“Nobody ever got fired for buying IBM”.

The etymology of this phrase comes from the early days of the computing era, when the technology was beginning to change the corporate landscape. It reflected one of the career risks of that day…and by extension, a way to avoid it.

If a purchasing manager bought a computer from a well-known, large, “safe” brand like IBM, he/she could avoid blowback if the product did not meet expectations. After all, it came from IBM – if you can’t trust IBM, who can you trust?

On the other hand, what if a purchasing manager took a gamble, opting to buy from a little-known startup company that might have a superior product? Well, if the product performed poorly, he might have gotten the pink slip (while little more than a pat on the back if the computer worked well, or even exceeded the capacities of the IBM computer).

Somewhat of an asymmetrical risk profile, wouldn’t you say?

We’ve talked a lot about this career risk concept with regards to advisors, client allocations, and global value investing. We used to show a chart of the cheapest stock markets around the world featuring countries including Russia, Greece, Brazil (and more recently Turkey!). However, instead of titling the column “cheap countries” we titled it “career risk”. Why? For the same reasons purchasing managers bought IBM computers.

If an advisor allocates client dollars toward “career risk” countries and the portfolio outperforms, then – from the client’s perspective – “box checked”. The advisor performed as expected.

But if those countries underperformed, well, angry clients are demanding to know why the advisor doesn’t have them invested in Amazon, Google, and Facebook. Clients might even be marching toward the door…

What’s all this have to do with Vanguard?

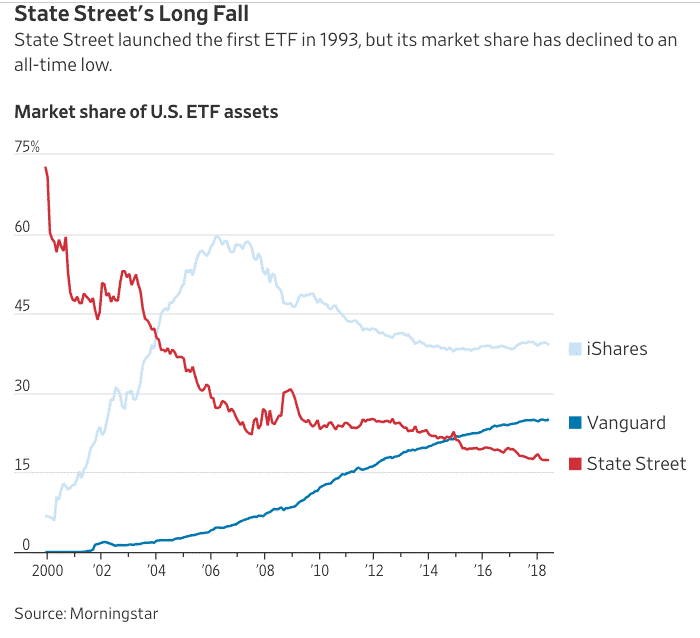

First, let’s be clear: Long-time readers know that I love Vanguard. I think John Bogle is a national treasure, and Cambria owsn Vanguard ETFs across all of our lines of business. Vanguard has done more to revolutionize the asset management industry than any other fund company, saving investors billions of dollars in higher fees. And investors have voted with their dollars…below is a chart of the market share of the big three ETF providers.

We often say that Vanguard sets the bar for where an investor should start in the investing world. So, with all the laurels I’ve just bestowed upon Vanguard, what’s up with the title of this article? (Technically I let Twitter users choose in a poll the title…and this won.)

Much like IBM, Vanguard is the large, safe, and often correct choice. But that doesn’t mean that every fund that Vanguard has is a good one. And it also doesn’t mean that every good fund Vanguard has is a wise investment all the time.

Let’s look at an example…

We recently published an updated white paper that addresses the challenge of finding reasonably-valued income investments as this bull market has grown long in the tooth (“Think Income and Growth Don’t Exist in this Market? Think Again.” and the foreign version “Think Income and Growth Don’t Exist Around the Globe? Think Again“ ).

As we noted in the paper, low rates drove hordes of investors into any investment that sniffed of having a decent yield. This meant dividend stocks saw huge inflows.

ETFdb lists nearly 200 dividend ETFs representing hundreds of billions in investor assets. The largest of them all? The Vanguard Dividend Appreciation ETF (VIG). This fund seeks to track the performance of the NASDAQ US Dividend Achievers Select Index (formerly known as the Dividend Achievers Select Index). The goal of the fund is to provide investors a convenient way to track the performance of stocks of companies with a record of growing their dividends year over year. From the fund material: “The NASDAQ US Dividend Achievers Select Index is comprised of a select group of securities with at least ten consecutive years of increasing annual regular dividend payments.”

VIG only costs 0.08%, so it’s basically free, and has a whopping $28 billion in assets across 182 holdings. On paper it all seems great.

But when we look closer, what are investors actually getting when purchasing VIG?

When we analyze this fund’s construction methodology, we notice that one big thing is missing – a link to value.

The main criteria for inclusion in the fund is whether the company has increased its dividend annually over the past 10 years. This means a security could have a PE ratio of 100 yet still qualify for inclusion. You might be paying through the teeth.

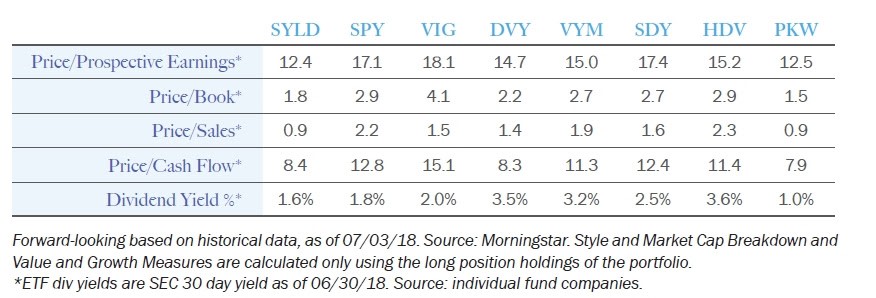

Let’s look to Morningstar for assistance in determining the outcome of this value-absent methodology. Below is a table from our white paper comparing the VIG ETF to the S&P 500 as well as a handful of other income-focused ETFs.

SYLD 1-year performance as of 06/30/18 at NAV: 12.6%. SYLD since-inception performance as of 06/30/18 at NAV: 78.9%. SYLD 1-year performance at market: 12.7%. Since inception at market: 79.0%. Expense ratio: 0.59% The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 855-383-4636 (ETF INFO) or visit www.cambriafunds.com. Please review, “Think Income and Growth Don’t Exist in this Market? Think Again” for a full discussion on the differences between these investments and their risks, charges, and objectives.

As you can see, the VIG ETF looks an awfully lot like the S&P 500, expressed by the SPY ETF. Importantly, the VIG ETF holdings register as the most expensive in the table for three of the four valuation metrics!

This begs a question – for valuations this high, can you expect to be rewarded with a beefy dividend yield?

Unfortunately, no. At 2.0%, VIG’s yield is merely in-line with that of SPY.

So, why in the world would investors sink nearly $30 billion into a fund that is basically a more expensive version of the S&P 500?

Because no one gets fired for buying Vanguard.

To determine if this Fund is an appropriate investment for you, carefully consider the Fund’s investment objectives, risk factors, charges and expense before investing. This and other information can be found in the Fund’s full or summary prospectus which may be obtained by calling 855-383-4636 (ETF INFO) or visiting our website at www.cambriafunds.com. Read the prospectus carefully before investing or sending money.

Investing involves risk, including the possible loss of principal. There are risks associated with investing in SYLD, including possible loss of principal. There is no guarantee that the Fund will achieve its investment goal. High yielding stocks are often speculative, high risk investments.

The Cambria ETFs are distributed by SEI Investments Distribution Company (SIDCO), 1 Freedom Valley Drive, Oaks, PA 19456, which is not affiliated with Cambria Investment Management, LP, the Investment Adviser for the Fund.

The S&P 500 Index is an index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe.