This post is similar to the recent post we did on F-Squared. We sent out a research piece recently to The Idea Farm list from Pictet, a multi-billion $ asset manager out of Europe. I am slightly embarrassed to admit I had never heard of them until recently when a reader emailed me some of their work. They have one momentum strategy they describe as:

“One of our most original and historically successful approaches is our “momentum” strategy that allocates invested capital systematically between four asset classes. For those not familiar with this approach, it selects from US 10-year Treasury bonds, US equities, emerging-market equities and gold, and allocates 100% of the capital to the asset class that has shown the best performance in the recent past.”

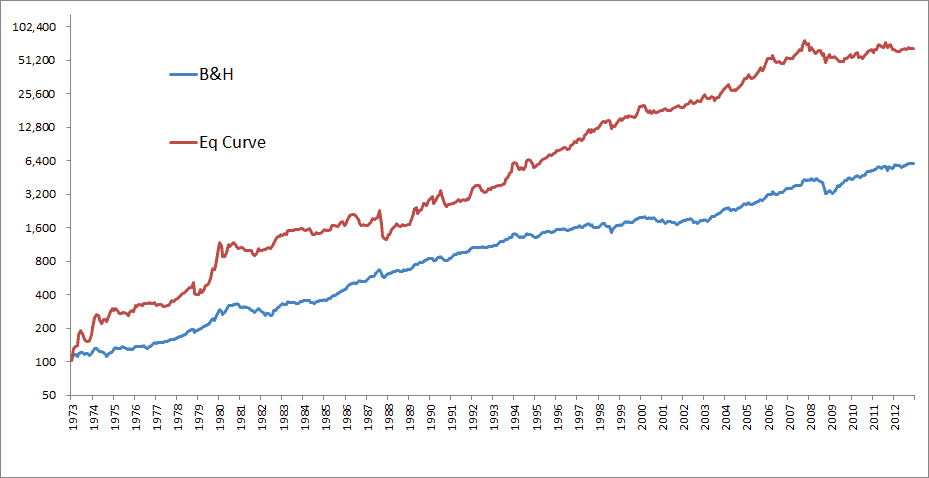

That’s awesome! You know I like it, although without a trend overlay and only selecting one asset can lead to some pretty wild swings. Just how wild? Below are the backtested results to 1973, 17% a year isn’t bad!

(4 asset classes updated monthly, ranked on 12 month total return.) Granted if you used more asset classes and invested in the top 1/3 of assets your risk adjusted returns improve a bit…