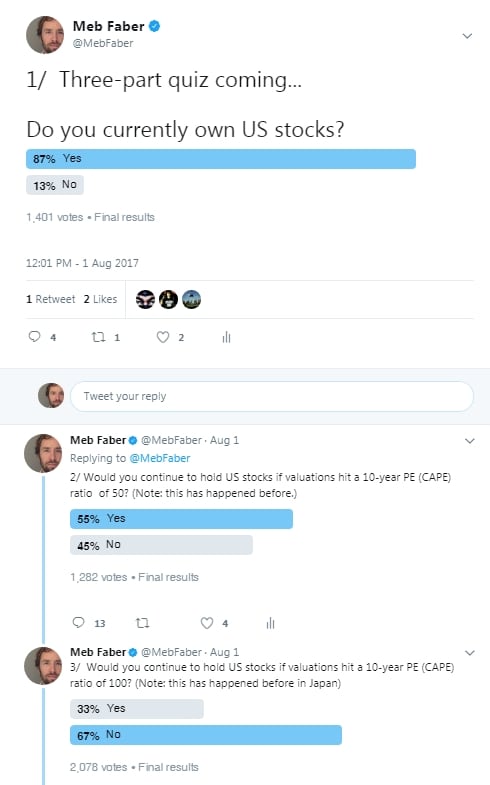

I’ve spent the last day marinating over this quiz I posted to my Twitter followers. I asked a series of three simple questions you can see below. The answers are surprising to me…there were 1,200 to 2,200 votes so a decent sample size. The Qs and As:

- Do you currently own US stocks? 87% said Yes

- Would you continue to own US stocks if valuations hit a 10-year PE (CAPE) ratio of 50? (Note: This has happened before.)? 55% said Yes

- Would you continue to own US stocks if valuations hit a 10-year PE (CAPE) ratio of 100? (Note: This has happened before in Japan.)? 33% said Yes

The first criteria for any investment should always be, “Will I get a return OF capital?” before the second, “Will I get a return ON capital?”. I don’t see how buying a basket of US stocks trading at the highest valuation they ever traded at in history is a good idea (CAPE ratio of 50 in 1999)? Or buying them at the highest ANY country has EVER traded at in history is a good idea (Japan near 100 in 1989)? Japan has seen three decades of zero returns after their bubble, but a third of the respondents would still make that investment…

Remember, when Mr. Market shows up at your door, you don’t have to answer….