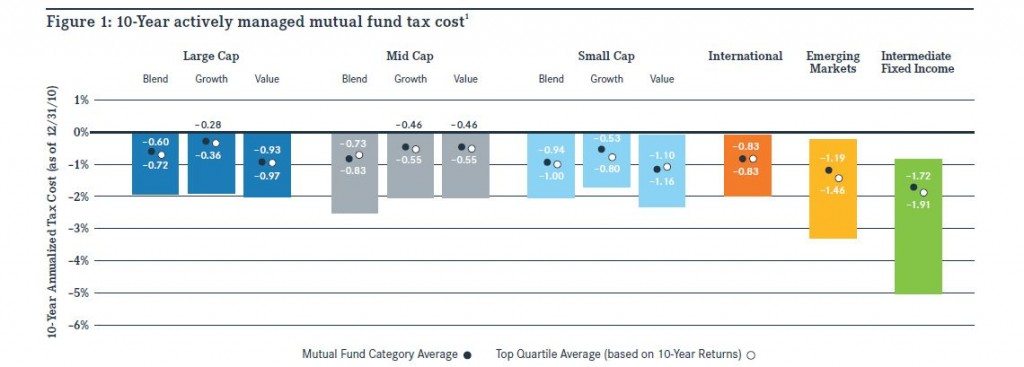

I think this is a really big deal. The average active mutual fund has a 0.3% to 2.0% per year tax disadvantage to an ETF (passive or active).

Was waiting for someone to put out a study like this – Managing Tax Challenges (granted it is by iShares so they are blowing their own horn). Further reading from my buddy Peter Mladina “Portfolio Implications of Triple Net Returns”.

“In 2007, open-end mutual funds paid the largest capital gain distributions on record. That year, 67% of mutual funds paid capital gains while only 3% of iShares ETFs paid capital gains. In 2009 and 2010, 16% and 25% of mutual funds paid capital gains, respectively; only 2% of iShares ETFs paid capital gains in both years.”