REITs have been the best performing major asset class since the market bottom in 2009, up over 200%.

What are the current drivers of REITs saying now across trend, yield curve, and valuation?

-Trend is certainly positive.

-Yield curve is above average, but not as steep as it was a few years ago.

-Valuation is really bad nominal, but not as bad on a real basis:

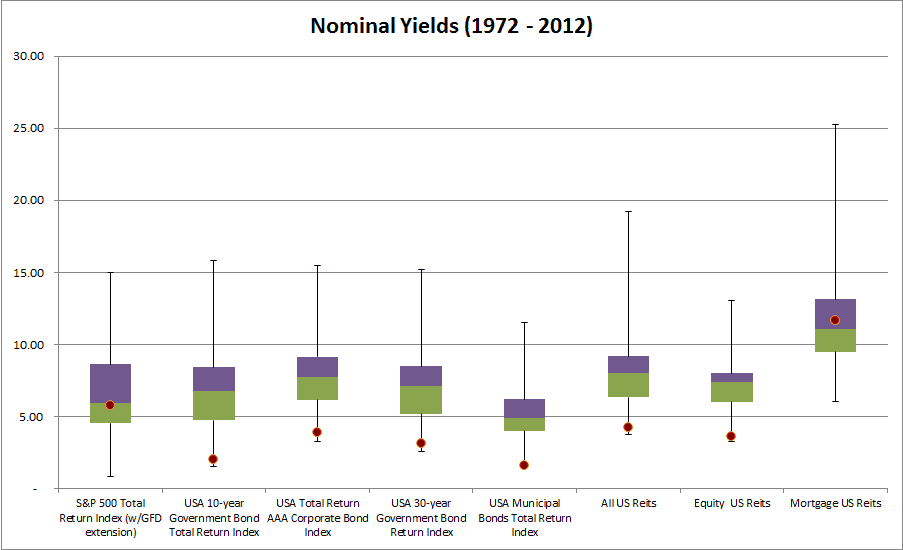

Below are two charts that I find highly useful. The first looks at yields on various indexes (the red dot is where we are now and purple/green represent one standard deviation bands). This chart poses the problem many investors complain about daily – where to find yield? (Note: S&P500 is TTM PE yield.)

One would conclude, that with the exception of mortgage REITs and US stocks, everything else is highly unnattractive. Bonds and REITs seem to be at their worst yields EVER (will update these at Q end – data is a bit stale as of March I think).

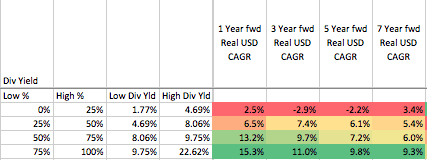

When you invest in REITs when they have a low yield, surprise, returns are worse (since 82):

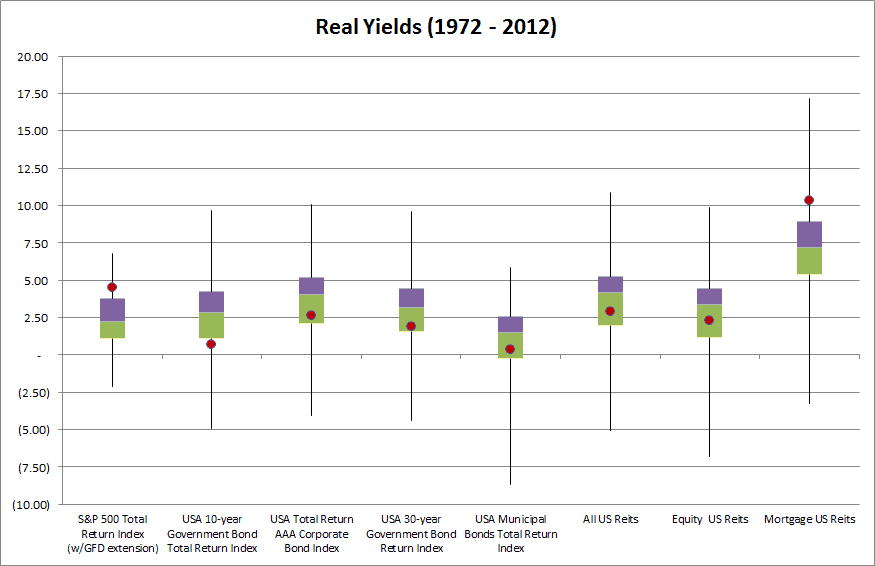

However, if one looks at yields after inflation, so called real yields, the picture changes. Most asset classes are in normal valuation ranges, and while bonds are still trading at low yields, stocks are even more attractive, and mortgage REITS too.

The world doesn’t look so bad.

And here are my thoughts on the asset class – ready to exit when the trends deteriorate (a few months ago so have cleaned up a bit since!).