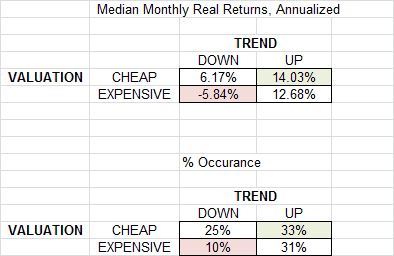

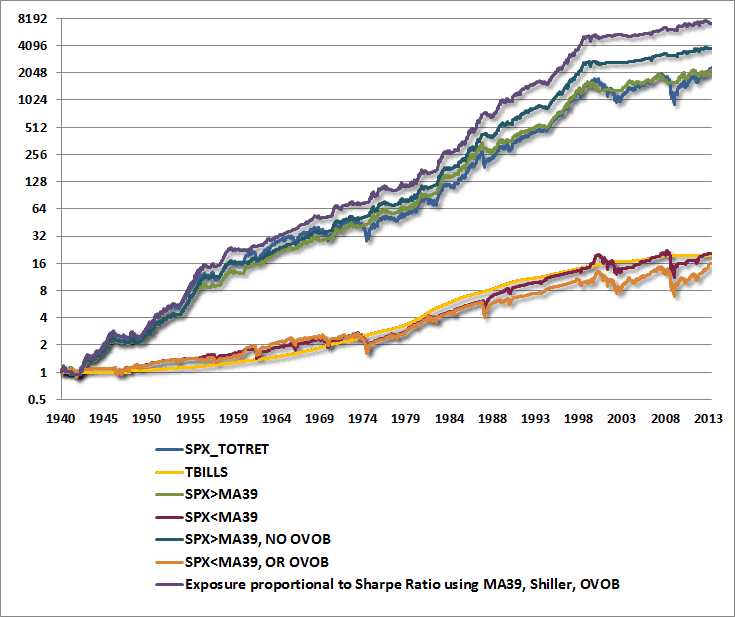

My friend John Hussman has done a lot of great work looking at stock returns during different regimes. At the end of the post is a chart where he looks at some various scenarios and how the market performs. Below, I simplify it a bit, and just look at US stocks since 1900 across trend and valuation. Trend is > 10 month simple moving average. Valuation is CAPE <> 17. Not rocket science.

Not surprisingly, the best time to be invested is in a cheap, uptrending market. The worst time? An expensive, downtrending market.

(The returns are median monthly returns after inflation, annualized.) We are currently in the category of up, expensive.

The biggest shock occurs when the expensive US market moves into a downtrend. What’s that you say? A bear market? Never heard of it…