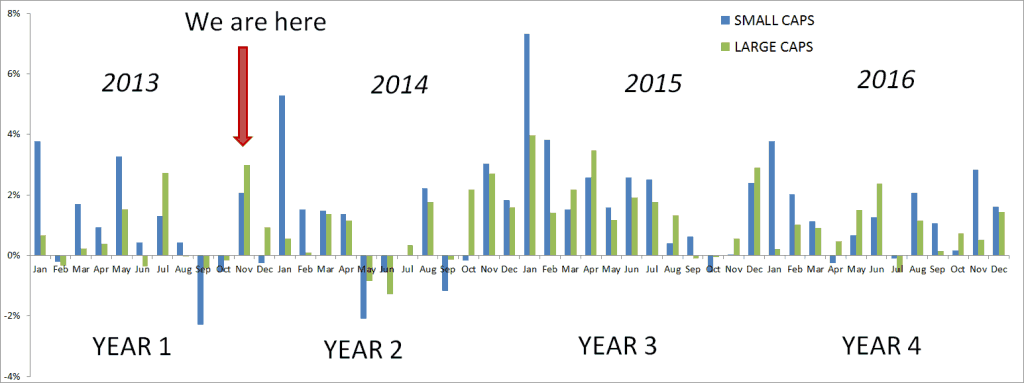

We did a paper years ago that combined the Presidential Cycle and the January Effect. It was also known as our least read paper. Anyways, if you were to follow history, and I’m not sure that you should, conclusions would be that the investor should be a little more concerned in 2014 , or at least rotate into mid or large caps until near year end. Then strap on for big runs in 2015/2016.

But that is just what happened in the past. (data up to 2009, will update soon.)

Amazingly, since publication, had one just rotated each year into the size (small, mid, large) that historically did best that year you would have beaten the S&P500 by 15 percentage points since 2010. Who says history doesn’t rhyme?

CLICK ON BOTH TO ENLARGE (note these are median returns, arith and geo average would be different but similar). French Fama dataset.

![]()