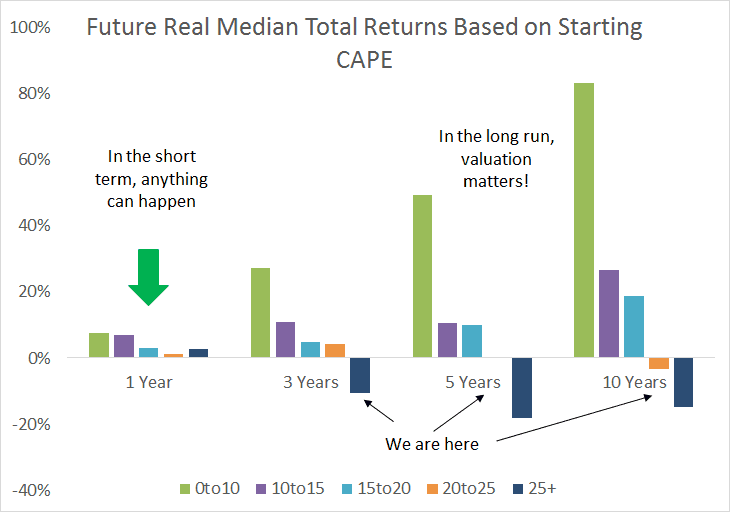

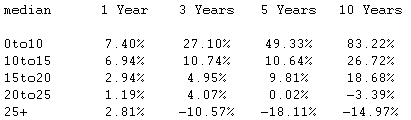

My readers are probably tired of my droning on about valuations in the US and abroad (if you’re new here, short summary: US is expensive, and the rest of the world is cheap). While I don’t think the US is in a bubble it is in the top 10% of valuations, which works as a massive headwind to returns in the 3-10 year period. What happens next quarter, or next year is anyone’s guess, but what happens over the next decade is more clear. Call 2013 a gift to US equity owners.

If you are still heavy in US equities (especially small cap and high yield) it is probably a good time to reevaluate…