One of the most fertile areas of research is in factor rotation. Any asset class, investment strategy, or factor, despite working well over time, goes through periods of over and underperformance. Those periods set the stage for future reversion, and are largely due to fund flows and people chasing performance.

Lots of the fund flows over the past # of years have gone into the marketing of low vol and high dividend strategies, both of which have resulted in pushing those stocks to lofty valuations. Don’t take my word for it. Head over to the Morningstar blog which lets you input any ticker and get an X-ray summary of the portfolio.The largest dividend ETF sports a P/B ratio of 3.7!!! (Search the archives but lots of posts on this topic like the Dividend Challenge, and also posts by Larry Swedroe (and here) and Wes Gray.)

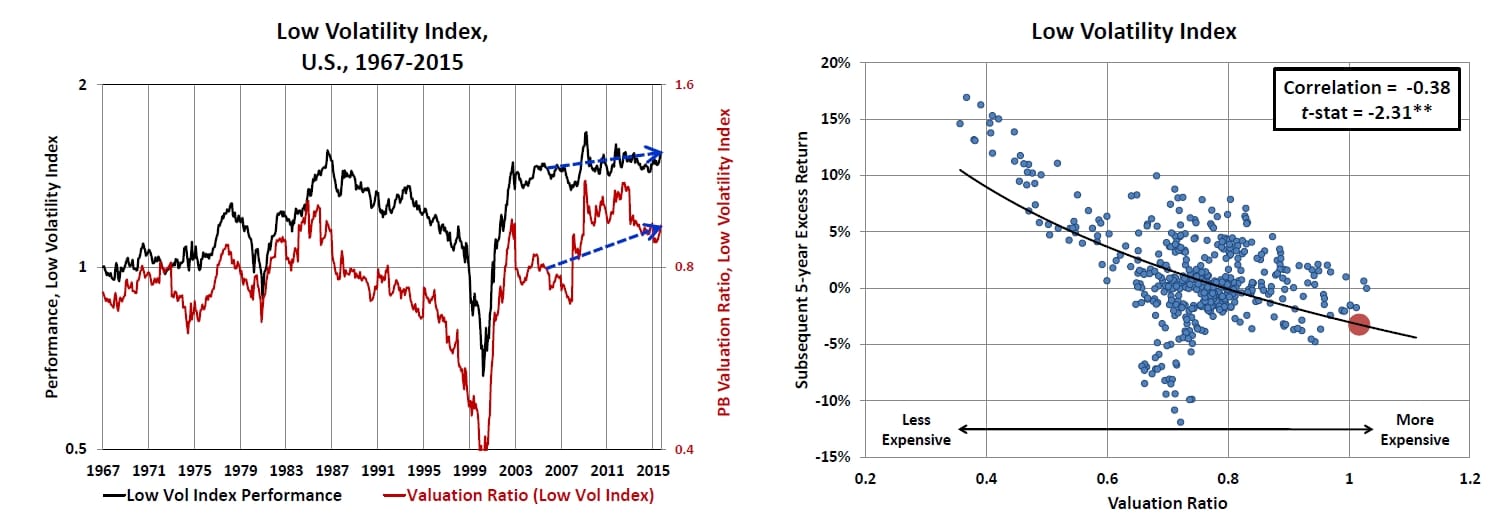

I sent this paper out to The Idea Farm – Rob and co tackle this subject in his new white paper “How Can “Smart Beta” Go Horribly Wrong?”. It is a great read and looks to be part of a series. See the below chart on low vol factor…one of the most expensive values ever!

Totally unrelated, but some fun endnotes from the article:

- Active managers have failed to deliver on clients’ return expectations through no fault of their own. This result is almost a tautology. When the capitalization-weighted index strategies are removed from the cap-weighted market, we’re left with more or less the same portfolio, that is, the holdings of active managers and individual investors. Collectively, because of trading costs and management fees, active managers and individual investors cannot beat the market; most will underperform. Certainly, some active managers will win. In fact, Berk and Green (2004) estimate that before fees about 80% of active managers do win, chiefly at the expense of individual investors. Unfortunately, even if active managers do win, Malkiel (2005) estimates that, on average, fees and other expenses consume most of the outperformance, leaving an average investor in active funds slightly worse off than if they had invested in a low-fee passive alternative. Collectively, an active manager’s very important role is to increase market efficiency by identifying mispricing. If investors collectively chose only passive investing, markets would be extremely inefficient both in terms of investment outcomes and aggregate capital allocation. French (2008) estimates investors collectively pay 67 bps in market value annually for this price discovery, a remarkably reasonable societal cost for the efficient allocation of capital in the aggregate economy.

- The Duke CFO Global Business Outlook, a quarterly survey of chief financial officers of public and private companies around the globe, showed an average 10-year nominal equity return forecast of 6.5% as of December 2015. The same survey conducted in June 2000 showed an average 10-year nominal return forecast of 10.5%. Although CFOs are not money managers or consultants, they are usually aware of standard valuation techniques and use them to explain their company’s share performance relative to the market.