Long time readers know that we take issue with the arbitrary 8% return target for most real money funds. We put out a paper in 2011 titled “What if 8% is Really 0%?” With news that CalPERS returned 1.1% in 2011, I thought I would update a little chart that seemingly would give many investors pause.

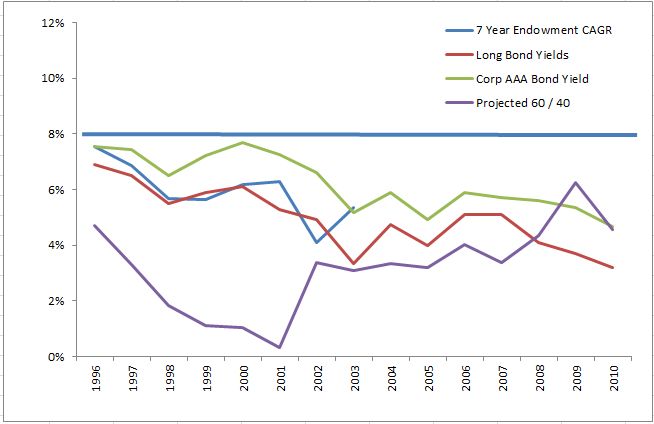

Below is the rolling 7-year return of the average endowment from NACUBO (data through 2010 as 2011 data comes out in February. Also recall endowment year end is in June.) Even though they have experienced years above 8% (1997-2000 all above), on a rolling basis they have YET to exceed 8%. If you compare the returns to simple bond yields it seems obvious that benchmarking your return target to long term or corporate bonds would be more reasonable (but painful). (This analysis also does not consider the exceptional outlier endowments such as Harvard/Yale.)

If you realize most real money funds are also heavily invested in equities, you can then even do a simple Shiller CAPE valuation model to predict equity returns (old post here on some of Hussman’s great work.) We use a 60/40 allocation, and as recent as the summer of 2010 the model predicted meager returns of around 4.5% to the portfolio.

Better ideas than using an arbitrary 8%:

1. Long Bond Yields

2. Corporate Bond Yields

3. Projected 60/40 returns (for those with equity like exposure, can tailor to their exact mix)

A few more good reads from the Barron’s crew here: A High Cost of Low Interest Rates, and A Deep Money Pit