We published The Ivy Portfolio back in 2009, and honestly it probably should have been three separate books (investing like the endowments, global tactical approaches to investing, and picking stocks via the 13F tracking of hedge funds). We went with the kitchen sink approach, and now the good news is that you can buy the $50 book for $9 on Kindle which is pretty cool.

I’ve got a good bit of totally new material coming out in the next few months so stay tuned (finally).

Anyways, we spent a chapter educating on 13F investing in Ivy, what works, what doesn’t work. We then have done lots of follow up posts on 13F ideas, and we will update this post from last year with new stats:

The Value of Ira Sohn (Hedge Fund Stock Picks)

There are a lot of people debating the value of stock picking events like the recent charity Ira Sohn Conference. Felix Salmon and David Gaffen debate the usefulness (Felix responds here) and Joe Weisenthal chimes in here.

There is so much misinformation in the 13F space, and most comments are simply not based in a firm understanding of what works and what doesn’t, but rather guesses. But that is what most financial commentary is (ie all of the commentary surrounding buy and hold and market timing, what drives stocks, often has the feel of debating religion or politics). I like reading David, Joe, and Felix but if you want to know what works and what doesn’t in 13F tracking you should be listening to people that have spent many years getting their hands dirty with the data and truly understand what works (and what doesn’t) like Jay at MarketFolly or Maz at AlphaClone or John Heins at Value Investing Insight.

There is also reams of academic papers on the subject including this paper from my friend Wes Gray at Empirical Finance that demonstrates ability to follow managers and disclosures.

Some of the comments:

Gaffen: ”Some of them (following hedge funds) work and some of them don’t…the more complicated you get and the more derivitives you get involved in the less you can follow…the ones that are slightly more straightforward you can follow.” David is spot on here.

Felix: ”Trying to chase hedge fund managers is a fools errand…my big problem in all of this is that you and I have no ability to pick stocks and if we have no ability to pick stocks then what on earth makes us think we have the ability to think we can pick hedge fund managers.” Clearly I disagree.

I am a quant. I used to pour through these filings by hand a number of years ago (take a look at the blog archives back in 2006 and 2007), but being a quant I could never get comfortable with following these managers until I tested them. I had an inkling that it worked but I wasn’t sure. Like Fama says, “if it is in the data”…

…so my intern and I went and backtested 10 funds (Buffett, Blue Ridge, Greenlight, etc) and what we found is that there is huge value in tracking the funds that have lower turnover and derive most of their value from their long stockpicking book. Like Gaffan says, there are some things that work and some that don’t – SAC doesn’t make sense to follow (too active), Rentec doesn’t make sense to follow (derivatives), and if you want more information there is an entire chapter on 13F tracking in my book. The benefits, the drawbacks, what works and what doesn’t.

But like Salmon mentions, 13F tracking rests on two questions:

-Can anyone beat the market?

-Can you pick a manager ahead of time that will beat the market in the future?

Most of the academic literature suggests no to both answers (on aggregate). But does that mean someone cannot answer yes to both questions? Of course not.

We can all backtest until the cows come home but all that matters is real time performance of course.

All data courtesy AlphaClone.

I included a list of 57 funds that I thought would be interesting funds to follow. Out of that 57, 8 were never added to the database. Excluding the never added, the other funds beat the S&P 500 by an average amount of 7 percentage points per year. (Historical research shows that following Buffett since the 1970s would have resulted in >10% outperformance per year – and he has beaten by 8% per annum since ’00. So much for all those detractors that say he isn’t a good stockpicker!)

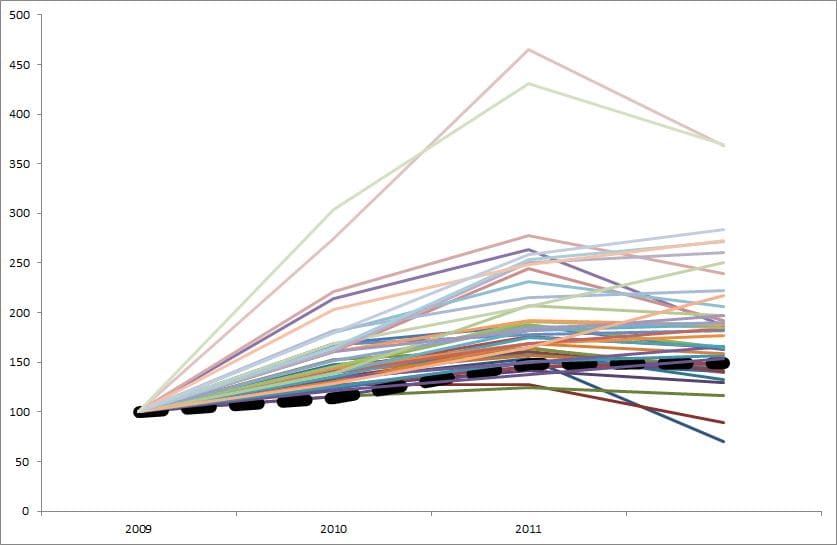

Roughly 70% of the funds beat the S&P500 over the time period. The average fund beat the S&P in 2009 and 2010 before losing about 5% in 2011.

Impressive real time results, and not to mention 13F tracking would have kept you out of Galleon.

So, at the end of the day would you rather listen to Seth Klarman or your local broker when picking stocks?

Top funds that did over 25% a year include:

Eagle, Pabrai, ValueAct, Newcastle, Abrams/Pamet, Baupost, Akre, Tiger, Icahn, Perry, Lone Pine, and Steel.

The worst funds were:

King Street, Tontine, Private, Glenview, Maverick, and Bridger

Here is a chart of all of the funds, and the black dotted line is the S&P 500.

Funds included in analysis:

Greenlight

Blue Ridge

Buffett

Eagle Value Partners (Witmer)

Pabrai Mohnish

ValueAct Holdings

Newcastle Partners

Abrams Capital (Pamet)

Baupost Group

Akre Capital Management

Pershing Square Capital Management

Tiger Global Management

Icahn Capital LP

Perry Capital

Lone Pine Capital

Steel Partners

Fine Capital Partners

Relational Investors

SAB Capital Management

Jana Partners

Appaloosa Management

ESL

Chieftain Capital Management (BW)

Viking Global Investors

Pennant Capital Management

Atlantic Investment Management

Highfields Capital Management

Glenhill Advisors

Cobalt Capital Management

Second Curve Capital

SemperVic Partners (Gardner Russo)

Cannell Capital LLC

Eminence Capital

Trafelet Capital Management

T2 Partners Management

Third Point

Omega Advisors

Chesapeake Partners Management

Bridger Management

Maverick Capital

Glenview Capital Management

Private Capital Management

Tontine Associates

King Street Capital

Defiance Asset Management

Abingdon Capital Management

Alson Capital Partners

Scion Capital

Shamrock Activist Value

Tracer

Barrington Partners

Gotham

Lane Five Capital

Libra Advisors

Thames River

Wyser-Pratt Management

Yaupon Partners