short ones. The scatter plot on a monthly level of PE vs returns looks like a shotgun blast. What if you looked at it on just a yearly level? Below is the same chart updated once a year.

Similar. By chopping off the highest valuations you get about the same returns but lower your volatility a bit with lower drawdowns (these #s are a little different since they are on a yearly basis, so the MaxDD will be understated). This also isn’t really fair since we know all of the data ahead of time, so now we go and look at what happens if you invested in stocks when the PE was lower than average, but only using the rolling data up until that time (we use the 1881-1900 as the initial average). Not bad, similar results without the datamining.

I would be interested in hearing unique ways in which investors utilize market valuation models in practice.