People often ask me why we use 10 year inflation adjusted PE ratios rather than simple trailing 12 months.

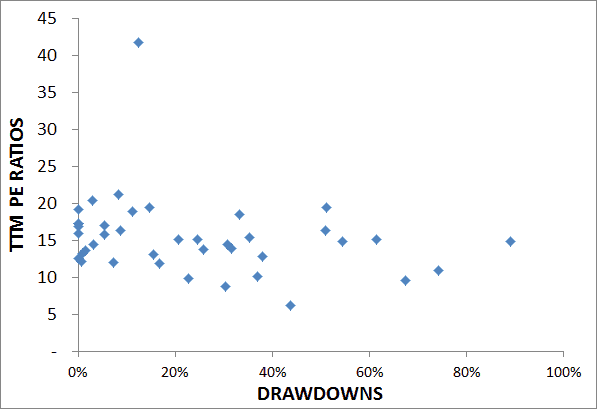

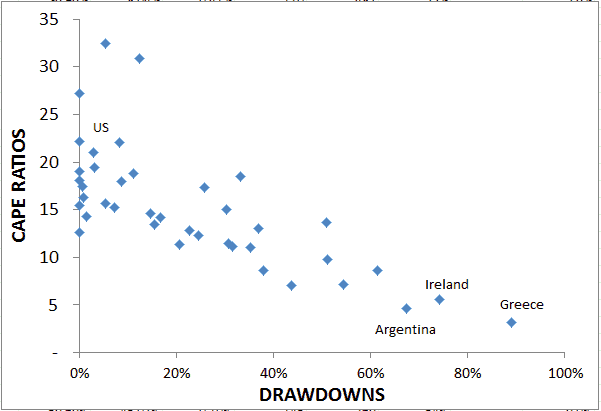

Below are two charts that I think are at the crux of the arguement, and basically visually demonstrate why CAPE works.

0.75 correlation for CAPE, and only 0.24 correlation for TTM PE.

The below basically shows that CAPE correlated highly with current drawdowns (ie you are buying the markets down the most) while TTM PE does not. My feeling is that it is too short of a measure for E (ie E may be depressed or elevated on short time frame buy way out of whack on long time frames).

This is likely why CAPE works so well – you’re buying what has gotten creamed and left for dead…