Research Affiliates has been churning out some great content lately. In their recent piece titled “Timing “Smart Beta” Strategies? Of Course! Buy Low, Sell High!” they examine some value based factor rotation strategies. Namely, they examined rotating among the factors that had the worst 1,3,5,and 10 year trailing performance. Not surprisingly it worked well.

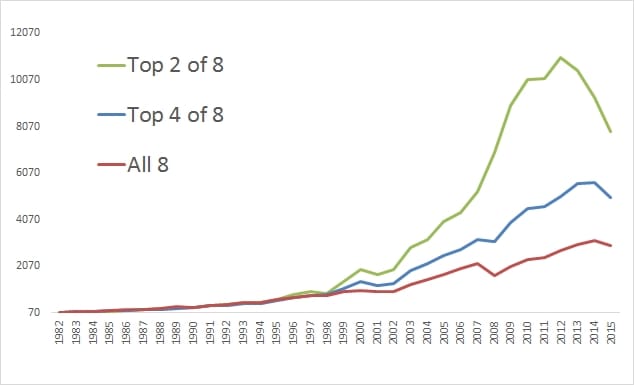

So I went and re-ran a similar study with eight asset classes back to 1972. So the simulation starts in 1982…We looked at what happens when you equal weight a portfolio with the Top 2, Top 4, and All Assets. (We used Large cap stocks, small cap stocks, foreign developed, foreign emerging, 10 year US bonds, commodities, REITs, and 30 year bonds)…

Top 2: 14.1%

Top 4: 12.6%

All 8: 10.8%

So, you can see that rotating in the poor performers adds some nice performance. Volatility rises a bit due to a more concentrated portfolio.Simple advice is to just make sure to rebalance your portfolio, and if you’re a little more value conscious, consider tilting towards the assets that have been doing poorly over the period. That would be foreign stocks and commodities right now.

Anyways, room for more research! We may go run this with the French Fama data back to 1920s when I get a spare moment…

You may want to tune into Rob and I talking about this concept of over-rebalancing on our podcast.