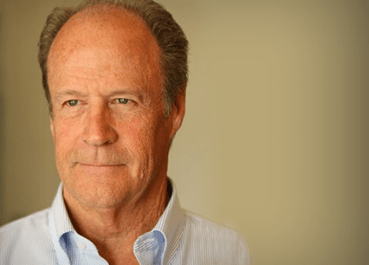

Episode #48: Van Simmons, David Hall Rare Coins, “The Rare Coin Market Can Go Up Dramatically, Quickly”

Guest: Van Simmons has earned his place in the rare coin pantheon as the leading coin merchant of his time. He specializes in portfolio construction, set building and helping clients acquire the world’s finest rare coins. As a partner and President of David Hall Rare Coins, he is held in highest regard by his clientele, many of whom have been with him for over 30 years. He is respected by his peers for both his knowledge and reputation for integrity.

Date Recorded: 4/12/17 | Run-Time: 1:13:10

Summary: In this episode, we break new ground for The Meb Faber Show. Departing from our usual world of stocks and bonds, we welcome expert numismatist, Van Simmons. For anyone unfamiliar with the word, a “numismatist” is a rare coin collector.

We start where we usually do – with a bit of background on our guest. Van gives us a quick overview on how he got into his line of work. But it’s not long before the guys jump into the world of rare coins, with Meb asking Van to provide a general, contextual overview.

Van’s description of the world steers the conversation toward perhaps one of Van’s biggest contributions to the coin collecting community – the creation of an innovative coin grading standard. Meb believes this grading standard was huge, as “not getting screwed” is such a concern for all sorts of investors.

Next, the guys cover a few, quick questions – how has coin space evolved over the years… what were the biggest seismic changes… and which demographic Van sees as the most active in this space. But they dig deeper when the conversation turns toward international demand – specifically from China.

Van tells us how he bought two high-grade Chinese silver dollars in the late 90s. He found them in his safe two and a half years ago, and wondered what they were worth. He called an auction company and was told that he could have sold them at their last auction about four months earlier for $60-70K a coin (Van actually sold the coins some months later at a hefty price, though not quite this high). And what had Van paid for those coins? $600 for one and $900 for the other.

Meb brings the conversation back to U.S. market, asking Van if there is a most famous or most traded coin – in essence, is there a “blue chip” coin?

Van tells us one of them would be a 1907 twenty-dollar high relief (a $20 Saint Gaudens). He follows up with more color on the coin’s origin, dating back to President Roosevelt, as well as some interesting trivia on it relating to its high-relief profile. Other coins Van mentions are the 1804 Silver Dollar and the 1913 Liberty Nickel.

Next, Meb asks how a new coin investor with a long time-horizon could get started with $10K. Meb reveals this is not an academic question – he actually intends to have Van build him a portfolio with a $10K seed. Meb’s criteria are: one, spread his money around as much as possible, say, up to 5-10 coins; two, he wants to tilt toward beautiful coins; and three, Meb wants coins that have some historical significance. Van gives us his thoughts.

The guys jump around a bit before getting onto the topic of counterfeiters. Unfortunately, this can be a problem. Van tells us a story illustrating the danger before the guys discuss how to avoid getting ripped off.

This leads into the topic of common mistakes that new coin collectors make. Van tells us that the biggest mistake is buying everything. The hardest thing to do is find someone you trust who will steer you toward great pieces that will hold value.

Next, Van and Meb branch out, discussing other collectibles. There’s talk of pocket knives, Native American artifacts, baseball/basketball cards – even a great story involving Meb’s mom and a Michael Jordan rookie basketball card.

Meb asks Van as technology improves, at what point does grading become software based, with optical recognition?

Turns out, this technology has already been here – and Van was a big part of its creation. But the collecting community preferred human-graders. It’s a fascinating story you’ll want to hear.

There’s lots more in this episode: a Mickey Mantle card worth $5M… Milton Friedman (one of Van’s clients) discussing the inevitable demise of the U.S. dollar… and of course, Van’s most memorable story related to collecting. This one involves a long-lost coin that turned out to be very valuable.

Sponsors: Wunder Capital and Soothe

Comments or suggestions? Email us Feedback@TheMebFaberShow.com or call us to leave a voicemail at 323 834 9159

Links from the Episode:

- http://davidhall.com

- The Velvet Tray – “A Trillion Dollars Isn’t What it Used to Be”

- “The Investment Performance of Gold and Rare U.S. Coins” – Lombra

- 7:00 – PCGS – Coin grading service

- 23:30 – St Gaudens $20 1907 High Relief coin

- 25:38 – PCGS3000® Index – PCGS.com

- 39:39 – Collectors Corner

Transcript of Episode 48:

Welcome Message: Welcome to “The Meb Faber Show,” where the focus is on helping you grow and preserve your wealth. Join us as we discuss the craft of investing and uncover new and profitable ideas, all to help you grow wealthier and wiser. Better investing starts here.

Disclosure: Meb Faber is the cofounder and chief investment officer at Cambria Investment Management. Due to industry regulations, he will not discuss any of Cambria’s funds on this podcast. All opinions expressed by podcast participants are solely their own opinions and do not reflect the opinion of Cambria Investment Management or its affiliates. For more information, visit CambriaInvestments.com.

Sponsor: Support for “The Meb Faber Show” and the following messages come from Wunder Capital, allowing individuals to invest in solar projects. Earn up to 8.5% annually while diversifying your portfolio and combatting global climate change. Create an account for free at wundercapital.com/meb. Do well and do good.

Meb: Welcome to the show, friends. We’re super excited to have my longtime friend, Van Simmons. Van, welcome to the show.

Van: Thank you, Meb. Nice to be here.

Meb: I introduced you on Twitter because we always ask for some Twitter questions that we’ll ask later. And I said, “We’re having one of the world’s top numismatists on the show.” I can never pronounce it. I wanted to get it out of the way early, and to almost everyone responded, “What in the world is a numismatist?” But for those that don’t know, rare coin collector, investor, trader. And I met Van, what was it, probably five years ago now, Van?

Van: At least.

Meb: At his beautiful home in Long Beach when a common friend had reached out, Steve Sjuggerud, who we’re gonna have on the podcast in a few weeks, which we’re also excited about. And Steve said, “Hey, Meb, I’m in town. Do you wanna grab dinner?” I said, “Sure, of course.” So went down to Long Beach and sat down with Van and his lovely wife. And Steve and one of the top up-and-coming surfers in the world, and just had the absolute best dinner. And so I was fascinated, and I think you’re gonna get to hear a lot of it today, with Van, chatting about a world that we haven’t really talked about on the podcast yet, which is collectibles, and coins, etc.

So Van, why don’t you give us a little bit of background to help us get started? So first of all, let’s talk about you. How did you get immersed into this world? Was it at an early age? Was it a late career sort of thing? How did you start to get interested in what’s now your career?

Van: You know, it’s funny. As a kid, my mother and father kinda…my father kinda said, “You know, you ought to start collecting coins because they’re a great piece of history,” and things like that. And I was, you know, 10 or 12 years old, and I collected coins but I was a collector of old rocks and everything else, pocket knives, everything as a little kid. So coins were kind of a natural thing when you start studying the economy and things like that, and you go into silver, and gold, and then rare coins. So I ended up getting into the coins business, I guess, because my father had made this suggestion that I start learning about coins because it would be a fun hobby.

And two, three years ago, my mother passed away at 90 years old. She could never figure out how I made money in the coin business. And a week before she passed away, she says, “Van, you’re never gonna be able to make a living buying and selling pennies. It’s just not gonna make any sense.” And at the time I was 62 years old and it was kinda funny that she was still concerned that I wasn’t gonna be able to make a living.

Meb: That’s great. So you started collecting from a young age. And take us kinda through, I think the vast majority of listeners probably don’t have a big background in rare coins. So we may have to start from kinda the basic. So let’s talk a little bit from, just get some of the verbiage and lingo out of the way. Why don’t you give us a really super broad overview of the rare coin space, and then we can kinda start to delve into some more specifics and off-shots from there?

Van: Ah, let me see, how to explain the coin business in five minutes or less, huh?

Meb: We got a couple hours. Take your time.

Van: Yeah, I know. No, it’s kind of the last bastion of free enterprise. You know, if you go to a coin show you’ve got dealers walking around with briefcases filled with money and coins, and some of them millions and millions of dollars in a briefcase in coins and stuff that nobody would even think about it. It’s a very collectible area. I mean, I’ve sort of been a collector my whole life. And when I started making money I started buying and selling coins on the side. And about 1977, ’78, I ended up meeting my business partner, David Hall, and we became partners in 1980 and have been partners ever since.

So the coin market as a whole, a lot of it is back because of the gold and silver market, although some of the coins which are the most expensive, some of the million dollar coins are copper pennies and things like that. But it’s an area where you have coins that are brilliant uncirculated, circulated. You have proof coins and business strikes. Business strikes are the coins that you’re carrying in your pocket today. Proofs are coins that were struck from a completely different set of highly polished dyes for collectors in the year of issue and stuff. And prior to 1858, proofs were not made on a regular basis. They were made for visiting royalty or special occasions and things like that.

And then the U.S. Mint started making them. And in the Philadelphia Mint started in about 1858, 1859 on a regular basis. And obviously slowed down through the Civil War and it picked up into the ’70s. Does that explain most of the coin business kind of lingo? I mean, most of it is just you have gold coins, silver coins, copper, and nickel coins. And there’s a wide variety of coins.

Meb: And so in many ways, thinking about coins, for a lot of people it seems like the Wild West. But in reality, you guys started this business, and you can probably take us through the early days a little bit. But you guys also implemented one of the most important, in my mind, innovative concepts applied to the coin business, which is kind of making coins be fungible. Or securitizing coins essentially by coming up with a grading standard. Could you tell us a little bit about that, and some of the early days, and David Hall, how that developed? And how that kinda changed the coin business in general?

Van: Well, in the late ’70s, early ’80s, the coin business was like the Wild West. I mean, you’d go to a coin show and I’d get people who’d buy coins at shows and always think they were getting a good deal. At a coin show your guarantee was 30, 30, 30: 30 steps, 30 seconds, or 30%. I mean, it was you bought it, you owned it, and if you had mis-graded it or something it was your problem. And by about 1982, David and I came up with a grading guarantee where we guaranteed the grade of our coins. And by ’83, we came up with a policy that we would make a daily market with a buy and sell spread on coins to any coin that was bought and sold through us. That was the first part that kind of revolutionized the market. All the coin dealers thought we were evil for doing it, and you couldn’t guarantee this, and you couldn’t guarantee that. But the fact was you could if you had a confidence in the way you were grading the coins and the product you sold and everything.

So about 1984, I was complaining because we needed Common Date MS65 Morgan Dollars, and we were flying to Florida, flying to Texas, different coin shows to buy coins. And everybody would over-grade their coins, and it was really hard. And one day David met me and he says, we were at breakfast. He goes, “Why don’t we start our own grading service?” He goes, “Because we can buy coins from Gordy, we can buy coins from John, we can buy coins from this guy and that guy.” He goes, “Why don’t we just start our own grading service?”

So we grouped together with about five other guys, who were the top experts in the world, and started a grading service. And it became popular, I mean, like the next day. There was nobody who could argue with it because you had the world’s experts grading the coins. And then we gave a money-back guarantee on the grades of the coins. So 1986, when we opened PCGS, we were in the black the first week, and we were in the black the first month, and we’ve been in the black ever since for 31 years. I mean, it’s been a very profitable business.

So that’s sort of how the grading company and everything started. And the market since then has evolved. And part of it, when we were at breakfast I said, “You gotta realize there’s a lot of wealthy people who would like to buy true, rare, great coins, but they don’t trust anybody.” Which I don’t blame them, because pride of ownership of a dealer or somebody who owned a coin always felt that it was better than what they were willing to buy it at. So you always had the problem of all collectibles where you go to sell it, it’s never quite as good as it was when you bought it.

And this leveled the playing field. We tried to make a level playing field for people. And I said, “You know, sooner or later there will be a million dollar coin. But the only way there’s gonna be a million dollar coin is if somebody’s willing to pay a lot of money for something that they trust the grade.” And I remember back in the early ’90s trying to figure out which coin was gonna be a million dollar coin. And the first one was a nickel, 1913 nickel sold for a million and two. And now there’s about 200 coins that are million dollar coins.

So, I mean, it kinda opened the marketplace to a wide variety of investors and even Wall Street. In the late ’80s, Wall Street got quite involved, and we decided we’d start an exchange where dealers could buy and sell coins on the exchange, coins graded by our company. And when I say our company, it’s now a public company that trades on the NASDAQ, so it’s no longer my company. I still sit on the board of directors, and I’m a major shareholder, and I’m here every day. But we have about 1,400 authorized dealers around the world. We have offices in Shanghai, Hong Kong, Paris, and Orange County. So it’s a pretty wide network of coins.

But it’s become very active in the sense that you have this market of coins going in and out every day, trading dealer to dealer. And I forgot where I was. But I think that’s where I was, some place like that.

Meb: Well, and this is so interesting, because so many areas of investing, the biggest hindrance for so many people is just that emotional response of just not getting screwed. And that scares so many people away from so many areas. And the way that I remember growing up getting exposure to the PCGS, which is the grading service for coins, is you guys actually, there’s a sister version for baseball cards. And we’ll come back to baseball cards later, but had given these cards the ability to make them tradable and had some sort of authenticity around it. So you guys have graded over, like, 30 million coins, I think I read somewhere. And you mentioned now that one of the cool things to me is that essentially it makes the spread come in. So it becomes all of a sudden a much more liquid market because you have kind of established prices, where it’s almost like trading on the New York Stock Exchange versus trading over the counter or bulletin board.

So take me a little bit through how you’ve seen the coin space evolve over the years. So I know that there’s, like any area, there’s been decades that have more interest and less. So since you guys started, David Hall, so over the past 30 years, what’s been the main kinda seismic changes? So the grading became one, but what else? What have you seen over the past 30 years that have been the big differences?

Van: Well, to begin with, the grading is what changed everything pretty dramatically. And the economics of the world, with the loss of the dollar value and things like that has affected the marketplace. But in the old days you had dealers who would buy and sell coins, and buy a coin at one grade and up it a grade, and then sell it at another grade. And so now you don’t have that, because all the coins are graded and certified by PCGS. But you do have telemarketers who come in and make 100, 200 calls a day. And I’m sure some of your listeners have had them, where they just call and hammer you on this, and hammer you on that. And people…you can’t control that part, but when you said the spreads and stuff have come down, they’ve come down tremendously. So that’s made it a very efficient marketplace in that sense. Did that answer that part of the question?

Meb: Yeah, and so let’s talk a little bit about, and this is kind of a similar question, but about interest in the way the world’s changed. And it seems to me, my first guess would be that rare coin collecting in general has a little bit of an older demographic. And however, I was chatting with a buddy in town this past weekend. And this just goes to show, by the way, I love the esoteric nature of this world where we were going to the horse race track in San Anita, and they had a big beer fest during the day. So it was a perfect day for me. But I was chatting with my friend and he said, “Yeah, Meb.” I said, “What have you been up to this weekend?” He’s in from out of town.

He said, “I hit up 50 banks, or 30 banks already.” And I said, “That almost sounds like you’re robbing them.” And I said, “What for?” And he goes, “Well, I go and I ask for all their 50 cent pieces, because invariably some of them still have these older 50 cent pieces that are silver, have a high silver content. And they’re worth, instead of 50 cents, $3, or $10,” or yadda yadda. “And it’s my fun kind of treasure hunt world.” And I just laughed because I thought that was so fascinating. And then we talked about this for, like, three hours, because I said, “Hey, I’m gonna have a numismatist on the podcast this week.”

But my point being, long-winded side story was that, it seems to me, if I had to guess that coin collecting is a bit of an older demographic from a couple of the generations older, are you seeing any younger interest from, I guess, my generation, or millennials, or anything else? And then that’s kinda what I was talking about with the demographic changes. Is that an influence? Or do you notice any waves of what’s going on in sort of that interest?

Van: I would say my average client right now is in their ’50s. I have a tremendous amount of clients in their ’30s or ’40s, but I have a much larger group of clients in their ’50s and ’60s. So with the internet, the tech boom, and all of this kind of stuff, you have a lot of young guys who’ve made a lot of money. And in the coin market, you have a couple of different markets. One, the really nice, high-end stuff has moved up a lot in price because you have a lot of people who have made a lot of money and have focused on really great coins.

So that’s priced some of the younger people out of the market. But they’re still buying coins. I mean, the U.S. Mint is the largest coin dealer in the world. I think they have 16 million people on their mailing list that they mail out to all these collectors every month, these new products that they make. And they sell millions and millions of coins to new collectors who are buying coins, and some of those collectors then find out they can buy older coins. Like a lot of the U.S. Mint products are new commemorative gold coins that they make. And some of the collectors are now calling and saying, “Yeah, I’ve been buying these new U.S. coins. I didn’t know they made old U.S. gold commemoratives from 1903 to 1926. There were 11 different coins they made.”

So some of the people will focus and move back into the older coins. But the demographics, I would say the majority of my clients are in their ’50s. Usually business people, usually people who have made money. And everybody kinda buys for a different reasons. As you know, Meb, I collect a wide variety of things from pottery, to glassware, to antique knives, everything, Indian things, I mean, Navajo things and stuff like that. But I get people who call and they say, “I wanna buy this because I love it.” Or, “I wanna buy this because I think it’s a great value.” Or, “What should I buy to leave to my kids or grandkids?”

And so you have different buyers for different reasons. A lot of the over 60 are looking, me being included, are looking to buy things that I can leave or pass from one generation to the next that has value and will continue to have value. It’s interesting because I’ve had a lot of pretty wealthy people, some of the richest people in the world, be clients. And I said to this one guy one time who’s “Forbes” listed at over $4 billion. I said, “You know, what are you trying to buy?” Because he was all over the map. At one point he wanted me to go buy Winchester rifles for him, and he was willing to pay me a fortune just to go buy rifles for him. And he goes, “Man, all I’m really looking for is something that’s great. If it’s great today, I wanna make sure it’s gonna be great in 20 or 25 years. I don’t care what the currency of the realm is at that time.”

He goes, “A Van Gogh is always gonna have value some place in the world, and I want something like that. So tell me coins,” and it was also guns, “That will always have value.” So your demographics, everybody has a different reason.

Meb: Well, and it makes sense, too, that the 50 year olds, because in general that’s who has the money. And I’m just curious in my head if some of the advent of Instagram and other areas, because coins tend to be a very visual sort of collectible, if that’s starting to help. How much of it is becoming international? Because the way that I think about it, I think a lot about that sort of investment where you see Bitcoin, often the transaction volumes spike when certain countries are going through economic turmoil. So I just wonder how much…do you see any sort of China demand? Or maybe South American demand when things are going poorly? Or do you see it more as driven by kind of macro forces like inflation, or gold and silver pricing, or geopolitical events? Is there any sort of broad paint brushes you can comment on there?

Van: Well, kind of everything you just said there. I mean, you know, when you have inflation, rare U.S. are probably the main focus where everybody goes to, because they’re so tradable, and they trade at such tight spreads. Those, and gold and silver bullion, but gold and silver bullion are limited by the gold and silver bullion market. The rare coin market can go up dramatically, quickly. Now the Chinese are completely different in the sense that they get interested in coins, and this happened in the last 7 to 10 years. What happened when, after Tiananmen Square and problems like that that happened, and all of a sudden China was opening up and becoming more of a capitalistic society and letting business go and everything, I told one of my friends, I said, “Let’s start buying Chinese coins, because these Chinese people may be buying coins in the next 5 or 10 years.”

I’ll give you an example of what a bull market can be in coins. So I ended up buying two high-grade silver dollars, a 1914, and a 1916 Chinese silver dollars. One was graded MS66, one was graded MS67, and this was in the late ’90s. I found them in my safe two and a half years ago, and I thought, “Oh, I wonder what these are worth now.” And we used to own seven different auction companies, so I called one of the auction companies that we used to own and I said, “Hey, can you tell me what these things are worth?” And he goes, “Oh, jeez, it’s too bad you’re calling me now because our last auction 4 months ago they would’ve been worth, like, 60,000 to 70,000 a coin.” I’m going, “You’re kidding.” He goes, “No, now they’re probably worth 40,000 to 45,000.” And I said, “Well, I’m gonna give them to you and let you auction them.” I forgot.

Six months goes by and I call him again and he goes, “No, they’ve kinda slowed down quite a bit. The most I can probably get is 25,000 to 35,000.” I said, “Fine, I’ll just sell them.” I put them in the auction, 1 sold for 25,000 and 1 sold or 45,000. Okay, I paid $600 for 1 coin and $900 for the other coin like 10 or 15 years before, but the Chinese got so hot on the coins that there becomes no price resistance. So the Chinese right now are very interested in their modern issues. And a good example, we opened an office in China about three years ago. And as you open offices…I mean, a grading company, our PCGS we opened over there. And it takes years for things to catch on, and we realize that.

So we’re going to a show last year, maybe a year and 2 or 3 months ago, and we thought, “If we can just grade 2,000 coins at this show it’ll help with some of the expenses, some of the marketing expenses, and we won’t lose too much money.” Well, we ended up grading 6,000 coins. And it really caught us by surprise, and we thought, “Okay, this is like baseball cards. It’s gonna kinda catch on overnight.” So the next quarter, there was another show. We flew to Shanghai and thought, “We’re not gonna do 6,000, but if we can do 3,000 or 4,000.” I think we did 11,000 or 12,000 at that show. And so the next show, last August, a year ago, or eight months ago or whatever, we went to the show and we were thinking, “Okay, well, we’re not gonna do 12,000, but man, if we could that would be great. Let’s not put any number on it.”

After three days, we quit taking submissions at 58,000 coins with a line of Chinese people out the door to submit coins. And the next day one banker comes to us and says, “I need you guys to submit some coins for grading.” And we’re going, “Well, we’re not taking anymore.” He goes, “No, you need to take these. They’re out in the armored car.” And we go, “No, we can’t take them.” And I go…I didn’t say it, one of the guys who works for me said, “Well, how many do you have out there?” He goes, “I’ve got 200,000 coins.”

Meb: Oh my God.

Van: Yeah, so now we…it’s a big bank and he’s getting the coins graded by us. And then he delivers them to his other banks below him, and the banks sell them to the general public because the certified coin market in China has become extremely hot for these new, modern Chinese coins. Now we just did a contract with him, and I don’t remember the number but I think they’re guaranteeing 300,000 coins a quarter, which is 100,000 coins a month from this 1 client. So when you said something about China, China can affect it quite a bit. Now the other thing is David, my business partner, got asked to go give a speech over in China. He went into a room and there was like 30, I guess, very…it was a lawyer and he wanted us to talk to his clients. There were, like, 30 of these Chinese people in there and an interpreter who explained everything David talked about.

And David held up a coin and he says, “This is an 1804 silver dollar. It’s worth 5 million. Here’s a 1913 nickel, it’s worth 4 million. Here’s this 1933 $20 gold piece that’s worth 8 million.” He holds up five coins, and they’re all, you know, the interpreter’s talking about it, and he puts them in his pocket. And he goes, “Here’s $25 million I’m leaving the country with.” And the room exploded. And all of a sudden, the Chinese were like, “Wait a minute, this is a way I can get money out of my country.”

So we’ve seen some of that happen now where all of a sudden some of the wealthy Chinese are coming in. And I’ve had several of them contact me. And it’s sometimes difficult to deal with them, but they have a tremendous amount of interest in anything that has value. And the U.S. coins are probably the most collected coin in the world.

Meb: That’s really interesting, because I wasn’t expecting you to go down the international tangent, but that in my mind has a bunch of wheels turning that we may have to have you back on to start to talk about that. Because that’s a whole other area that I hadn’t really considered, which is a lot of countries as they come out of the emerging status, particular India and China, but other countries, too. And then ones where capital flow is restricted in many cases, China being the prime example, you think of potential ways that may benefit, and certainly rare coins is one.

Let’s come back to the U.S. coin market for just a minute just so we can kind of get a little more perspective and get a little more specific. Is there such a thing as kind of the most famous or number one most traded coin? So if you were to say, like a blue-chip coin, like the S&P and say, “You know what? Here is the Apple of the coin market.” Is there one such coin that kind of exhibits that? Or is it spread across 10 or 20? Is there such a thing like that?

Van: There’s a couple, like a 1907 $20 High Relief is probably the staple coin. Everybody knows what a $20 Saint Gaudens is. They were made from 1907 to 1933, not every year, but they were made up until 1916 and they started again in ’21. But the 1907 High Relief, what happened is President Roosevelt went to a world-famous sculpture at the time, Augustus Saint Gaudens and said, “We’d like you to design the most beautiful coins on Earth.” And he designed the $10 Indian, wire edge $10 Indian, and the $20 Saint Gaudens. Well, he died a month before the coins were made. And when the coins were actually struck and made, the relief was so high that they had trouble getting the gold up into the dye, into the [inaudible 00:24:06] and getting it fully struck.

And they also, when they were finished, that were being struck nice, they couldn’t stack them. They would rock back and forth because of the relief. In other words, Miss Liberty’s knee was too high. The bird’s feather, or eagle feather, or wing was sticking too high, so they’d rock back and forth. So then they hired Charles Barber to re-design the coin. So everybody says, “Oh, I’ve got a $20 Saint Gaudens.” Well, they have a $20 Saint Gaudens that was re-designed by Charles Barber. The 1907 High Relief, they only made 11,200-ish of, 11,200, 11,300. There’s different numbers out there. But that’s kind of a coin that’s about a $50,000 coin in the grade of MS65 that has always been one of the main coins that everybody looks at.

Now you could go to some of the more expensive coins like an 1804 silver dollar that may be worth $2 million, or $3 million, or $4 million. There’s real famous, rare coins out there, the 1913 Liberty nickel, there’s only 5 of those known that are several million dollars a coin. So I think if you were looking for, what’s the IBM, or the Apple stock? A 1907 wire edge 10 or a 1907 $20 High Relief would probably be 2 of the main coins.

Meb: And one other cool thing you guys have done is we spend a lot of time with academic paper and trying to quantify how just adding certain investments to a portfolio works, etc, and you all have developed a whole series of indices called “PCGS 3000,” and had sub-indices as well that shows the value and essentially indexes a lot of the value of coins. So we read a few white papers from various professors. I think one of them was from Penn State. We’ll toss these in the show notes as well so readers can take a look.

The takeaway in general was that, particularly for the rare coin market, if indexed, did somewhere in between equities and bonds. So pretty strong return. It was actually pretty close to equities, and seemed to have quite a bit of history in various sub-sets. Some that were more exposed to gold, for example, obviously would have a higher exposure to gold markets, but others, like the rare coins, seemed to be fairly uncorrelated, which is a pretty interesting takeaway. So I wanted to talk a little bit about…all right, so the investor listening in who has a long time horizon, and wants to say, “Okay, I’m gonna start to dabble in rare coin collecting. I’m really interested in this space.”

Let’s do a real example. And so let’s say Van, let’s say I have $10,000, and I wanna make this…this isn’t a hypothetical. I wanna grab Jeff one day, drive down to Long Beach. We’ll grab lunch or something, and say, “All right, Van. I would love for you to build a portfolio for me starting out with $10,000. My criteria are such that I don’t wanna just blow it all on one coin, because I tend to be pretty aloof and I’ll probably lose it. So maybe as small as 2 or 3 coins, but all the way up to, say, 5 to 10 if you think that’s reasonable. And then the second criteria would be that I would like to tilt towards beautiful coins. So I would rather not just have some mis-stamp that’s really ugly coin that it’s just valuable because it’s rare. And then lastly, with the tilt, or if you had to decide on any of the other ones would be coins that may have a little bit of historical significance, like the one you were just talking about as well.”

So what would you tell someone that would have that sort of request? If you were to build a portfolio for me today, where would you begin?

Van: The coin business has five or six basic areas, which would include U.S. silver dollars, which are a very widely-traded market. They have 19th-century type coins, which are coins that were struck from the late 1700s to the early 1900s. And by type coins, I mean they had…people used to collect coins by every date and every mint mark. And as the market became more mature, it became more efficient and people started moving towards higher quality. So people couldn’t find an 1849 oh such and such coin in a high grade. So they started buying one of every variety, or one of every type, like a Liberty Seated Quarter with arrows at date, or arrows at date and rays on the back. Or with motto, or no motto, because prior to the Civil War, they didn’t have the motto “In God We Trust” on coins. It wasn’t until the two cent piece came out with that one it. So that’s a very collectible area.

Then you have the U.S. gold coins, which are, you know, $2.50 gold pieces, 5s, 10s, $3 gold pieces, things like that. And the silver commemoratives, and then the 20th-century modern singles, which include Buffalo Nickels, Mercury Dimes, Walking Liberty Half Dollars. Those are kind of the meat and potatoes of the whole coin business. There’s a lot of variables you can go off on. If you said to me, “Van, I wanna buy beautiful coins. Beautiful coins that are good value.” I mean the Liberty Seated dimes, quarters, half dollars, and dollars, which is Miss Liberty seated on the front with an eagle on the back in proof, those coins to me are fantastic values and fantastic beauty to look at as far as eye appeal. I’ve never shown one to somebody, except one libertarian guy who, or he’s an anarchist. He goes, “Well, at least it doesn’t have some president’s head on it.” He goes, “It’s got Miss Liberty, so I guess it’s okay.” But those coins are very, very collectible, very, very beautiful.

The other areas, the Barber half dollars, and quarters, and dimes in proof. In proof were coins that were struck for collectors, so you take an 1875 quarter. I mean, somebody went to the Philadelphia Mint in 1875 in their buckboard and picked up a highly-polished coin for their coin collection. But back then it was mostly the Europeans who were buying, the English and the Europeans who were buying the U.S. coins. Well, in 1875, after the Civil War there became a pretty active market in the United States on coin collecting.

So I’d put half the money, or 30% to 50% of the money in silver coins, and 40% to 50% of the money in rare gold coins. And the gold coins you have a couple of different options. You can go with the standard 19, 20th-century gold type coins, like a $20 Saint Gaudens, or a $20 Liberty, or $5 Liberty, or $3 gold piece. Or you can go with some of the gold commemoratives, which are also…actually on my website, on the front page there’s an article on why I think gold commemoratives are so underpriced. I mean, some of those, they get blown up out of price range with telemarketers who push the prices too high. And then when they walk away from them, and this happened in the ’90s with these coins. And then about 2005, 2007 the telemarketers quit selling them and the prices came down 80% to 90%. But these are coins that have been collected since 1903. I mean, they have a very strong collector base.

When I was a kid in 10, 11, 12 years old, I always wanted to have a gold commemorative dollar, a real gold coin. And the only one I could ever even think about would be a dollar because it was less than a $2.50 or $5 gold piece. So I would split it between gold and silver. You can go into nickel and copper. It’s a little longer term play, I think, right now, but you would have to decide, “Am I doing this to make money right away? Am I doing this to make money over five years? Am I doing this because I love coins and I don’t care. But in 10 or 20 years, I’d like to sell it for a lot more money. Or I’m gonna pass it to my new child.”

If you were looking to buy things that are a good long-term play, some of the nickel coins, 3 cent pieces that are made out of nickel, Liberty Nickel coins, Shield nickel coins, those are your…I know I’m probably talking Chinese here, and I apologize. Back to your question, I would do a…

Meb: No, it’s good. Like I said, I’m gonna drag Jeff down there, and we’re gonna take a bunch of photos and post them in the show notes, etc. But I do lean towards the prettier coins. One of the things you said that I picked up somewhere on a prior interview is you said, thinking about collectibles and where to start, it says, “If you wanna understand collectibles, stop thinking of them as investments and start thinking of them as history.” And so part of it, to me, is is this whole sort of economic history, and I love reading a lot of the historical texts on history involving the economics of the U.S. and all over the country. And so coins are kind of a very tangible bridge to that to me. Also that they’re worth something, and my father and my grandfather used to collect coins. And we have kind of their leftover collections, as well as I have a couple of those change proof sets, which are probably only worth about five bucks from when I was born and my brother, etc.

So that’s kind of my criteria. It’s something, look, if it makes inflation plus rate of return, I’m happy with that. But also that it’s something beautiful that I can share with children, or nieces and nephews, etc. So that’s my criteria. But a lot of the description, I think, is really interesting. But some of the ones I was flipping through certainly are absolutely gorgeous coins. So we’ll have to do an in-person video of it when we come down.

Van: Yeah, I mean, that part’s pretty easy.

Meb: Good. Well, let’s talk a couple more question on coins and then we’re gonna veer into some other areas. So if people were buying, and they’re not using reputable dealer, like David Hall. So let’s say they’re buying on an eBay, or just buy it from some coin show, what’s the risk of counterfeiting? Is it something that’s becoming more prevalent with technology, or less prevalent because of the grading? What’s the sort of risk there?

Van: There’s a pretty big risk. It’s against the law to have any counterfeit U.S. coin. So that’s a…the treasury will come knocking on your door and arrest you. But the reality is, last time we checked in China there were 132, or 113, or 152 shops that were making counterfeit U.S. coins. It’s not against the law in China to make counterfeit U.S. coins. It’s against the law when they end up over here.

So I got a client, I probably had five of them last year who called and said, “Oh, I’ve got an 1804 dollar.” And I go, “No, you don’t.” And they go, “No, no, I do.” And I go, “No, you don’t. There’s a handful of them known and everybody knows where they are. You don’t have one.” They go, “No, you don’t understand.” I go, “No, let me clear it up. You had to pay cash for it, and you met some guy in a parking lot in an airport, right?” He goes, “Yeah, how’d you know?” I mean, there’s a lot. You do run into a problem with counterfeit coins. I would stay away from…everything I sell is prior to 1945, so I’m not a big fan of the newly modern minted things, which includes the proof sets that you’re talking about that were made in the ’60s and ’70s, or the new issues that are sold today. But they sell millions of them, so there’s a huge collector base for them.

The counterfeit problem on, and I’m not saying eBay, but on the internet, there is a chance of it. To what degree? I don’t know, because I don’t do business with them, or on that. I mean, usually somebody brings a coin, I’m the last person they’re gonna bring it into if it’s counterfeit, so I don’t see that many of them. We see them in the grading room. Like I just had a guy in here yesterday, bizarre. This guy comes in a month and a half ago and pulls out some coins, and I about fell off my chair because the last time the coin was seen was 1978. He goes, “Well, is it worth about 200 grand?” And I said, “It’s worth probably 500 grand to a million dollars.”

And so he brought it back yesterday to have me sell it. It’s a one only coin. It was a specifically made gold coin for the director of the mint, a real, real important coin. And then he pulls out a 1907 High Relief, which was the coin we just talked about. And I said, “Well, it doesn’t look quite right. It looks like it’s been polished.” And he goes, “Well, I bought that back in the ’70s.” I said, “Okay.” I sent it down to the grading room and it came back questionable authenticity. So I went back downstairs and I said, “Okay, show me what’s wrong.” And there were some identifying marks that the coin was counterfeit, but it was counterfeited back in the ’60s or ’70s. And this was a coin he spent a lot of money on back then. So you do run into the problem with counterfeit.

The one thing is, if you’re buying coins, you have to buy coins that have been graded and certified. And make sure you’re dealing with somebody who’s reputable. So you do run into the problem there.

Meb: And so for someone who’s starting out, so I assume that’s a common mistake. Common sense, listeners, don’t buy coins in parking lots. But so where do people go? I mean, so dealers like David Hall, but also you mentioned some exchanges. Is there one big standard exchange? Are they kind of spread out? What are some of the mistakes that, kind of, people starting out make? And where should they go to do it the right way?

Van: The biggest mistake people make, and I’ve found this in everything I collect, is the easiest thing to do is spend money. So you end up buying everything. And usually once you learn more about it you have to sell about 90% of what you bought in the beginning because you’re just buying everything. So the hardest thing to do is find somebody that…let’s say you decided you were gonna spend 10,000 or 10 million. The hardest thing to do, in my mind, is find somebody that you can trust who’s gonna say, “Okay, here’s where I would place the money, in a product that, I can’t guarantee it’s gonna go up tomorrow, or next year, or in five years, but it’s always been a great product.” And it’s like a piece of property down there on the beach that maybe in 2007, 2008, 2009, to 2010 the property didn’t do much in value, but the property still had value. And it was going to have value again somewhere down the line.

So you wanna buy the right product. The easiest thing to do is spend money. Hardest thing to do is slowly spend it and buy over time, and focus on certain things if you like certain things. If it’s just a commodity and you’re saying, “Okay, I wanna place 100 or 200 grand into coins,” then it’s easy. You can find somebody who can sit down and select some great coins for you that have good value. And you just have to stick with, in my mind, higher grade. In the grading system, the scale goes from 1 to 70. And once it gets to 60, it becomes mint state, brilliant uncirculated. So you have ’61, ’62, ’63, all the way to ’70.

And once you get to ’65, it becomes very collectible in coins after 1850. That’s almost the magic number. A lot of people don’t want lower graded coins. They like the number MS65. And it’s funny because I’ve had collectors who used to collect Barber dimes in MS65. They got too expensive so then they moved to Mercury dimes in MS65. And then when those got too expensive they moved to Roosevelt dimes in MS65. They didn’t go for lower grades. They stayed with the higher grades in just different coins. So buying higher quality, and buying from a reputable person. And you can find…there’s lots of dealers out there who are very knowledgeable and will treat you right.

Meb: Is there like an association, or is there a place people go to find a list of these dealers?

Van: No. I wish there was, but there’s not. I mean, there’s different associations, but in my mind there’s just more crooks on there than there are…

Meb: And same thing for exchanges? Is there one particular exchange, or is it kind of also spread out?

Van: It’s kind of spread out. I mean, you can Google certain coins and find them, and things like that. There’s Collector’s Corner, which is an exchange that we own that people go to and they pay a fee, I think, to get on it and become a member. And you can buy coins off there, they can see coins listed. But you still have to find somebody who’s gonna direct you in the right way, unless you know what you’re doing. If you know what you’re looking for, then it makes it pretty easy. You can just search it out.

We were buying and selling coins before we created PCGS. When you look at a coin, we’ve always graded it through 100. So if we grade a coin 65, in our mind it’s 652, 658, 657, which is essentially, A, B, C, and D quality coins. But David and I have always tried to sell just the A and B quality coins instead of the…in other words, the high end for the grade, now low end for the grade if that made sense.

Meb: Yeah. Well, and it’s also kind of like the S&P 500 the way you’re talking about rated over 65 and higher, is you’re kind of staying with the quality coins that people will be demand for going forward. And like having a financial advisor, I think a lot of our listeners struggle with, you know, there’s tens of thousands of financial advisors out there. Most of them well meaning, but of various levels of quality. And even the ones that have the designations, kind of like you mentioned with the associations, aren’t necessarily the best. Or in certain areas where they’re not RIAs that don’t have to follow the fiduciary standard. So trust is a difficult thing with investments. And I don’t know if there’s any hard and fast rules about finding a reputable dealer, but certainly if anyone listening, I think Van is one.

Sponsor (Meb): Let’s take a quick break from the show to bring you a message from our sponsor. What if you could help combat global climate change and make money at the same time? Introducing Wunder Capital, the award-winning online investment platform that allows individuals to invest in solar energy projects across the U.S. Guys, living here in California, I can tell you there’s a lot of support for this type of environmentally conscientious investing. Even outside of California, as I speak around the country it seems I regularly meet advisors and investors who are interested in ways to combine investing with social responsibility.

So here’s how these two things come together at Wunder. Investment goes directly to helping U.S. small and medium-sized business install solar panels. Wunder manages the portfolio for you, making the process easy. As those businesses repay their loans to Wunder, you receive monthly payments deposited directly into your bank account. So what kind of return can you make? Well, Wunder’s online investment platform allows you to earn up to 8.5% annually. And remember, this is while diversifying your portfolio, curbing pollution, and combating global climate change. And best of all, Wunder Capital doesn’t charge investors any fee for managing your money.

I checked Wunder’s sign-up process and found it to be simple and straightforward, plus you could invest with as little as $1,000. Create an account for free at wundercapital.com/meb. That’s Wunder with a “U,” Wunder Capital. Do well and do good. Now back to the show.

Meb: Van, let’s shift gears just a little bit because I’d love to keep you for three hours, but it’s a beautiful SoCal day, so I’m sure you’re not wanting to spend inside all day talking on the phone. I may misattribute…

Van: I’m sitting here smiling right now, but go ahead.

Meb: I may misattribute this quote to you when we had this dinner. So Steve may have said it, it could have even been your wife. I don’t remember, but I’m attributing it to you. And we were talking about collecting. And if you guys ever visited Van’s house down in Long Beach, it’s this beautiful…it’s almost like a museum. So you see kind of pieces all over from the oddball stuff, to like Van mentioned, pocket knives, and firearms, and memorabilia. He mentioned at one point he even had a tiger in there. But Van, a quote you said essentially is, I was talking about being an investor and forecasting. And I said, thinking about collectibles and memorabilia, I said, “What’s a good idea how to forecast what’s gonna appreciate?” Because to me, like the art world and all this stuff seems so subjective.

And I think you said something along the lines of, “You want to buy what the generation that’s next coming into money coveted when they were younger.” Is this something you said? Am I completely making this up, or it’s something that’s…

Van: Yeah. No, that’s true. That’s true. The problem with most of the stuff that’s being built today, it’s made out of plastic. So I have a tough time with it.

Meb: And I cannot tell you how many times I’ve been out walking our dog where I think a little bit about that. And so you’ve kind of seen some of it over the past decade, right? You’ve seen this huge run up in classic muscle cars from the ’60s, the Corvettes, and Dodge Challengers in other areas. So do you have any broad thoughts on kind of the collectible space, on what maybe is currently popular for your generation, but maybe any thoughts on what might, and it reminded me earlier about China, and etc, what might become interesting and popular going forward? And a quick aside is, what may seem undervalued today that could be a good investment?

Van: Well, there’s a couple things there. Part of it is finding something that is…older things, it takes a while usually to find out something is great. The hardest thing to do when you’re buying collectibles is find somebody who knows… There’s a lot of people who know things that are really good, and there’s like 1 in 100 who know the difference between something that’s really good and something that’s great. And the difference between something good and something great is like night and day. So when you look at the stuff that they’re buying today, and you had mentioned pocket knives. I was just talking to guy and he said, and he’s a big knife dealer out of Tennessee or West Virginia. All the knife collectors are from the south some place, Georgia and everything.

And I was talking to this guy, and he was one of the most knowledgeable guys on Earth. And he goes, you know, “Buying that stuff you collect, nobody’s gonna be buying in 20 years.” And I said, “That’s okay, Tommy. Just keep selling it to me, I’ll buy it.” And he started laughing and I said, “What’s everybody buying today?” And he goes, “Well, this one knife.” And he explains some plastic, carbon-fiber plastic knife that he just sold for $24,000 for a pocket knife, and it was just made in the last 6 months. But you have these new young Chinese guys who have money who are going after that type of thing.

I tend to always lean towards something that has a historical background, and a trend or a following for. I don’t like to buy new things because it usually takes 30, 40, 50 years before something becomes collectible. I don’t wanna buy something now hoping in 40 or 50 years it’s gonna become collectible. I’d rather buy something that’s had a track record for 40 or 50 years. I think some of the most underpriced things, you have the American Indians who are now opening casinos and are making a ton of money, and they’re buying back their old heritage.

I think the Navajo weavings, the rugs, I think, are tremendous. And I say rugs, because some of these, you know, you could take a piece of pottery that’s 25,000 that some Indian made 4 of them that day. Well, an Indian weaving, you had some Indian woman who may have worked on it for 2 or 3 years making it, and it’s 25,000. And the other thing, I think it’s overlooked because it hasn’t been marketed correctly. This is art done by women, which has been completely overlooked.

And then the other thing is, I don’t know if I ever showed you I collect Indian peace medals, and 99 out of 100 people have never even heard of one. But starting with Thomas Jefferson, the U.S. Mint made these medals with the image of Jefferson on the front, and it’s two hands shaking hands on the back, a general’s cuff with a hand, and an Indian hand, tomahawk, and a peace pipe, and it said, “Friendship and peace,” on the back. Thomas Jefferson had 50 of these made and gave them to Lewis and Clark. And Lewis and Clark took them out and gave them to Indian chiefs. Said, “Our chief is at peace with your chief.” And these were so coveted that they were all buried with the Indians. And the majority of them that you see today were from Indian grave robbing back in the ’20s and ’30s where people were digging up Indian graves looking for their Indian peace medals. That’s what almost all of them are today. And I think there’s less than 400 or 500 in the world right now.

And they made them all the way up to Ulysses S. Grant was the last silver one they made. Or no, Benjamin Harrison, one of those. Anyway, but it was Ulysses S. Grant. But that’s an area that I think is very undervalued because it was made by the U.S. Mint, it was made in silver, it was made collectible by Indians like them and regular Americans like them. And they’re both Americans. I hope I’m not saying something wrong here. To me, I think those are fantastic investments, very undervalued.

And as far as new stuff, one of the guys in my office has a website that he deals in vintage Lego parts, and they’re just plastic. And I said to him, “Do you have a lot of them?” And he goes, “I’ve got over 200,000 pieces on my website, little pieces.” And you could say to my youngest son who’s like a genius, and he’d go, “Oh, this piece fits this. And he knows exactly what…” I’m talking about pieces that are a quarter of an inch in size. They know what everything goes to. So there’s a collector base for that stuff, but not me.

I understand the reason I like knives or guns is because they were handmade and they were made to be used as tools. And to find them in mint condition is very, very difficult. Things I like about coins is most of them were made to be spent, and people really weren’t saving them, except in Europe. And coins also, every coin change usually represented something, like in 1834 they lowered the gold content in coins. So the big $10 gold pieces got a little smaller, and all the larger ones hit the melting pot because they were worth more money. Kind of a sign of things to do, the government was taking gold out of their currency. That was the first sign of what they were gonna do in the future.

So there’s different break-off points for different times in history as to why things were made and what they represent. So that’s kind of a long, drawn-out answer. I don’t even know if I answered your question.

Meb: No, that’s good. Like I said, I spend a lot of time thinking about it because it’s such an interesting way about thinking about collectibles. And to me, there’s obviously a lot of randomness, but I was trying to even think about what my generation growing up would’ve cared or about or would covet. I mean, something like a first-generation iPod maybe, that in a box that hadn’t been opened.

Van: Absolutely. Or an Apple Mac, or any of those things.

Meb: Yeah, computers. But I don’t even know what else. So I grew up certainly collecting. My brother was a huge baseball card guy. So he’s seven years older than me, so we kind of caught the tail end of the card collecting before it kind of started having massive, massive production, I think it was in the ’90s, and got saturated. A funny aside story is my mom is from North Carolina. And so my brother and I, every Saturday, or whatever it was, like, Christmas day, we’d go get a couple baseball card packs from the store. And he could spend hours at Bill’s Card Collectibles in Denver, I remember. And I did it, probably because a lot of it had to do just with spending time with my brother, but I also loved baseball and baseball cards in general.

But the funniest part, so my brother had boxes and boxes and boxes of baseball cards, and I had some but not as many. And I remember my mom, so she grew up in North Carolina, so was a huge college basketball fan in Carolina. And just to be part of the team, she would buy some basketball cards. So sure enough, fast forward 10 years, who has the most valuable investment? Well, it was my mom who had unintentionally bought, like, Michael Jordan rookie cards, right? You fast forward and my brother has an entire storage room of baseball cards, but what’s most valuable, it was mom.

And along the same lines, I also read a ton of comics. The kindest thing my parents did to me was they said, “Meb, we’re gonna budget you on your spending. You’re not gonna buy everything you want, but if you ever wanna buy a book, or if you ever wanna read we’re happy to buy you any book you want.” And so I kinda took that and ran with it, and so ended up buying a ton of comic books. And sure enough, same thing, one day I spent all day cataloging the values and Mom was like, “Oh, we have a few comic books in the attic.” And sure enough, they’re these old cowboy comic books that are worth 10 times more than my entire collection.

There’s always a bit of randomness but it’s just kind of humorous to me that my mom is clearly the best investor in our family. A couple quick questions and then we gotta start winding down. I mean, this could literally go on two, three hours. It’s fascinating to me and we may have to have you back on. But one question that popped back in my head was, as technology improves, at what point, Van, do you guys incorporate, or does someone? Is the ability to grade these coins become software-based, meaning that you could have a program that’ll optically recognize potentially these coins? Is that something you see that’s on the horizon, 5, 10 years? Starting to become commonplace? What’s your thoughts there?

Van: I’ll answer that, but then I do wanna go back to baseball cards. We had a computer in the ’90s that graded coins. And we had a guy who came to us and said, “There’s this new software. I can build a computer that can grade coins.” And we kinda rolled our eyes. And I said, one of my friends and clients was the guy who invented CAD/CAM computer software, and he was like this genius computer guy. And I said, “Well, who all could do this?” I said, “Could this guy do it?” He goes, “Yeah, he could do it. There’s a guy in Germany who could do it, a guy in Hong Kong, and myself.” And I said, “Really? So there’s only like four people in the whole world?” He goes, “Yeah, but they’re focused on other things.”

So we put him up in a cabin up in the mountains here by Big Bear, and he sat there for two years and studied the movement of the eye as I had graders go up and look at coins and grade coins. And it ended up where I think his computer made either 2.2 million or 2.2 billion calculations in 4 seconds on a coin, and it would grade the coin exactly the same a million times out of a million times. And so when we had this big presentation two years later, and I mean, “The Wall Street Journal” was there, and “The New York Times” was there, “Forbes” was there. Everybody showed up to see this computer, which in a sense was artificial intelligence.

And he sits down and explains this thing, and I brought the guy who invented CAD/CAM computer software. And when the curtain pulled open and here was this guy sitting there, my friend looks at me and goes, “You guys are grading coins.” And I said, “Yeah.” And he goes, “Well, you picked one of the absolute best in the world.” So afterwards I said, “Pat, how good this this guy?” Now this was two years later. He goes, “There’s only four guys who could do this.” He goes, “Rocky in Germany, Billy in Hong Kong, myself, and Lou.” He goes, “There’s only four guys in the world who’d be smart enough to do this.” So we do have the ability to do that, but the coin collecting community ended up rejecting it because they like the human emotion tied to collecting a coin, to grading a coin. So that became more important. And so we’ve never used it.

Every once in a while some penny stock company will come to me and say, “You can buy our stock. We’ve got a computer that’s gonna grade coins.” I’m like, “Oh, yeah, sure you do.” Because, I mean, we spent a couple million dollars building it, and it ended up becoming worthless to it.

Meb: That’s fascinating. I have lots of really terrible ideas. We talk about this a lot on the podcast. Almost every morning I have a terrible business venture idea. And my other one was, and I don’t know the answer to this, is that, so most of these coins are not in circulation. But to a certain extent, there has to be some amount of coins in circulation that are valuable. And when I say valuable, I may mean a penny that’s worth a dollar, or $5, instead of being a penny. I doubt there’s any that are worth, obviously, a million. But I said, “I wonder if you could apply that same optical technology to be basically just have a Coin Star machine down at David Hall, and just have circulated coins and dollars go through it.”

I even heard someone tell me the other day, and I think this is just so wonderfully enterprising out of people, is they get dollars in 5s, 10s, 20s, and ones that have interesting serial numbers they sell them on eBay, and people will pay many multiples of the price for dollars that have 6 0s in a row, or whatever. Is that something that would even be remotely viable? Or is that just kind of a terrible idea?

Van: No. We have a website, I can’t tell you the name of it. We have so many different websites, but there’s one where I think it’s called “What is my coin worth?” And that may not be what it is, but you can go in there and punch in exactly what it is, and it’ll show you the value and all the different grades, which helps a lot of people on that. But you’re talking about doing a coin machine where you just pour it in and a bunch of coins get kicked out the side and say, “These are worth more.” That’s a great idea, I just don’t know how we could do it. But then if we could do it in baseball cards and everything else, because you know we grade…I don’t know, 5 million cards a year, or 2 million cards a year. Nobody knows what their cards are worth, which is okay with me. They pay us millions of dollars to grade their paper, so it’s okay with me.

One of the thing in collectibles, and I get asked from time to time, do I buy high grades? Do I buy gold? Do I buy silver? If you wanna put something away for 5 years, or 10 years, or 20 years, or something to leave to the next generation, you wanna focus on something that’s gonna make a difference. Buy something that makes a difference today and 20 years from now. And you can go back to your baseball cards. You know what a 1952 Topps Mickey Mantle is. I mean, those cards…I started buying those in 1982 when the coin market and the baseball card market had come down. And I didn’t know that much about baseball cards but we teamed up with a guy named Tony Galluvich [SP].

And we opened a card buying business called American Card Exchange, and Dave, and I, and Tony were in this thing. We hired a PR firm and pretty soon “People Magazine” wrote us up, “Playboy Magazine,” “Life Magazine,” all these magazines wrote us up that these guys are actually buying and selling baseball cards. And at the time, “Sports Collectors Digest” was like 25 pages. It was a small little paper. And they ran an article in there, and it had a cartoon of a sorcerer, like a money changer sitting at a table with a sorcerer’s cap on throwing money up into the air. And it says, “Guess who’s getting in to ruin the baseball card market? Van Simmons and David Hall, the two coin experts, are gonna promote baseball cards in high grades.”

Well, the reason being is a 1952 Topps Mickey Mantle is a card that makes a difference. That’s like the holy grail. Not the…you know, a Honus Wagner T206 is really the holy grail, but it’s a High Relief, so to speak. And so I was buying those cards because they were about 4,000 to 5,000. In the ’70s, they went down to 1,000 to 1,500, so I was paying 1,100 to 1,700 for these cards. I bought nine of them, and at that time which were graded mint. In 1987, they were worth $7,800, or $8,000, or $9,000 a card, and I blew them all out and thought I’d hit the lotto, and I did really well.

Well, by then we had promoted baseball cards so well that by ’87, ’88, you had baseball card stores on every corner and people were buying vending boxes of baseball cards in the late ’80s, early ’90s, and the old cards nobody was paying attention to. It was all the modern stuff. And then when we started grading baseball cards in ’92, let’s say, by ’94 it caught on. And somebody called me and said, “Hey, did you hear Topps Mickey Mantle just sold for 50,000 in a grade 10?” Because we grade baseball cards on a scale of 1 to 10. And I said, “Are you kidding me?” I said, “That’s ridiculous. I used to pay 1,200, 1,300 bucks for those.” I go, “Man, talk about a market that’s peaked.” Okay, well, I was right in the sense that you buy something that makes a difference, because that card makes a difference.

An hour later my business partner walks in and says, “Hey, look what we just bought.” And he throws this card down. And I said, “Did you pay 50 grand for this?” And he’s standing there looking at me all fat, dumb, and happy, and I’m laughing at him. And he goes, “Yeah.” And so we made a dollar bet that it would sell on auction for a year or more later for more money. He put it in auction a year later and it sold for 120,000 to a lawyer. That card today, if one showed up today in a grade 10, I just found this out about 2 or 3 months ago because I asked the guy who runs the baseball card grading service for me, Joe Orlando, he’s the president of it. I said, “What’s a 10 1952 Topps Mickey mantle worth?” He goes, “Oh, I don’t know, 5 milllion bucks?” I said, “[inaudible 01:00:10].” I said, “Wait a minute, I’m talking about a…” He goes, “No, man, that’s what it’s worth.” He goes, “There’s some big Hollywood people who are just paying through the nose.”

And there was a, I think it was a Carl Yastrzemski card that sold last year in auction. And the thing brought, like, 500 grand or something, and I couldn’t believe it. And the guy who bought it called and said to David, “What do you think about this?” And David said, “Oh, it’s a great card.” What do you say, right? And the guy says, “Do you think I got a good buy?” And David says, “I think it’s a great card.” And then a couple days later another guy calls and says, “I just offered him 750 and he wouldn’t take the card.” And David’s going, “What?”

And then a week later the guy calls back and says, “Yeah, I just offered him a million dollars and the guy won’t sell the card.” And so David called the guy and says, “Did you really get offered a million dollars for that card?” And he goes, “Yeah, but I’m a 38-year-old hedge fund manager.” He goes, “Well, I make a lot of money. I don’t wanna sell the card for a million dollars. It doesn’t make any difference to me. I’d rather keep the card.” So some of the stuff, it gets overvalued. And I’m not saying that’s overvalued. I’m just saying there’s people who want it more than I do. But things that make a difference when you buy collectibles is an important way to look at it.

Meb: That’s really funny. And I’m trying to remember off the top of my head, so the highest coin or baseball card auction, are they both around kind of that $5 million to $10 million range?

Van: Yeah, probably. There’s the 1933 $20 Saint Gaudens that sold 10 years ago or 15 years ago I think brought $9 million or $10 million. There was a silver dollar that sold recently for $10 million or $12 million. I don’t know the exact figure, 1794 Specimen first silver dollar struck, supposedly that we had graded. And there’s some big tech guys who have made a lot of money, and they’re looking for places to park their money besides the U.S. dollar, or besides any currency, you know, long-term, I guess.

Milton Friedman was one of my clients, you know, the Nobel Prize winning economist. And he goes, “Well, you know, Van, all currencies are toxic.” I said, “What does that mean?” He goes, “They’re all like a burning match.” He goes, “Sooner or later they’ll all go to zero.” He goes, “The U.S. dollar is no different than any other currency. Sooner or later it’ll be nothing more than a museum relic piece hanging on the wall.” So, in fact, his sister-in-law was one of my clients, and she was buying coins at one time, and she quit. And I called her and I said, “Dorothy, I haven’t talked to you in about six months. You used to call me every week.” She goes, “Yeah, I was buying coins to leave to my son.” I said, “Oh, did you buy enough?” And she goes, “Well, he passed away. He was 67 years old, he passed away. So now I’m giving all my coins away to Stanford University,” which I guess is what she did with her coins. So people buy for different reasons.

Meb: That’s amazing. So kind of along those lines of, those are some interesting stories. Do you have a most memorable, and I’ll kind of ask it in different parts and you can pick and choose, most memorable trade/collectible/investment? Over your career there’s been a lot of interesting things that have passed through your hands. Anything that sticks out in particular?

Van: One that was pretty funny, as I had a lawyer call one time and he said, “There’s a guy who has some great antique Winchesters, and Colts, and Holland and Holland shotguns who passed away up in Hancock Park up by Beverly Hills.” He goes, “I’d like you to go up there and make a bid on this stuff.” I said, “Okay.” And I pull up to the front and there’s these huge gates, and there’s this guy sitting in front of the gates in his car. And he goes, “Are you Van?” I said, “Yeah.” And he goes, “Okay, what’s it worth?” And I go, “Well, what’s what worth?” And he points, and I said, “What are you talking about? The house?” And he goes, “No, the iron gates.” And I’m looking at the gates and I’m thinking, “The iron gates?” And I started laughing and I go, “What the hell am I gonna do with iron gates?”

And in my subconscious I was sitting there trying to think, “Well, I wonder what those things are worth?” You know, trying to think, like I was really gonna buy iron gates. And he goes, “Oh, these were the gates that were used in the beginning of the movie ‘Gone With the Wind,'” and so on and so forth. He goes, “I’m just kidding you.” We went inside and he had this huge collection of guns and stuff. But that was one of the funniest things.

I’ll tell you a great story, though. When we had our auction companies we had a guy who collected coins in the ’50s and ’60s, and he was a schoolteacher who just had a really good eye and bought great coins. And when he passed away, his wife called us and wanted to sell the coins. Well, we’d never heard of the guy because all the dealers he dealt with back in the ’50s and ’60s had passed away. And this guy had coins that were six-figure coins.

And so when we announced that we were selling his collection, and so on and so forth, the president of the American Numismatic Association called my business partner and said, “What ever happened to his 1804 dollar?” And David goes, “Well, we didn’t know he had an 1804 dollar.” So David called his wife and the wife says, “No, he lost that coin back in the late ’80s. And he was just sick because it was a world famous coin.” And we’re like, “How do you lose an 1804 dollar?” So then the guy from the ANA calls back like two weeks before the auction and says, “Did you ever find the 1804 dollar?” And David says, “No, she just said that he lost it and was sick.” And he goes, “Well, it doesn’t surprise me because when I was at his house looking at the coins, when it came time, this one tray of coins and the 1804 dollar was in it, he was putting stuff in his safe. And I said, ‘Here’s this tray.’ And he goes, ‘Oh, just put it on top of the China cabinet,’ like it was no big deal.”

So the next day David wakes up and he calls this lady and says, “Can you look on top of the China cabinet?” She looks on top of the China cabinet and there’s the 1804 dollar. He put it in the auction and I think it sold for $4.1 million. That thing would’ve been sold at a garage sale for $100, and they wouldn’t opened it up and moved it and all the coins would’ve fallen.

Meb: That’s literally making my palms sweat just listening to that story. I went to a coin collector in Denver and found just kind of a fun Spanish doubloon or something, I forget. It didn’t cost very much, and gave it to my nephew for his birthday. And same sort of thing, by that night had already lost it. I think it was only 50 or 100 bucks, but it’s floating around my mom’s house somewhere. We’ll find it. Van, we’re gonna wind down. Just one or two more questions, we’re gonna let you go. We’ve already cruised through the hour mark. We ask this of all the investors on our program, and so do you have a memorable kind of worst investment? Is there anything that you got super excited about and maybe invested in or purchased, and the market just bottom fell out? Or everyone decided they weren’t interested in Garbage Pail Kids anymore, or whatever. Is there anything that comes to mind?

Van: No, mostly anything I buy that’s new. I mean, my wife got me sucked into these little clay houses that they sell for Christmas and stuff that you decorate and all that one time. And she started collecting those, and she got me hot on them. And I’m laughing at myself thinking, “Van, what are you doing? You know this is a mistake.” And now they’re worth, like, five cents on the dollar of what I paid. But mostly when you buy older high quality things, like in business, every rare coin I buy I usually lose in about 15% of the coins and break even on 15% of the coins, and make money on 70% of the coins. So you always make mistakes buying and selling coins, and I buy and sell them every day. And I say making a mistake, all of a sudden I get back from a coin show and I go, “God, why did I pay so much for this?” I end up losing money on it.

But no, most of the stuff if I stay with older, high quality great things, you usually don’t get hurt very bad. If you get stuck with stuff that is marginal, a lot of times you can get stuck because more of it keeps coming out. Like you and your brother when you looked at the modern baseball cards. All of a sudden there was like…like now there’s almost no market for them. The older baseball cards there’s a huge market for.

Meb: Yeah, so to kind of tie this together, for investors who listen to this and they’re like, “Man, that was fascinating,” and they wanna learn more about the market, what’s the best way to really immerse yourself? Is there any books you recommend, or trade publications? Or do you say, “Hey, you should just start going to coin shows and reading up?” Is there anything off the top of your head that would really help the person starting out?

Van: There’s a lot of books out there, and I haven’t read them so I don’t know which ones are good and which ones are bad, but I would think you could, you know, like anything. I collect California pottery. And I collect old pottery from the early 1900s to ’60s and ’70s pottery. And I probably in 2 months bought 20 books and read all of them. I think the best thing is to learn as much as you can possibly learn and then find a dealer. Like I have one dealer that I bought all my pottery from. I mean, every single piece. Well, I’m sorry, I bought one other piece in auction but he told me to buy it. You have to find somebody you trust. I’m a big believer in finding somebody.

It’s the same thing when I bought art. I have a couple hundred paintings that I bought over the years, and I bought probably 195 of them from 1 guy. I’ve kind of known the guy for years, and when I decided I was gonna go into this one area, I studied art and tried to figure out what area was the most underpriced. This would’ve been about 2010, 2012 after the art market got hit. Then it was like, what area is the most undervalued, and what are hasn’t been promoted? What was the weakest area of the market that had desirability and collectibility, or would in the future? And I found a guy who wrote about 15 books on art. And it was very worth it to me to pay his fee for his advice.