I’m excited about the addition of a new analyst to the team, Prabhat Dalmia. Prabhat is a recent MBA graduate from UCLA Anderson and has over 10 years of experience in software development and technology consulting experience. He holds a Bachelors of Technology in Chemical Engineering from The Indian Institute of Technology, Kanpur. So far he hasn’t met his match for any sort of research challenge, so if you have any great ideas fire them over…

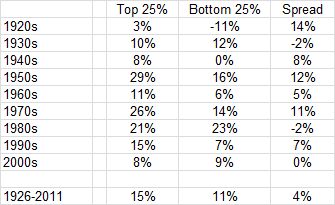

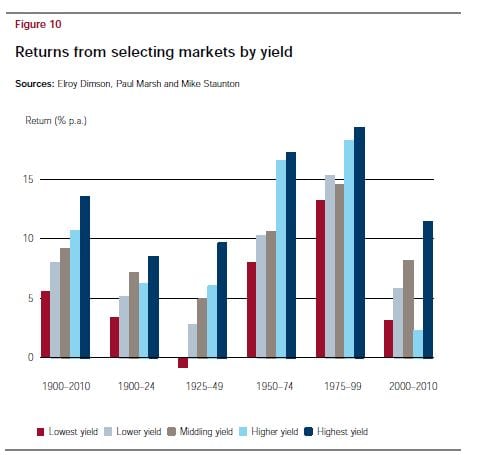

We were playing around with some ideas on country valuations, and below is a simple strategy of sorting countries by dividend yield. The top 25% of countries sorted on yield outperform the bottom 25% by about 4% per annum, rebalanced yearly (all in USD). This work was inspired by the work of Dimson, Marsh and Staunton from Triumph of the Optimists. We don’t have access to their data so we used Global Financial Data, and this included 9 countries to start and 18 by study end. The DMS crew in the 2011 GIRY report found an even larger spread of ~8% across 19 countries from 1900-2010. Nice free download of the Global Investment Returns Yearbook 2011 (GIRY). (Automatically download PDF here.):

(Note: DFA also has a great piece using the DMS data titled “Eight Decades of Risk Parity”, but it is not public but worth a read if you can find it…)

Countries included: Australia Austria Belgium Canada Denmark Finland France Germany Italy Japan Netherlands Norway Spain Sweden Switzerland United Kingdom.

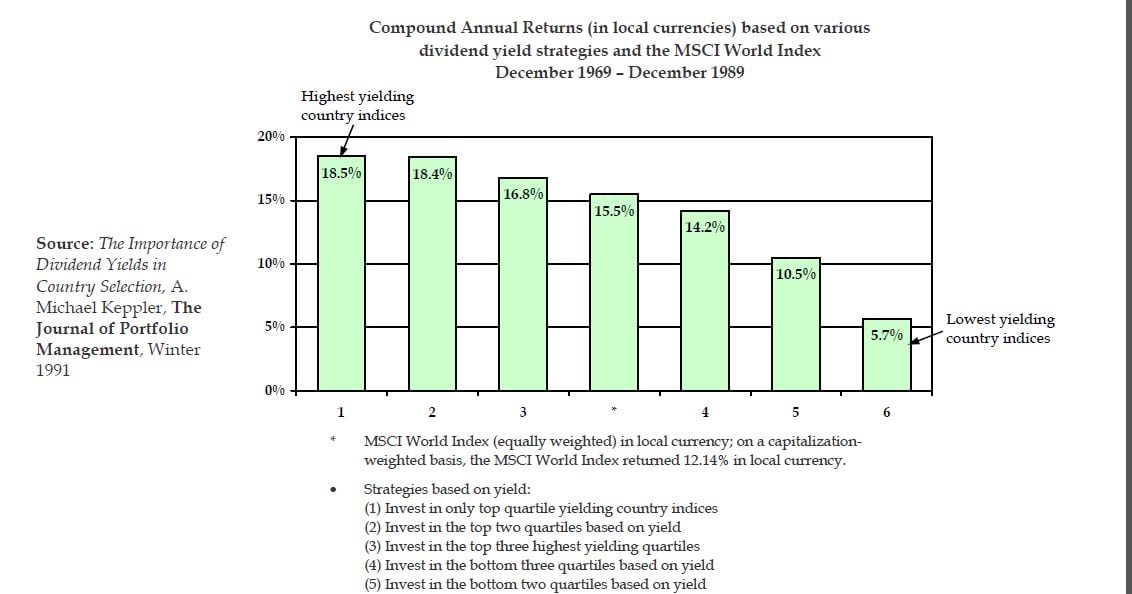

Another study by Keppler found similar results. Lots more in the publication The High Dividend Yield Return Advantage by Tweedy Browne.

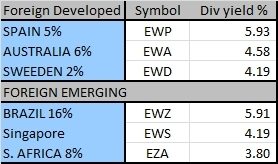

Below are a couple ETFs in foreign developed and emerging with particularly high yields (the %ages next to the country name reflect the % allocation in the EFA and EEM indexes).

(disclaimer: we may own some or all of these for clients):