Most risk based assets got clobbered in May, but the worst was foreign stocks (EAFE and EEM both around -11%).

That would trigger our old reversion system that we wrote about way back in 2007 and 2008, and it has performed great since. Here is a good summary post, and a bit of a rehash below.

The challenge, of course, is not catching a falling (and falling) knife, or as my friend here demonstrates the problem with jumping in too early…

Old post below:

With most equity-like asset classes putting in some terrible numbers for May, I thought we would dredge up some old research on returns following terrible months in asset classes.

I have written about this subject a number of times. For background you can check out some earlier posts linked at the end of the article.

My research has shown that negative returns 2 and 3 years ago produce approximately 6% outperformance in the current year. If you are lucky enough to have 3 down years in a row, the outperformance jumps to well over 10%. (Supported heavily by the academic literature.)

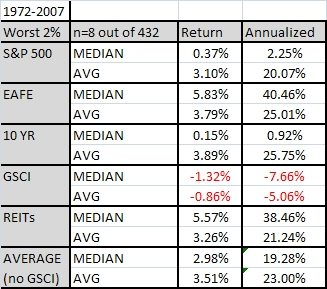

On the monthly time frame, I examined asset class performance after a really bad month.

The take-aways from this study were:

– It does not pay to buy an asset class after a really bad month for the following 1 month.

– 12 Months later the return is not much different than average.

– 3 and 6 month returns, however, are stronger. You pick up on average about 3-4% abnormal returns buying after a terrible month.

A simple strategy would be:

After an asset class has a terrible month, wait a month then take a 2 month position. i.e. after this (probably) terrible month, buy July 1 for a two month hold. Those with a little longer time frame could move out to a 5 month hold.

It looks like a good “trigger” for equity like asset classes is around -10%, and for bonds around -4%. That equates to about the worst 2% of all months. The worst 5% of all months is around a -7% trigger for equities and -3% for bonds.

Below is a summary chart of this strategy for the five asset classes I mentioned in my paper. The returns are simply the excess returns (nets out the average monthly return over the entire time period) to a strategy of buying an asset class a month after a really bad month, with a two month hold.

Note that this does not work for the commodity index, and one could speculate that is due to differing risk premiums and sources of return to that asset class.

Here are the real time results for all the occurences in 2008 and 2009, not bad!

I imagine if you broke out the asset classes into further subdivisions (sectors, countries, etc.), the same principles would apply but the triggers would widen due to the increases in volatility.