The title could just as easily have been ‘The Problem with Market Cap Weighting’

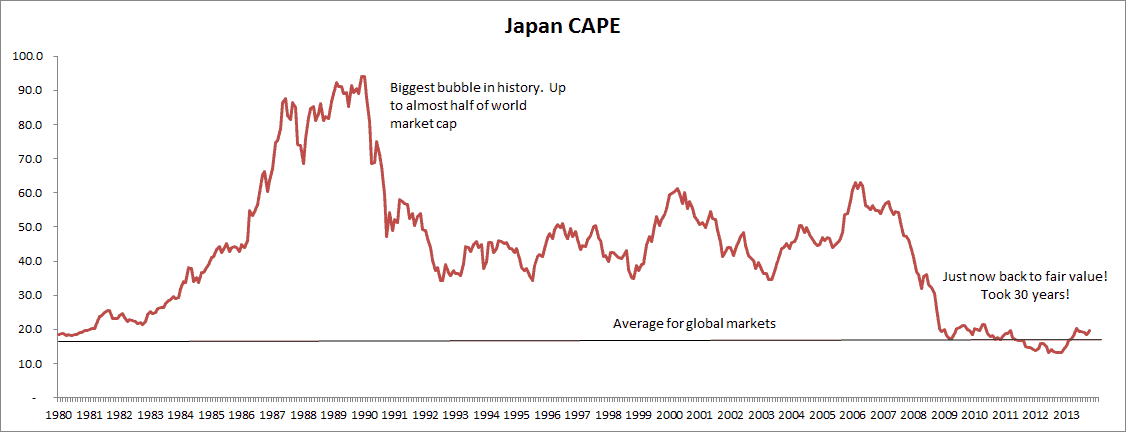

When overvalued assets grow to be bigger and bigger parts of a market, or become the market, you no longer want to invest in that market. That, to me, is the biggest failing of buy and hold. It ignores common sense. Below is Japan’s historical CAPE. It is by far the biggest bubble we have ever seen. Our cute internet bubble in 1999 (CAPE of 45) is HALF the size of this one. Can you look at your client with a straight face and say it is just as good of a time to invest in Japan in 1989 as it is now?

Japan got to be nearly half of the world’s market cap. And if you believed the ‘efficient’ market, you just went along and invested half of your stock allocation in Japan. What did that cost you? About -4% per year real returns in Japan from 1990-2010. That’s 20+ YEARS of negative returns.

What is the biggest market cap in the world now? The US (at half). What is the 2nd most expensive country in the world? Yep, same. Now there is a big caveat and that is the US isn’t in a bubble. Nowhere near it. But the US isn’t cheap like the rest of the world. So you are still depriving yourself better opportunities elsewhere.

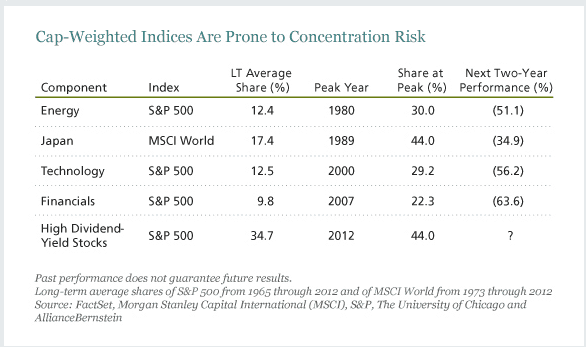

Below is a great piece from Alliance Bernstein. Note how bad investing in these bubbles is.

What is it flashing warning about now?

You guessed it, my least favorite asset, US high yielding dividend stocks…