I was going to do this post as an issue of The Idea Farm, but there is already a two week backlog of good pieces so I figured I’d just post it here. Passive and active are meaningless terms to me since I’m a quant and everything is active in my mind. You have rules for buying, selling, and rebalancing. It is always ironic to me that likely the largest and most famous index, the S&P 500, is really an active fund in drag. It has momentum rules (mkt cap weighted), fundamental rules (4Q of E, liquidity requirements), and a subjective overlay (committee input). Does that sound passive to you?!

However, most of the early indexes were built to be representative of the marketplace. So while indexing was revolutionary, it was not necessarily the best approach for managing money. Over the past 30 years we have seen an amazing amount of research that has shown simple ways to construct mechanical portfolios, ie indexes, that outperform these market cap indexes. Simple indexes that take into account value, momentum and trend, and carry have been applied within and across asset classes to form more robust portfolios. Second generation indexes have improved upon the first generation (commodities are a great example here). (For a recent piece of ours that details why market cap indexing is flawed, check out Global Value in the Journal of Indexing.)

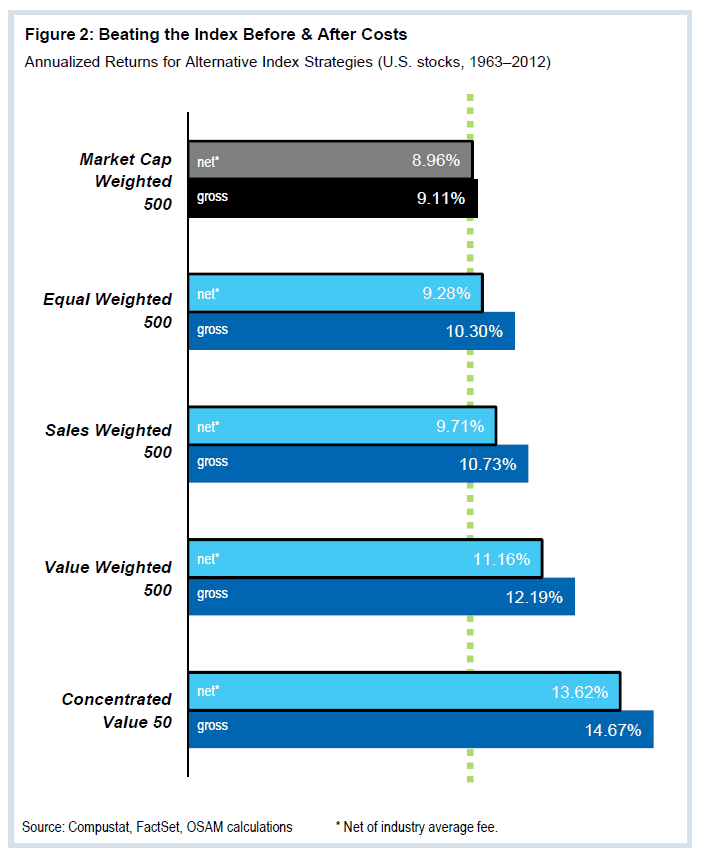

Below the good folks at O’Shaughnessy put together a piece titled “Combining the Best of Passive and Active Investing” that is well worth your time.