Science and Art of Manager Selection (Barclays)

A Primer on the Euro Breakup (Variant)

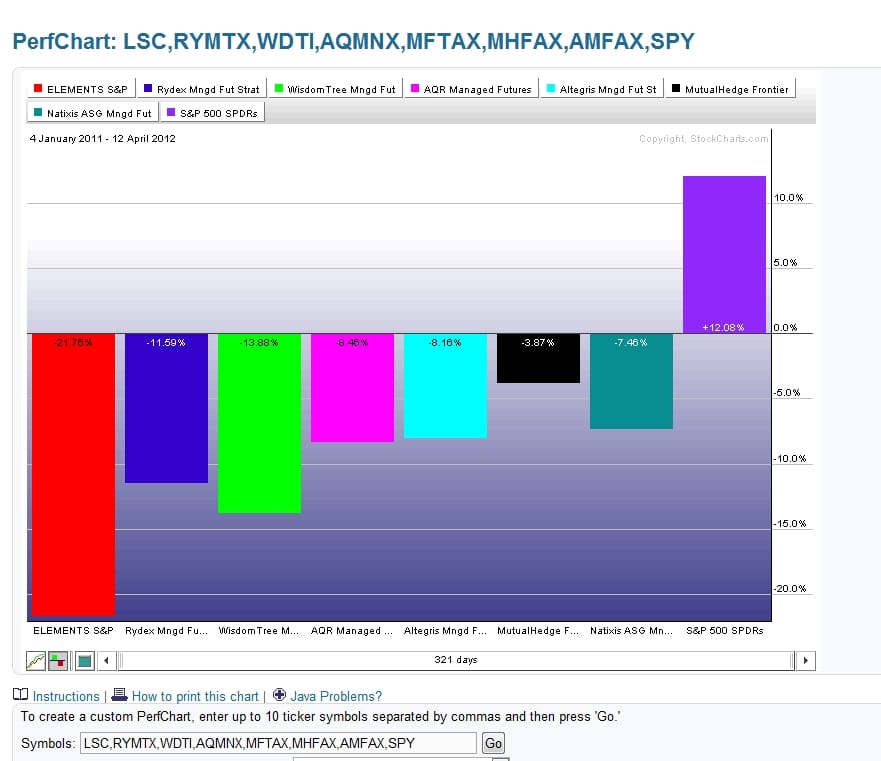

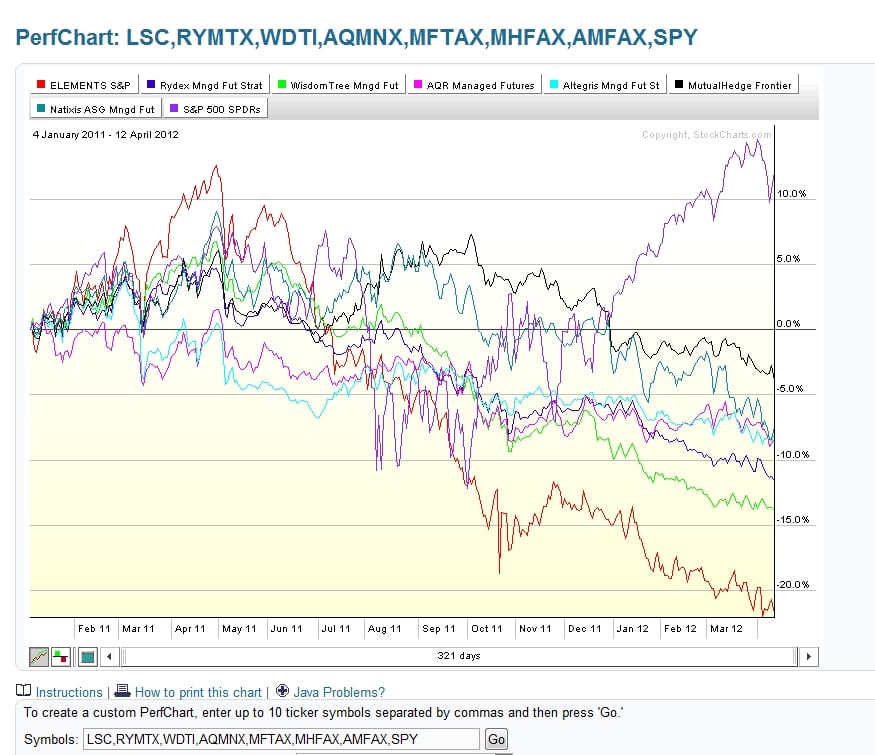

Below is a chart of the top 5 public managed futures by AUM, kind of reminds me of the old Tom Basso article “Buy Them on Sale” (and actually looks like MS getting this right with their recent bump in managed futures allocation recently). I also include the LSC ETN and the WDTI ETF and SPY for comparison.

Historically managed futures (which is usually nothing more than simple trendfollowing) is very expensive and waiting for someone to disrupt. The top 5 managed futures mutual funds have $7billion in AUM while the the average expense ratio is 2.71%. The average sales charge for the A class is 5.75%. Talk about SuperFees!