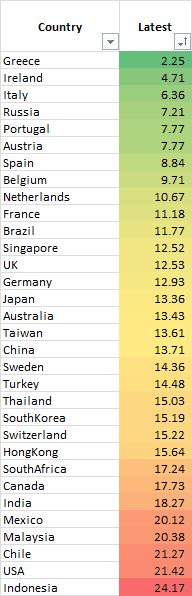

Overall, the equity markets are fairly cheap (updated through August). Background on the below from my new paper Global Value: Building Trading Models with the 10 Year CAPE. I sent this out to The Idea Farm a few weeks ago as well

PS Some of the #s are a bit different than the last update as we are using the MSCI indexes below…

ABSTRACT

Over seventy years ago Benjamin Graham and David Dodd proposed valuing securities with earnings smoothed across multiple years. Robert Shiller popularized this method with his version of this cyclically adjusted price-to-earnings ratio (CAPE) in the late 1990s, and issued a timely warning of poor stock returns to follow in the coming years. We apply this valuation metric across over thirty foreign markets and find it both practical and useful, and indeed witness even greater examples of bubbles and busts abroad than in the United States. We then create a trading system to build global stock portfolios based on valuation, and find significant outperformance by selecting markets based on relative and absolute valuation.

Over seventy years ago Benjamin Graham and David Dodd proposed valuing securities with earnings smoothed across multiple years. Robert Shiller popularized this method with his version of this cyclically adjusted price-to-earnings ratio (CAPE) in the late 1990s, and issued a timely warning of poor stock returns to follow in the coming years. We apply this valuation metric across over thirty foreign markets and find it both practical and useful, and indeed witness even greater examples of bubbles and busts abroad than in the United States. We then create a trading system to build global stock portfolios based on valuation, and find significant outperformance by selecting markets based on relative and absolute valuation.