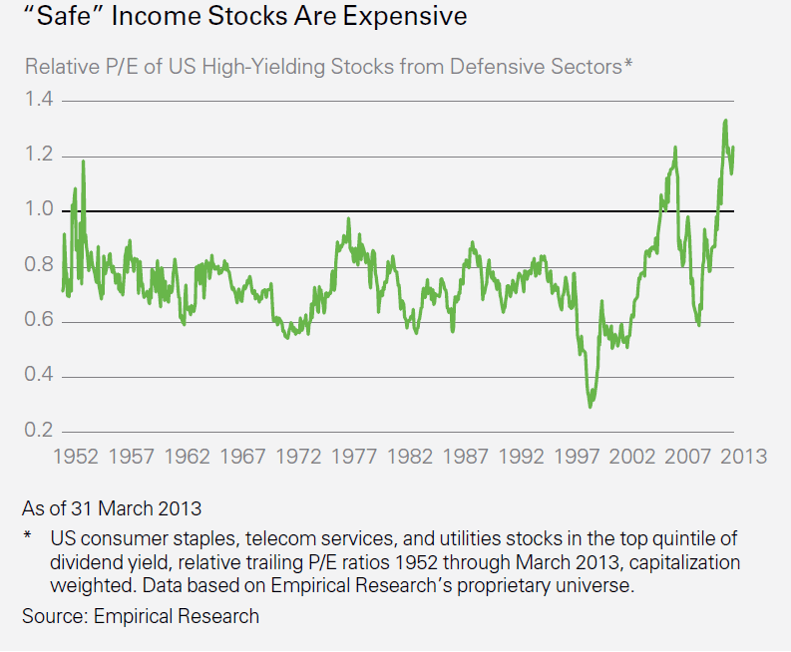

I was giving a talk the other week in Chicago and one audience member asked me what was my biggest concern in the markets. I responded that it was high yield stocks in the US. I am finishing up a longer piece that should be out next week, but below is a simple exercise for those that want a sneak peek.

1. Goto Morningstar and input a ticker for a high yield stock ETF or fund, let’s say VIG since it’s the biggest:

http://etfdb.com/type/investment-style/dividend-etfs/

http://portfolios.morningstar.com/fund/summary?t=VIG

2. Scroll down and take a look at the valuation metrics.

3. Compare to the overall market.

4. Be surprised.

Due to flows, this is a good example of an asset class getting distorted and investors buying into something and getting something quite different than what they expected. This asset class, which historically trades at a 20-40% valuation discount to the overall market is now at record PREMIUMS. Dividends have worked historically because they have had a value tilt. What happens when they don’t? Buyer beware.