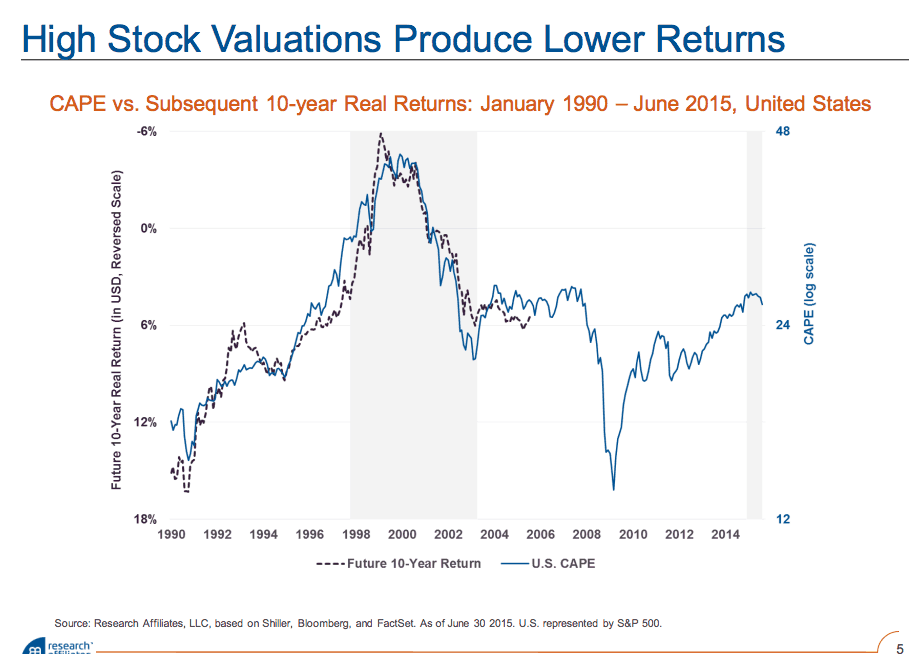

I talk a lot about global stock market valuations on this blog. For those unfamiliar with my work, here is an old article “Everything you Need to Know about the CAPE ratio“, or you can pick up my book Global Value. I believe long term valuation metrics are incredibly useful in predicting long term future stock returns. But, value is a blunt tool and understanding how the macro environment affects what people are willing to pay for stocks, and cash flows, is vital.

Rob at Research Affiliates has done a lot of great work with the CAPE ratio.

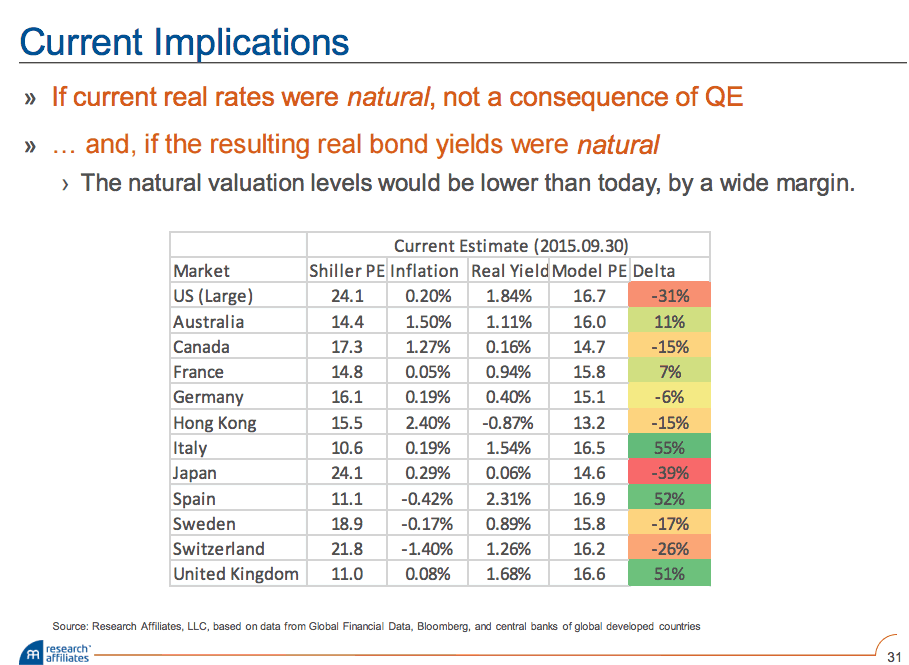

Below are a few screenshots from a Powerpoint presentation he gave to the Q Group this fall. For those unfamiliar, the Q Group is a quant forum that has been around for 50 years that hosts seminars with some of the top quants, fund managers and academics in the world. They charge $6,500 for membership, but they post all of their presentations and audio, so just think of how much I’ve already saved you in 2016! (Homepage with links here.)

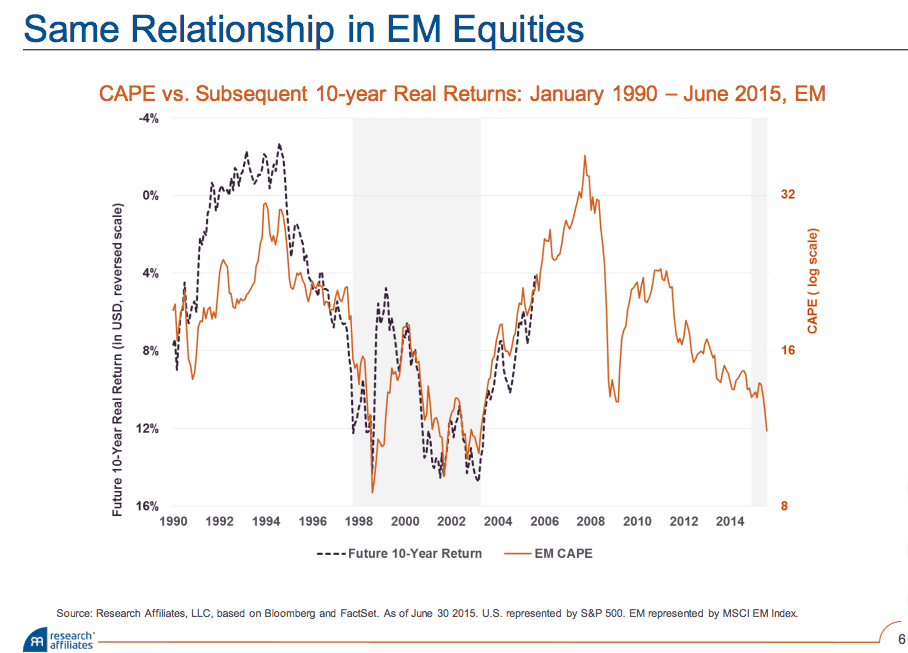

The valuation metric that is suggesting low single digit returns for US stocks is also suggesting some whopping double digit returns for emerging markets.

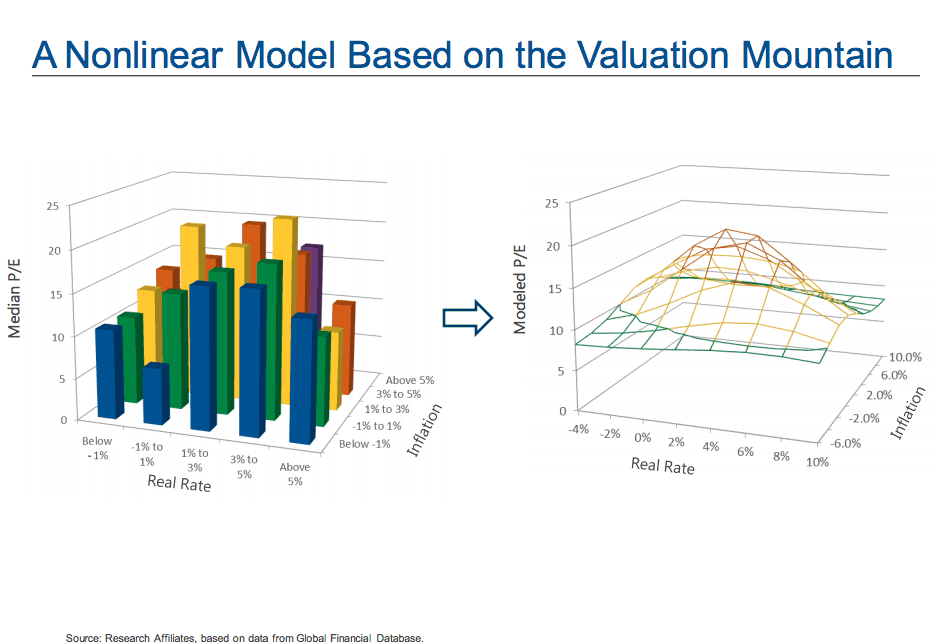

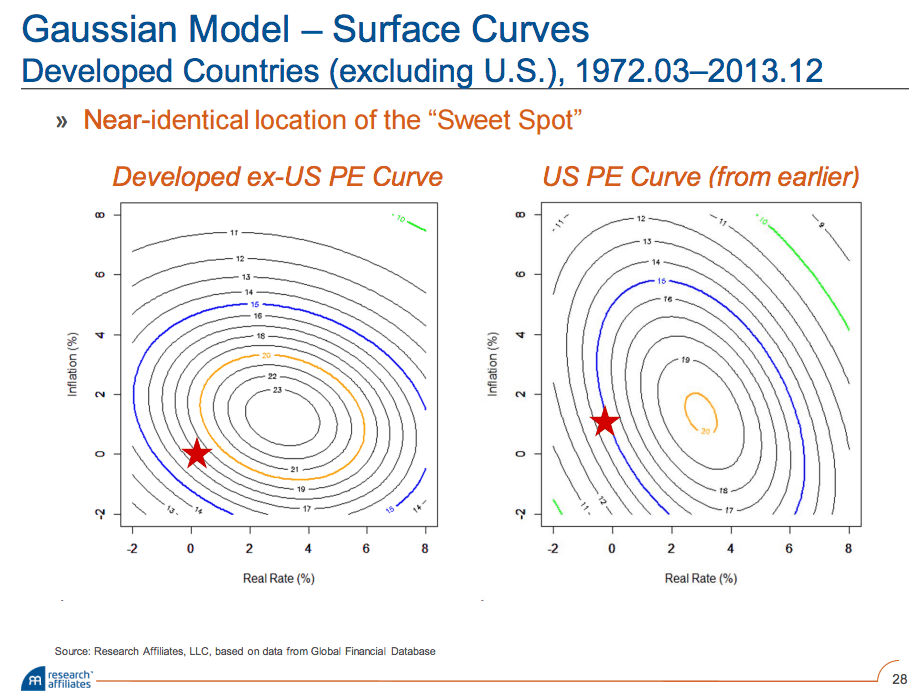

One of the key observations is that investors are willing to pay more for stocks when they are in the inflation “safe zone” of around 1-4%, and ditto for real interest rates. Why? Likely future cash flows are more certain and less likely to be eroded by inflation, or deflationary problems.

And the same thing occurs in foreign markets:

So where do we stand with markets now? Some are expensive (US, Japan) and some are really cheap (Europe, Russia)…Broad foreign developed is around 15 and emerging around 12. We update long term valuations metrics quarterly on The Idea Farm and will send them out tomorrow.

Enjoy your Sunday and Go Broncos!