What is a simple way to generate more alpha? Take your alpha strategy, and do the opposite!

The Surprising ‘Alpha’ from Malkiel’s Monkey and Upside-Down Strategies

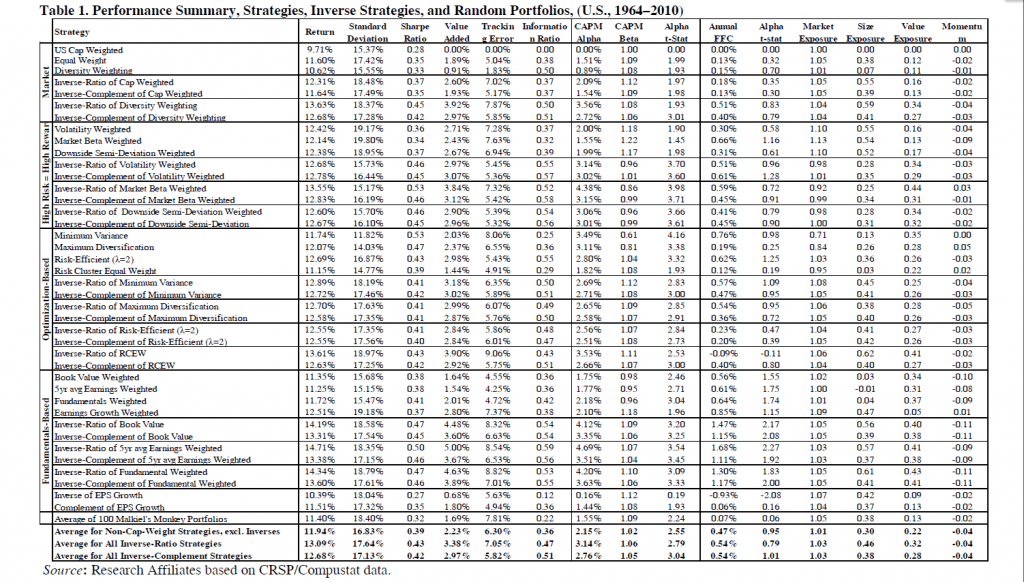

Fantastic table on page 16, click to enlarge…

Abstract:

The latest index literature is bursting with new innovations based on quantitative strategies that are predicated on sensible investment beliefs. Empirical studies confirm that these strategies do indeed deliver economically large and statistically significant excess returns over the cap-weighted market benchmarks in nearly all geographical and country studies. To the casual observer, it will be shocking to learn that inverting the portfolio construction algorithms does not reverse the alphas. Embarrassingly, the inverted strategies often outperform the originals.

This paradoxical result is driven by the phenomenon that seemingly unrelated and non-value-based strategies and their inverse strategies often have unintended and almost unavoidable value and small-cap tilts. Even Burt Malkiel’s blind-folded monkey, throwing darts at the Wall Street Journal, would produce a portfolio strategy with a significant value and small-cap bias that would have outperformed historically. The value and small tilts stem from the fact that these new weighting schemes sever the link between a company’s share price/capitalization and its weight in the portfolio. Generally, an investment thesis where price does not drive the weight in the portfolio will have a value tilt and an investment thesis where company size/capitalization does not drive portfolio weights will have a small-cap tilt. As a result, these strategies produce outperformance against the cap-weighted benchmark due to the often unintended value and small cap tilts and independent of the investment philosophies that drive the product design.