We’ve been doing a lot of work on longer term valuation metrics, and finding some not so surprising results (buying value works, duh). Shiller has been cranking out some great indexes too, though for the life of me I cannot understand why Barclay’s would launch them as ETNs.

Anyways, here are the sector CAPE values as of last month….Shiller compares them to their long term average, which makes sense given some sectors may be lower growth. I’ve included the median CAPE value as well in parenthesis. As of Q3 end. Bolded are the three cheapest relative to median since 1993. Note Shiller takes top four then drops the lowest momentum.

Consumer Discretionary 25 (24)

Consumer Stapels 22 (22)

Energy 15 (21)

Financials 9 (14 )

Healthcare 18 (24)

Industrials 17 (22)

Technology 26 (28)

Materials 18 (23)

Telecom 18 (14)

Utilities 15 (14)

Background reads:

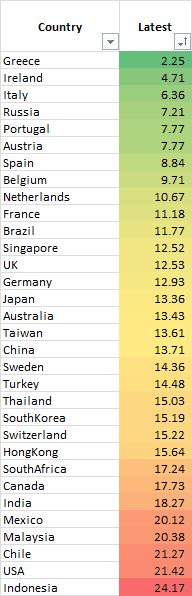

Overall, the equity markets are fairly cheap, although the US is a tad expensive on an absolute and certainly a relative basis. Background on the below from my new paper Global Value: Building Trading Models with the 10 Year CAPE. I sent this out to The Idea Farm a few weeks ago as well.

Over seventy years ago Benjamin Graham and David Dodd proposed valuing securities with earnings smoothed across multiple years. Robert Shiller popularized this method with his version of this cyclically adjusted price-to-earnings ratio (CAPE) in the late 1990s, and issued a timely warning of poor stock returns to follow in the coming years. We apply this valuation metric across over thirty foreign markets and find it both practical and useful, and indeed witness even greater examples of bubbles and busts abroad than in the United States. We then create a trading system to build global stock portfolios based on valuation, and find significant outperformance by selecting markets based on relative and absolute valuation.

As of end Q3.

We were exploring some different options on ways to construct global value portfolios of countries on a macro level, and as a result, here is a really fun paper:

Global CAPE Model Optimization

We’ve been having a lot of fun playing around with CAPE data (extending it to PEG ratios, other indexes, etc). GMO puts out their 7 year asset class forecast that is often eerily accurate.

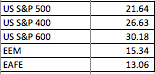

Anyways, we included it below along with our estimates of CAPE values for various indexes and as you can see, broadly they are pretty similar and stairstep in the same direction from most expensive, small caps, to least expensive, emerging markets (our EAFE and EEM only cover about 90% of the universe).