I’m on the Amtrak Surfliner heading down to San Diego to give a talk on Shareholder Yield at the TD Ameritrade conference. I am taking the train because a) I love trains, and b) my last drive to SD took over 7 hours and the trauma of SoCal traffic haunts me.

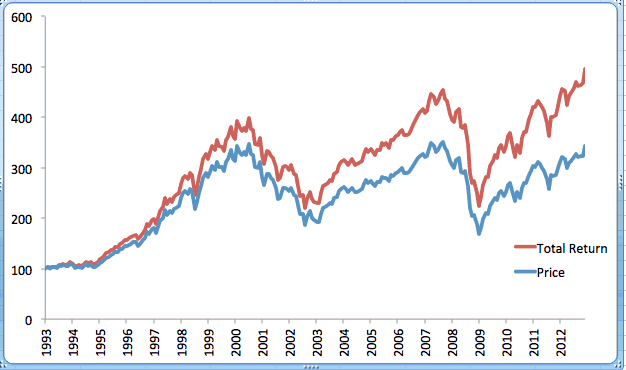

Anyways, I’ve noticed a lot of media lately in print, online, and TV talking about how close we are in the stock market to new highs. All of the commentators are referring to the price series, which is ridiculous since it excludes dividends. In honor of recent 20th bday of the ETF, below is a price and total return chart of SPY. As you can see, we’re already at all time highs…

Talking about, or basing strategies on, price only data is just silly. Can you imagine someone talking about bonds buy excluding the income or coupon payments?!

PS If you’re at the conference come say hello!