I think we are in the midst of a profound change in the way real money institutions invest. It is becoming increasingly clear that many real money institutions (pensions, endowments, etc) don’t offer a heck of a lot of alpha or value add to their investment process. The top Harvard and Yale’s potentially do, but even some call that into question.

My firm was the first to launch a 0% management fee ETF, and will likely launch more in a series of what a friend calls “investable benchmarks”. It will be fun to see if the endowments can beat the hurdle of a simple buy and hold ETF. More than likely, you will have a stratification of institutions into allocating to super cheap beta through ETFs, and then focusing their value add in some areas that may still offer value such as illiquid or liquid alts (timber, PE, managed futures, etc).

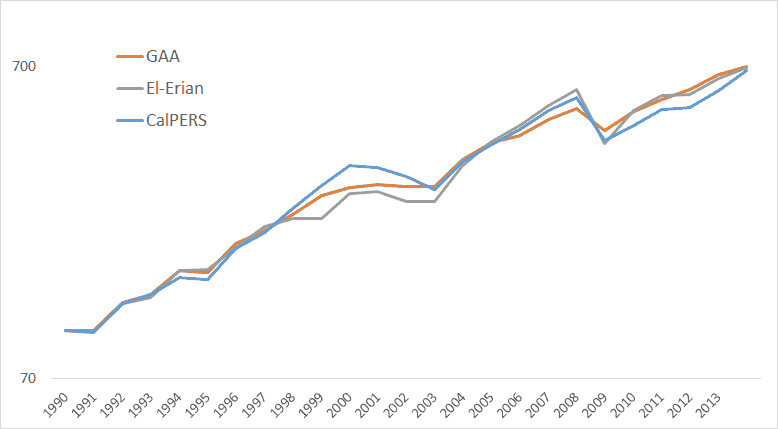

Below is an example of one of the big funds, the $300 billion CalPERS and portfolio returns from 1990-2013. I included two portfolios from our recent book Global Asset Allocation now available on Amazon as an eBook. (If you promise to write a review, go here and I’ll send you a free copy.) If you already read the book, you know my thesis for buy and hold investing is that the allocation doesn’t matter that much, but fees do.

As you can see, CalPERS would have been just as well off just firing their whole staff and buying some ETFs. It would certainly make the record keeping a lot easier! And they would save a whopping $500 million a year on operating costs (2,700 employees) and another few hundred million on external fund fees. And you get to avoid all that nasty press on how much you are paying those evil hedge fund managers and their performance fees (disclosure, written by someone with two private funds).

Click to enlarge. (Thanks to all the people that sent over the performance back to 1990.)