Back in the day my firm was going to launch two exchange-traded funds in the Fall of 2008. One was going to be a tactical endowment style ETF, and the other was going to be a foreign listed hedge fund ETN with funds sorted based on discount to NAV.

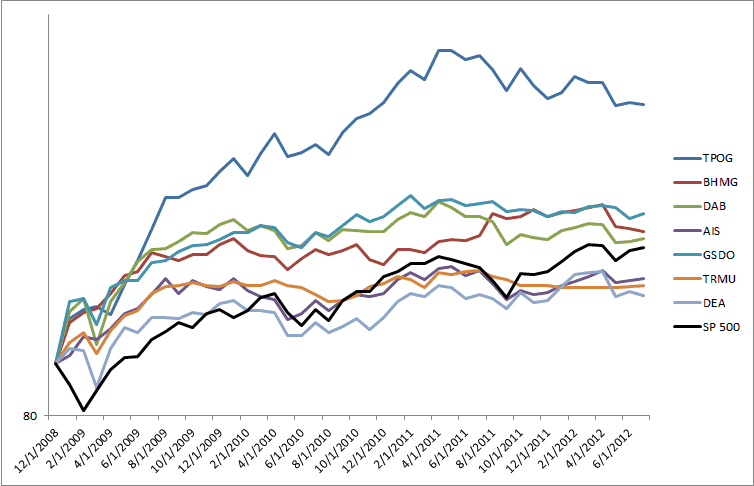

Fast forward and our partners got cold feet as the financial markets were imploding. We wrote a little bit about the foreign listed hedge fund space in our book The Ivy Portfolio, and below are a few of the funds we profiled with performance since 2009 publication. Some have done better than the S&P, some worse, and one much better. That fund is Third Point, and one of the reasons the performance has been so strong is that it was trading at a 30-50% discount to NAV at the end of 2008 as we mentioned back in early 2009. (Foreign listed hedge funds trade like closed end funds do in the US with discounts/premiums to NAV.)

Lots more info in the archives and the blog on these funds. I eventually gave up writing about these funds as very few have/had any interest or even knowledge of their existence, and they are a pain for US investors.

Third Point, TPOG

BH Macro, BHMG

Dexion Absolute, DAB

Alternative Investment Strategies, AIS

Goldman Sachs Dynamic Ops, GSDO

Thames River Multi Hedge, TRMU

Dexion Equity Alternatives, DEA