I’ve received a lot of great feedback on The Idea Farm. So far I’ve sent out about 30 emails that have represented over $40,000 worth of research (including some research that is available to institutions only).

If you’ve haven’t been following it, take a look, there are about 2 emails per week and the blog is archived here. (And to be clear, I don’t take any affiliate revenue for passing on any of the research.)

Some fun ones recently from Empiritrage, Whitebox, and Pantheon.

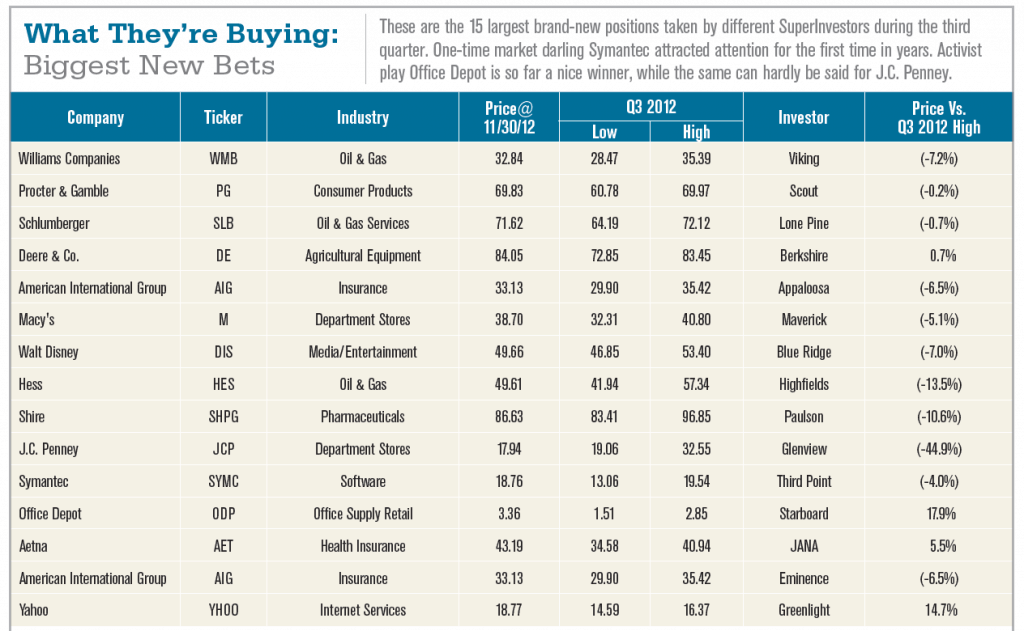

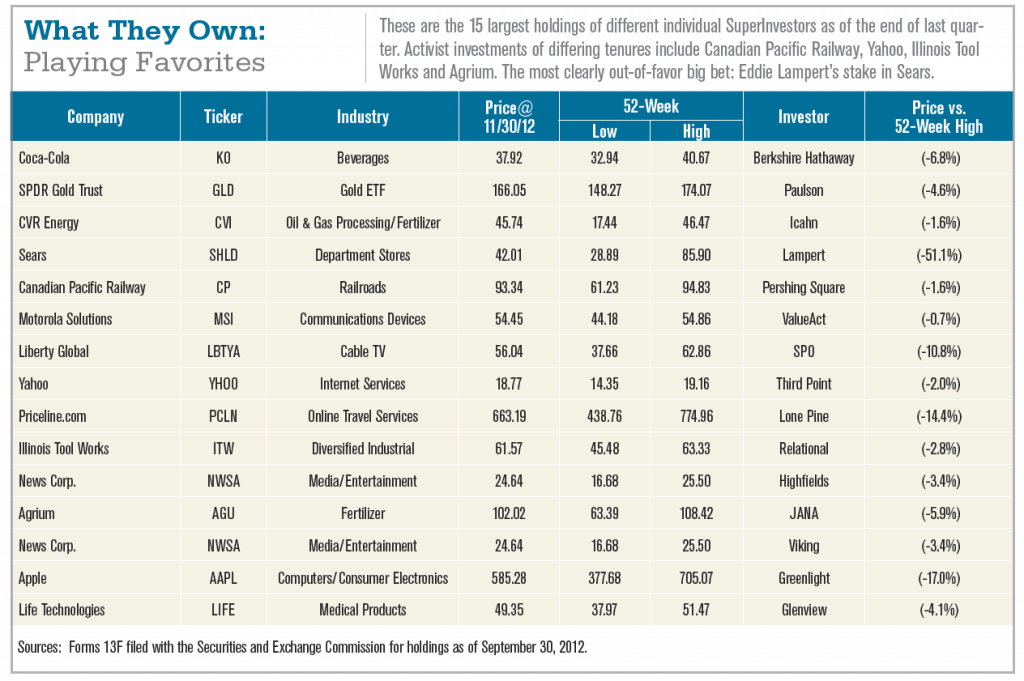

Below are a few charts from the next upcoming email this Sunday from Value Investor Insight, with a few screens on hedge funds and what they’re buying, enjoy!

But first, a few fun quotes:

Julian [Robertson] was maniacal on the importance of management: ‘Have you done your work on management?’ Yes, sir. ‘Where did the CFO go to college?’ Umm, umm. ‘I thought you did your work?’ He wanted you to know everything there was to know about the people running the companies you invested in. Lee Ainslie, 12.22.06

Human beings are subject to wild swings in their levels of fear, risk tolerance and greed. That won’t change. I base my whole approach on buying when others are fearful and selling when others are greedy. The reason Shakespeare is so relevant still today is that his plays were all about human nature, and human nature never changes. Mark Sellers, 6.19.05

Gold kind of scares me because very often the people involved with it seem to be slightly insane. My other problem is I don’t know how to value it. That said, I can certainly see why gold could be considered somewhat of an insurance policy, if not an investment in its own right. Any kind of systemic economic turmoil is likely to drive gold prices higher. James Montier, 10.31.08