Episode #440: Jason Buck, Mutiny Fund – Carry, Convexity & The Cockroach

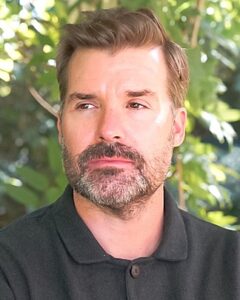

Guest: Jason Buck is the founder and CIO of Mutiny Fund and specializes in volatility, options hedging, and portfolio construction.

Date Recorded: 8/17/2022 | Run-Time: 1:28:44

Summary: In today’s episode, Jason shares the winding path that led him to launch Mutiny Funds and focus on the risk management side of things. We spend a lot of time talking about what true diversification looks like and why people don’t consider human capital when constructing portfolios. Jason shares how this led him to launch the cockroach portfolio and long volatility strategies.

Sponsor: Composer is the premier platform for investing in and building  quantitative investment strategies. What used to take Python,Excel and expensive trading software is available for free in an easy to use no-code solution. Learn more at www.composer.trade/meb.

quantitative investment strategies. What used to take Python,Excel and expensive trading software is available for free in an easy to use no-code solution. Learn more at www.composer.trade/meb.

Comments or suggestions? Interested in sponsoring an episode? Email us Feedback@TheMebFaberShow.com

Links from the Episode:

- 0:39 – Sponsor: Composer

- 2:16 – Intro

- 2:50 – Welcome to our guest, Jason Buck; Girl stomping grapes in Napa and falling (link)

- 5:50 – Jason’s background; Pirates of Finance; Mutiny Investing Podcast

- 13:22 – Jason’s interest in long volatility strategies

- 28:37 – Time To Hedge Your House ; How Jason has taken all of his experiences and turned them into a long volatility product

- 41:42 – What the manager universe looks like

- 54:11 – Jason’s thoughts on position sizing with long volatility strategies

- 1:04:21 – Capital efficiency and using leverage and risk reduction as an entrepreneurial hedge

- 1:09:15 – Why Jason should market to venture capitalists and corporate treasuries

- 1:15:04 – Some things that Jason and Meb don’t agree on and the Cockroach portfolio

- 1:22:13 – Jason’s most memorable investment

- 1:25:33 – Learn more about Jason; mutinyfund.com; Twitter @jasonmutiny

Transcript:

Welcome Message: Welcome to “The Meb Faber Show” where the focus is on helping you grow and preserve your wealth. Join us as we discuss the craft of investing and uncover new and profitable ideas, all to help you grow wealthier and wiser. Better investing starts here.

Disclaimer: Meb Faber is the co-founder and chief investment officer at Cambria Investment Management. Due to industry regulations, he will not discuss any of Cambria’s funds on this podcast. All opinions expressed by podcast participants are solely their own opinions and do not reflect the opinion of Cambria Investment Management or its affiliates. For more information, visit cambriainvestments.com.

Sponsor Message: Now, quick word from our sponsor. Many consider Renaissance Technologies Medallion fund one of the best hedge funds of all time. From 1988 through 2018, the fund returned 66% per year. That means if you invested $10,000 in 1988, you could have cashed out with over $200 million 30 years later. The secret sauce, algorithms. Medallion is run by an army of computer scientists, mathematicians, and neuro engineers that build investing algorithms designed to eliminate typical human biases. And it makes sense, most investors regret making impulsive investment decisions. But unless you’re a PhD-wielding, Python-coding, Excel wizard, algo investing has largely been out of reach for the average investor until now. Introducing composer.trade, a no-code platform for building and investing in algo strategies. composer.trade is putting the power of quant into the hands of regular investors with their game-changing app. With composer.trade, you can invest in strategies like sector momentum or the Dalio that execute trades automatically, depending on market movements. You can even build your own strategy from scratch with their drag-and-drop portfolio editor.

I interviewed Composer CEO Ben Rollert in episode 409 back in April and was impressed with what I heard. There’s a reason why over 1 trillion is managed by quantitative hedge funds, and composer.trade lets you trade like the pros for a fraction of the price. Put the power of quantum your portfolio, and get one month free by going to composer.trade/meb. That’s composer.trade/meb. See important disclaimers at composer.trade/disclaimer. And now back to the show.

Meb: What is up everybody? We got an awesome show for you today. Today’s guest is my good friend, Jason Buck, founder and CIO of Mutiny Funds, which specializes in volatility, options, hedging and portfolio construction. In today’s episode, Jason shares the winding path that led him to launch Mutiny Funds and focus on the risk management side of things. We spend a lot of time talking about what true diversification looks like, and why people don’t consider human capital when constructing portfolios. Jason shares how this led him to launch the Cockroach portfolio and long volatility strategies. Please, enjoy this episode with Mutiny Funds, Jason Buck.

Meb: Jason, welcome to the show.

Jason: Happy to be here, Meb.

Meb: Last time I saw you, Manhattan Beach? Where was it?

Jason: Yeah, we’re having some dinner and drinks with you, me, Toby, and my partner, Taylor. It was a great time. Good dinner, good drinks. Good people. Good times. Always love Manhattan Beach.

Meb: Well, come on back. I don’t want to jinx it. We’re trying to get a…putting in an LOI on an office that you can see the ocean from. So, listeners, come see us. Hopefully, by the time this drops, we will be moving there. You’re a real estate guy, we’ll get into that in a minute.

Jason: In Manhattan Beach, or El Segundo?

Meb: In Manhattan Beach. There are not too many offices there. It’s all like ’70s surf porn style, like, the carpets are gross. It’s old, like, it’s funky. We actually looked at Mike Tyson’s old office, Tyson Ranch in El Segundo. Amazing. They put some real money into that, had a boxing ring in the middle. But it’s this cannabis company. So, we didn’t take that one. We’re trying to get closer to the water. Anyway.

Jason: For people that don’t live in California, you would think we have all this pristine real estate and everything. But most of it’s ’50 to ’70s absolute garbage, especially closer by the beach. And you have, like, terrible walls with no insulation, no AC, no heat, like you said, terrible carpet. Like, it’s hard to find grade A quality office space on the coast.

Meb: That AC discussion is a little too close to home. We just renovated our house, and it took forever. But we have an AC unit sitting in our garage for quite some time. And it’s not plugged in yet because of permitting process, which is a whole nother discussion. And my wife is a stickler, wants to do it by the books. I’m like, “Let’s just plug it in.” In September, we can unplug it. I don’t care, but it’s so hot in here. Anyway. We haven’t had ACs for 10 years. I don’t know why it matters now. It’s just the knowledge that it’s there and can’t use it is what bothers me. You got a background, for those who are listening to this on audio only, of 22 steps to make wine. Where are you today? Give us a little insight.

Jason: This is exciting for me because, as a longtime listener of your podcast, I know how good you are at coming up with anecdotes to relate to the guests based on where they say they’re coming to you from. So, I can’t wait to hear this one today. So, I am sitting at home in the heart of Napa Valley in the most beautiful wine country in the world. And so this is where we find myself today.

Meb: Yeah. There are 22 steps to make wine in the background. My favorite meme video, before the word meme was really around, and we’ll put this in the show note links, listeners, you got to watch. It was the famous one, I don’t know if you’ve ever seen it. The girl stomping grapes in Napa, and she falls out of the grape tank. Have you seen this? And starts screaming. Poor lady. Anyway. Listeners, I will add it to the show notes links. You always been a Napa guy. How long have you been there?

Jason: It’s been about 13 years now. So, I grew up in Michigan, have lived all over the U.S., all over the world, but I’ve been living here in Paradise for about 13 years. And, yeah, it’s pretty amazing. And actually, you’ll appreciate this, as a Californian, it actually just starting to rain right now. And so it’s nice to get these rains when we can get them as far as mitigating the drought and wildfires.

Meb: So, I know your story, but I want to spend a little time with it for listeners because I think it really, almost more than any guest, informs what you’re doing now. I mean, everyone’s life experiences take them to where they are, but some more kind of directly than others. I actually spent, you don’t know this, but, listeners, Jason has a great podcast and YouTube series that he co-hosts with Corey on the YouTube. What are the names of it? Give us the…

Jason: “Pirates of Finance” with Corey Hoffstein.

Meb: And Corey wears various robes and sort of odd outfits on, glasses of the week. And then what is the podcast?

Jason: The YouTube show is “Pirates of Finance.” And then with my firm, Mutiny Funds, we do the Mutiny Investing podcast as well. And, yeah, just various podcasts and interviews here and there. So, like you, I’m just always on the mic, it feels like.

Meb: And we see you from time to time on “Real Vision” as well. However, I spent my birthday with you, you don’t know this because we were homeless, and still renovating for six months when it was supposed to be two. And we were in Candlewood Lake, Connecticut, and it was my birthday. And so to escape my family, and children, and in-laws’ families and children, I went kayaking. And then there was a little bar all the way across the lake. And I was like, “There’s no way I could take the kayak all the way over there.” But I started listening to a podcast you did, I think it was with “Real Vision,” but it was like your four trades or something.

Jason: Oh, yeah, yeah.

Meb: But I started paddling, and then I was like, “WelI, I can’t stop now because I want to listen to this.” And so I paddled all the way across the lake. Luckily, I didn’t get murdered because it was July 4th weekend, got to the bar, had a frozen mudslide. It’s probably the best-frozen mudslide I have had in my life. And then paddled back. It was a very pleasant day. Jason, you were telling a good story. So, I don’t want to recreate that, but I do want to hear a little bit of your timeline because you are not always what you are today. I don’t know what to describe you as.

Jason: I was waiting. I hope you would tell me because when people ask me what I do. Yeah.

Meb: You’re not always a Cockroach guy, but give us the origin story.

Jason; Sure. So, we’re the same age, so actually, when people always ask this, I don’t know about you, but in my head, it runs through Goonies in Chunk. Like, when I was six, I pushed my sister down the stairs. It’s like, “Where do you want me to start kind of thing.” I’ve always been an entrepreneur. I also was a soccer player. I was fortunate enough to play soccer all over Europe, South America, the United States, as a kid. Ended up going to the IMG Academy, playing soccer there and graduating from there. And then went on to play soccer at College of Charleston in South Carolina. I was initially an international business major, found that kind of boring because, I mean, it just all made perfect sense to me growing up in a family of entrepreneurs.

And then so I switched my major to comparative religions. So, I studied, especially Eastern mysticism, those sorts of things. Postcollege decided to work on my entrepreneurial skill set. I started commercial real estate development company in Charleston, South Carolina. I’ve developed some buildings along that King Street corridor, that beautiful, thorough fair that goes right through the heart of Charleston. And then just got absolutely wrecked in the GFC of 2007, 2008. Totally blew up. It changed the course of my life pretty dramatically.

After that, I tried to figure out there has to be a way to hedge entrepreneurial risk. As an entrepreneur and having a lot of friends entrepreneurs, it doesn’t matter how idiosyncratically good you are as an entrepreneur if you have a global macro liquidity event, like we had in 2007, 2008, because you’re trying to build projects years in the future. And so you need there to be less volatility and more certainty in the future, not less of either, or more volatility and less certainty. And so then spent the better part of the next decade, figuring out how to trade options, how to trade VIX futures, trying to figure out all these ways to be long volatility and hedge tail risks. And just felt that there’s got to be a way to hedge that entrepreneurial risk. Even though people don’t think it’s possible, I happen to think it is. And you can use some of that macro liquidity kind of issues to hedge entrepreneurial risk. Obviously, you’re taking basis risk, but I think it allows us to be, I have a tool for entrepreneurship where we can be much more aggressive at what we’re really good at, and try to hedge some of those global macro liquidity risks.

So, in 2018, stumbled across my partner, Taylor Pearson, we started chatting online, started talking about all things related to markets and volatility. We both added mutual love for a lot of Chris Cole white papers about volatility. So, we started talking about, you know, even though I’ve been building these total portfolio solutions kind of based on the Harry Browne permanent portfolio model, but doing it in a more modern sense, and you and I’m sure we’ll get into that, the idea was, well, these are all well and good, but I think a modern version of Harry Browne permanent portfolio requires things like long volatility, tail risk, commodity trend managers, and most retail people have zero access to that. And so even though I knew how to build those for myself and my family, just figured there had to be a way to offer retail clients more access to products like this. And so that’s what Taylor and I got together about is, like, look, if you want to have some access to long volatility and tail risk, there’s a lot of path dependencies that you need to cover. So, you’re going to need an ensemble approach to those path dependencies to do it well.

And we figure out if we could aggregate a lot of accredited retail investors together, we could provide access to the best-in-breed managers, and try to create a ensemble beta-like return from these spaces. So, Taylor and I set about to do that in 2020, we launched our long volatility strategy, starting with five managers, we’re up to 14 managers now. And then in September of last year, we hit the goal I’ve been working on for about 10 years of launching our Cockroach Fund. And the idea with Cockroach Fund is something that’s after your own heart of owning all the world’s asset classes and rebalancing, but the Cockroach Fund basically has global stocks, global bonds, a long volatility ensemble, a commodity trend ensemble. And we also have gold and cryptocurrencies as well. So, yeah. The idea is to try to build the least shitty portfolio, so people can manage their savings no matter kind what the global macro environment throws at them.

Meb: I love the Harry Browne 2.0. So, for listeners, Harry Browne, permanent portfolio decades old was, and you can correct me, 25% stocks, bonds, cash, gold. Was that the original permanent portfolio? And there’s been some spins on it. But like you mentioned, you know, historically model, the Harry Browne portfolio, it’s a pretty good portfolio. It’s lower return because of the huge portion in cash and bonds. But it’s one of the more stable across decade portfolios because of the, particularly the gold allocation, which has been doing all for the past number of years.

Jason: Like you said, to me, the modern version is, instead of cash, what if you used long volatility and tail risk that gave you a much more combat cash position to kind of offset the stock exposure? And then instead of just gold, like you said, which is a singular path dependency for, people would say inflation, but maybe purchase power parity over multi-decade or multi-century cycles is, like, instead of gold, why don’t we use commodity trend followers that can trade 80 to a 100 commodity markets? And that’s a better ballast in an inflationary environment, or maybe a better beta to really offset the disinflationary bucket of bonds. So, that’s why we say a modern version of Harry Browne’s Permanent Portfolio. But, as you know, you’ve put it out there. It’s like, this goes back to Talmud. Even our pitch deck, it’s got a shout-out to you in there because we go all the way back to the timeline to the Talmud. Obviously, we think that Harry Browne’s work was the seminal work in 1972-ish. Even before that, Alfred Winslow Jones, you know, started with hedged funds because they went long and short, and people kind of forget that. And so the other one we… So, we include on our timeline, we include your Trinity Portfolio and Chris Cole’s Dragon Portfolio along those timelines for really adapting those to more modern usages.

Meb: Yeah. The insightful thing that you had was thinking about risk. Obviously, you had to go hand to stove, face to fire. I don’t even know what the analogy you want, head in the toilet, you know, experience to kind of go through it, and most, if not all, older traders and investors have, at some point. And often it informs your path, which is one of the reasons I’m a quant. Certainly, imploded all my money in the dotcom bust. Looking back on it, you know, on trying to think about risks, do you think some of the ideas today would’ve helped? And in particularly, what would’ve helped most in that scenario, if you could go back and talk to 20-something, Jason?

Jason: Well, talking to 20-something, Jason, I would find very annoying because he’d just be optimistic and transigent. Wouldn’t listen to this, this old guy speaking to him now. So, that’s part of it. But, yeah. The idea is, what I don’t think anybody’s really talked about, with these broadly diversified portfolios as much, especially, to say, the Harry Browne portfolio, even above that at the 30,000-foot level, we like to talk about is combining offence and defense. And so people don’t realize that a 60/40 portfolio that most people have as a target date fund, and that’s their broad diversification is just offence. You and I know in rising GDP environments, risk on environments, you know, 60/40 is going to do just fine. And then when we have these liquidity events or recessions, you know, correlations go to one and these things don’t do well. And so when people are offered a portfolio, even if they’re diversifying into VC, PE, real estate, all of these different things, those are all still long GDP. Therefore, offensive assets that really do, as long as we have a wash of liquidity and risk on, they do great. So, we really think about it at the top level is you really want to balance your offensive and defensive assets.

The idea of what this would help me, prior to 2007, 2008, in the sense that by adding long volatility, tail risk, commodity trend managers, maybe a little bit of gold and cryptocurrencies, by adding all of those defensive assets with your offensive assets, that allows you to survive. I feel like I’m going to quote you back to you, you, a bunch of times on this podcast, like, “The only form of actual winning in this game is surviving.” That’s the way we had to play the game. Because as long as you can stay in the game, where most people blow up and they get kicked out of the game. So, yeah, surviving is the only success in this business. I was thinking about this before we got on.

And if I think about the Buffets, the Mungers, the Marques, Mauboussin, O’Shaughnessy, and I’m going to throw you in this bucket just to embarrass you for a second is, at some point, when you’re in this game for decades, do you feel you would just automatically start coalescing down towards, just being almost like a Taoist with your aphorisms? Because you’ve seen so much that it really just comes down to really the basics, like I’m saying, like, offence plus defense or surviving, where it’s, like, everybody wants to talk about this individual equity thesis they have, but it’s more, like, what is your broader framework for constructing a portfolio? And can you survive?

Meb: Yeah. And I think a good analogy for that, too, for the finance peeps on here or the product issuers. So, many times, I’ll see someone launch a fund and then a popup will come, like, fund close after one year. And I was like, “Did you not build a minimum of 5, but realistically a 10-year time horizon, because one year is just a coin flip, you have no idea.” There’s a quote from a Ken French, who’s the French in Fama-French, listeners. He had a couple amazing quotes from a podcast he did a couple years ago, but he says, “People are crazy when they try and draw inferences that they do from 3, 5, or even 10 years on an asset class, or an actively managed fund.” And let that sink in, listeners. So, I’m just going to delete the three and five. People are crazy when they try and draw inferences, that means conclusions, from 10 years on an asset class or actively managed fund. And how many, every survey, one after another, shows people looking at one to three years, at the most? I mean, like, if you even survived that long, three being the end of the possible time horizon. He’s like crazy if you even look at 10.

Jason: Yeah. That’s why I think about all those behavioral risks is, and this is what my partner and I talk about all the time is, like, you have to keep people, like you were saying, surviving. So, by having defensive assets, you allow people to not make stupid mistakes and jumping in and out of funds at the most inopportune times. So, that’s the biggest thing we think about. And then going back to your question of, like, you know, pre-2007 Jason, or mid-20s year old Jason, would have these defensive assets helped me? Absolutely.

But the other thing that we like to talk about and think about is, as I said, this is a tool to hedge entrepreneurial risk, even though it is a complete total portfolio solution for an investment portfolio of your savings. But the idea is, you have to think about your life a lot more holistically. And as an entrepreneur, you have all these long GDP risk-on assets. And most people don’t think about that. So, as soon as you have any savings left over after consumption that you don’t need to put back into your business, you actually need to be solely investing in defensive assets. And I think your paper that I share all the time that’s my favorite is that financial advisors are almost quadruple levered long to SPY, but people don’t realize that. And so as an entrepreneur is actually, I shouldn’t be even looking to buy more stocks and bonds, I should only be looking for defensive assets to hedge the risk that I’m building with my business. And I let you kind of go into what the quadruple leverage is for financial advisors.

Meb: The first step, which you hit upon having gone through it, but so many people also hit upon in hindsight, which is usually the way we learn, right, is I need to start thinking about risks, but all risks, and particularly one specific to your life and situation. And so many people, it automatically defaults. And they think about it when it comes to certain things, they think about it when it comes to car insurance, they think about it when it comes to house insurance, those type of manageable risks. Portfolios it’s like, for some behavioral reason, that just goes out the window. And the 4X topic you’re referencing was your average financial advisor is four times leverage the stock market and doesn’t know it. He has his own money, and I’m saying he, because all the financial advisors are men, but he or she has all their money invested in U.S. stocks of their portfolio. Maybe they have 60/40, but the 60 dominates the 40 in volatility and drawdowns.

They have their clients’ portfolios invested, so his revenue is directly tied to U.S. stocks. And so, as that goes down, if it gets cut in half, if your revenues get cut in half. The business, which he’s associated with, you know, if you don’t own your own business, you’re exposed to recessions and layoffs. And lastly, of course, clients go crazy when they lose a bunch of money, and they withdraw. So, it’s a compounding effect. And so you can make the argument, and I did this on Twitter the other day, that, theoretically, you should or could own no U.S. stocks at all. And I don’t know a single person that does that. Do you know anybody, like an investor, that’s U.S.-based that owns zero? I don’t know a single one.

Jason: No, nobody that’s domestic. Yeah.

Meb: I think pretty profoundly, this is a good idea for a blog post. You can make that argument that they shouldn’t own any. Anyway.

Jason: Yeah. I feel like I’m the outlier on all your Twitter polls. When you ask, who owns emerging market stocks? Who owns commodities? I’m always raising my hand, like, the one idiot in a crowd that’s your outlier.

Meb: Where’d you fall on my most recent one? My most recent poll was has inflation top ticked? Have we seen the high print inflation for the cycle or no? I think it was 9:1.

Jason: Yeah. The best part I think about, and you know this, you’re trolling people when you do this is, like, when we construct portfolios, the way you and I do, is we don’t know. And that’s the whole point is, like, how do you construct a portfolio when you retired from the crystal ball game, when you know you can’t predict the future? And so it’s fun for us to play this, you know, what’s your opinion? But hopefully, it doesn’t affect our portfolio construction. And that’s kind of the point the way I see it.

Meb: Okay. So, we got a little background, you got smashed in real estate… By the way, how has Charleston real estate done since then? Is that on the regret list? Like, it’s up there with Bitcoin, or what?

Jason: Meb, you are the first person that it’s asked me that, but you are so correct. I mean, it is ridiculous. It is ridiculous how much it’s appreciated since then.

Meb: I went down recently for a pandemic wedding, meaning like they got married during the pandemic, but had the party and my goodness. I mean, Charleston, you always read the magazines everywhere it’s one of the best in the world. And it was great, but the expansion into Mount Pleasant, and all those restaurants, and bars, and everything, just on and on and on, world-class city.

Jason: Can you imagine when I moved there in ’97, there wasn’t a single chain store on King Street, and you didn’t ever go like North of Calhoun? Like, it literally changes so much every two to three years, it’s like going into a different city.

Meb: Did it go through some stressors during the pandemic? Were you like, “Hold on a second, maybe I should get back involved in this.” Or you’re just like, “No, I am never going to that city again in my life.”

Jason: I try not to, except for my brother who actually opened a restaurant there during the pandemic. So, I’ve been back a few times to visit his restaurant. So, I mean, yeah, he has that courage to kind of step into that fray.

Meb: Did he make it through?

Jason: Yeah. Yep. They’re still open running. It’s Coterie on Warren Street. It’s a fusion. And, you know, usually, I hate fusion restaurants, but it’s a great fusion between Indian cuisine and low country cuisine. They blend really well together.

Meb: Oh, Man.

Jason: Yeah. My brother was a craft cocktail bartender in Mumbai for a few years, setting up restaurants there. So, he’s got the background to kind of put those two together.

Meb: God, that sounds delicious.

Jason: Exactly.

Meb: That’s like my two favorite foods. I’m trying to figure out how that works. But Southern food, I would definitely be 250 if I lived in the South at this point. I don’t think I have the off switch. I can’t take sweet tea anymore though, it’s too sweet for me. I’m like one-quarter sweet, and I feel really bad ordering that, embarrassing. Like, can you just give me a smidge of sweet and the rest unsweet? But I got a bunch of boiled peanuts in my closet that I got to cook. All right. So, went through that experience, forever seared in your brain. Was concentration in leverage a piece of that, or just not so much?

Jason: Yeah, no, I think it is every time, in the sense that, that’s the best part about real estate and the worst part about real estate is that leverage. And then that illiquidity, you know, a lot of times you can get a nice illiquidity premium. I know that you’ve talked a lot about these days. But when you’re a young entrepreneur and you don’t have context to really know better is using probably an extreme amount of leverage, especially in commercial real estate or real estate in general. That’s why everybody loves that asset classes because they get leverage, and it’s marked to model. But if you’re selling condos or you’re renovating properties and you have all of these different time cycles and they need to align with the time cycles you have with your bank for your loans, your balloon payments, etc., if you’re highly leveraged going into that situation, which I was. And so it’s entirely my fault, in hindsight, is if you’re expecting these projects to come to fruition over the next 1, 2, 3, 4 years, and they’re all staggered out, and you have amount of leverage on them. But then 2007 happens. It’s always interesting, commercial real estate guys will say, ’07. Stock market people will say ’08. But that’s the difference.

So what would happen is, and people don’t realize this, it went from mark to model to almost mark to market overnight. Because if, let’s just say you’re redeveloping a building that has condos in it, so you’re renovating, it’s got 20 condo units, but people have put down a deposit of let’s say 5% to 10% of the purchase price, 2007 happens, you’re waiting to close and finish those apartments so that way, therefore, you know, you can close on those loans, you can pay off your bank, you can pay off your investors, etc. But then 2007 happens. And those people just walk away from those apartments, they walk away from those deposits, like, you’re just left holding nothing at that point. So, then that leverage gets manifested both ways. So, the leverage worked unbelievably well on the way up, but then on the way down, you’re completely wiped out. But the unique structure of, let’s say commercial real estate is you have that light equity tranche that you’re basically levered up.

So, if the structure of your deal falls apart and people walk away from their just deposits, then you can’t really make your balloon payments with the bank. So, therefore, the way the contract is structured is actually the building goes back to the bank. That’s the structure of the contract. What I find fascinating is that the banks didn’t like that when it did happen. But I was like, “It’s in black and white, it’s in the contract.” Basically, they wanted risk-free interest. That’s what the banks thought going into 2007, right? They were happy to leverage up all these deals because they never thought they were going to have to actually take back the properties. They weren’t doing necessarily the best job at underwriting. But is interesting is, like, you have a contractual obligation. If I don’t fulfill my side of the contract, here are the keys, you can take back the building. And none of them wanted to do so. And I was, like, it was really interesting to see their reactions in the sense, now, looking back a little bit circumspect about it, to see that they didn’t want to live up to their contractual obligation. And it was interesting when they got into it, I don’t think they were assessing what could happen if they had to take back the keys.

Meb: You walk forward, you go do a silent treat in a monastery for five years in Nepal. Wasn’t there something in between, by the way, weren’t you living in Mexico or somewhere?

Jason: Yeah. I’ve lived in a lot of places. I lived all over the world. So, yeah. What happened also to just add insult to injury is because I was so tapped into the residential mortgage side, I could see the kind of cracks in the walls. And I was a little bit worried in late ’06 going into ’07. And I remember even asking, you know, I got together all these older real estate developers, all over 50, 60 years old, like seven, eight guys, some of the biggest developers in the Charleston area. And I said, “Look, I’m concerned here. Should I be worried?” And to a man, they said, “No, this time’s different.” Now, what I had to find out in hindsight is that obviously real estate developers are preternaturally optimists. And they don’t mind about declaring bankruptcy and starting over again. So, I should have known who I was talking to, but I didn’t have the context to understand that.

So, what I said, I was tapped into kind of those mortgage market, what’s going on. So, as soon as I started seeing real problems in 2007, I knew exactly who the worst lenders were on the mortgage side. And so those Countrywide, WashMu, all those names that we’ve all forgotten since. So, I actually started buying put options against those mortgage providers. But because I was not a professional options trader and didn’t know my options well, I had to learn hard lessons about options Greek. So, even though I bet on the housing collapse, I actually lost money on those trades because I didn’t realize time horizons, Theta, Vaga. This is how I had to learn even more painful lessons. So, even though I called the housing crash, I actually lost money buying put options on the housing crash.

So, it was adding insult to injury. So, what you’re referencing is it probably took another couple years, where I went down to Mexico to live cheaply, kind of lick my wounds, trying to figure out what I wanted to do next, trying to figure out what happened. I mean, it was like, not to overdramatize, but you’re essentially in the fetal position on the floor because it’s one thing to lose your own money, but as soon as you start losing family and friends’ money, it’s the worst feeling in the world. And you go from this idea that, like, you know, a rising tide lifts all boats. And when we’re young, we have so much hubris, and you start to think you’re a genius. And then the market shows you that you are lucky. And then you have an existential crisis where you have to figure out, am I a complete moron? Is there any skill sets I have? What should I do with my life? It was really that dramatic. And it’s easier to say it now and laugh about it, but it was an intense few-year period of figuring out, trying to rebuild myself from scratch, so to speak.

Meb: I was really going to depress you, and I can’t find it, but we’ll post the show note links. I wrote an article, in I think 2007 or ’08, and I understand that they’re lagged. But the article was, does trend following work on housing or real estate? And it basically showed these very long, slow periods on real estate. And basically, it was like, you started exiting, like you said, 2007 for a lot of these things. But the nice feature is it had you getting back in at some point too, and then you do nothing for a decade. So, had you been a reader of the Meb Faber blog, I think it would’ve been world beta.

Jason: Well, the hard part, though, about what you’re saying is… Well, and now that we live in a much more financialized world, maybe it’s getting easier and easier, but it’s not so easy to get out of real estate. I still talk to commercial real estate developers all the time. And it’s like, if I have a project that has…you know, I get into it in 2006, and it’s not going to come to fruition until maybe ’09, ’10. And you’re saying, “Get out of the market ’07.” It’s like, “What do I do?” And that’s why I started figuring out these hedges because if you can understand options training, everything, you’re going to take some basis risk away from, you know, commercial real estate. You may be used in S&P as a proxy, but that’s how you can hedge the risk with combats put options if done well and professionally. And so that’s maybe the way to do it because you can’t really time the real estate markets if you’re working on value add development projects. It’s that illiquidity.

Meb: It’s the problem. You know, I thought about this years ago when there used to be…didn’t there used to be Shiller Futures on individual markets, so you could…

Jason: Regional. Yeah.

Meb: Regional markets. So, there was like Phoenix, Seattle, Denver, whatever, New York, and you could hedge the futures, which, to me, was like a profound innovation that no one was interested in oddly. That’s so weird to me. I mean, there was even a housing up and a housing down ETF. And both of those failed too. But the challenge you mentioned, like, the direct hedges is tough. And then even finding the direct hedge, the timing of it, like you mentioned, so trying to figure out what else would actually help you survive. So, good news is now you have the answer. So, let’s hear the conclusion. We got the diagnosis, what’s the prescription? How have you kind of cobbled together some of these concepts into your hedge portfolio? Because this was the first offering, right?

Jason: Yeah. So, after the bad experience of learning what I didn’t know about options Greeks, and I love that you always talk about the dotcom boom, because you and I were both yellow trading back then. So, we can’t make fun of people for yellow-trading meme stocks now. And…

Meb: No, we can make fun of them, but we can just say, “Hey, this was me 20 years ago, young whippersnapper, so.

Jason: But what I always say is what’s great is they’re all going to learn about options Greeks, right now they’ve just been Delta directionally correct in making money. But then now, in the last year, they’ve had to learn about what the options Greeks mean. So, that’s why that painful experience in ’07, in ’08 led me to really learn more about trading options over the subsequent years. And then part of it was I started getting into, I figured out an intermarket spread trade between VIX and S&P in 2012 and was doing a relative value trade there. So, I started learning all of these options trades, all these VIX trades. And so in 2015, I started following all of the other long volatility and tail risk managers in the space and started tracking all of them. And like I said, there’s a lot of path dependencies to a volatility event or some sort of liquidity crisis.

And so I was never comfortable with just allocating to a single manager or single strategy. Once again, I believe in ensemble approaches. The other thing that always bothered me is, like, in ETFs or ’40 Act funds, etc., there’s just not a lot of options for this kind of stuff. No pun intended. But I used to love…I mean, for decades, I’ve been reading your work, ReSolve, Alpha Architects, Logical Invest out of Switzerland, all this stuff. It’s like, you can create a pretty broadly diversified portfolio using ETFs and mutual funds. But as soon as you start looking for convex hedges, like tail risk or long volatility, it’s just an impossible to stuff those into those products, given the regulatory burdens.

So, if that existed, I probably would’ve never created this fund. So, they didn’t exist. So, we had to figure out something that was a workable solution. So, what we figured out is by aggregating all these different path dependencies, and beautiful thing is, if you are an institutional allocator, you can find very niche strategies. And this is what retail doesn’t usually have access to these kinds of things. It’s like, if I’m an institutional allocator, or pension, or endowment, I can find super niche strategies and just allocate whatever percentage I want to that manager and make sure they stick to knitting, and then that’s all they do. But we don’t really have that kind of in the retail space, or in the ETF side, so to speak.

So, I started assessing and tracking all these different managers that do different styles of long volatility and tail risk trading. And then by aggregating an ensemble of them together, it gives me more of a beta signal from that long volatility, tail risk. I wish some of maybe like the Eurekahedge indexes are fraught with all sorts of survivorship bias and all these other shenanigans. But if some product like that was tradeable and packaged into an ETF, it would be a great way to maybe have access to these long volatility and tail risk managers. But it didn’t exist. So, that’s what we created first.

And we always had these debates, going back to 2018, where we’re going to launch our total portfolio solution with our Cockroach Fund first? Or we were going to launch this long volatility ensemble first? And Taylor and I decided to do the long volatility ensemble first because it didn’t exist. And that’s what people needed most to really hedge their portfolios. So, that’s why we launched with that one first. Ironically, it took all of 2019 to get all the regulations in place. We started marketing in January of 2020, that it was available. We had to aggregate $5 million to get the fund launched. We weren’t getting any takers. Then March of 2020 happens. Now, everybody wants insurance after the flood. So, we actually launched the fund April 17th, 2020 for our long volatility ensemble. And Taylor and I talked about like, “This is going to be the hug of death. If we see V-shape recovery from here, like we saw, this is going to be really painful if volatility crushes. But otherwise, we’re hedge for a second or third leg down.” I mean, we’re happy to get launched, but it was inauspicious timing for launching a long volatility fund.

Meb: Yeah. There have been plenty of strategies, companies that were launched in the depths of recessions, or inverse terrible times. We’ve had a few certainly. So, if you can survive that, too, kudos. But the good news is people can see what the full spectrum of outcomes are. I think that’s more helpful than anything. All right. So, give us a broad 10,000-foot overview of what falls into this category. I know it gets specialized and complicated quick. But for the listeners, what types of funds and strategies make the cut and what doesn’t?

Jason: Yeah. I’ll try to kind of define terms, and that’ll help us from a 30,000 overview. Classically, I think people talk about tail risk. And the idea with tail risk is you’re just buying deep out-of-the-money put options that can really balance the portfolio in the liquidity event. I think that’s what, historically, most people have kind of read about, which if they see, maybe just the headlines, that’s what Taleb or Spitznagel talks about. The idea of tail risk is that, you buy put options, say, with a negative 20% attachment point. So, it’s kind of like insurance. If the market falls anywhere less than 20%, I don’t really make money off of that insurance. If it falls 20% or more, I start to get covered on those put options. And so that’s the tail risk convexity options is just rolling puts, just like almost systematically, just rolling those puts, and saying, “Great. I’ve got this attachment point.” And the reason I just say negative 20%, as you’ve highlighted before is, like, usually, that’s a literature where behaviorally people start to capitulate at a negative 20% down move in S&P.

So, the classical forms of tail risk hedging that actually can go back decades are that form of just putting on put options and rolling them, and you’re just paying that bleed. So, just like insurance, it’s going to cost you every year to put on those positions. So, the idea is, you can hold like 97% long S&P and allocate 3% to these deep out-of-the-money put options that’ll protect you in case you have a massive liquidity crash. So, that’s the classic example of tail risk options. When we start talking about long volatility, understandably, people don’t have a clear definition of that. The way we like to talk about it or think about it is, when I just said, when you’re buying those deep out-of-the-money put options, that’s like it buying insurance. And you have that, every year you’re going to bleed waiting for the event to happen if it only comes along, like, once every decade.

The other way you could mitigate that bleed is what we call long volatility, which we believe is just buying options on both tails. So, you’re buying both puts and calls, but you’re doing it opportunistically because you’re trying to reduce that bleed. So, the easiest analogy is maybe forest fires, right? Like, you’re looking for, you know, when the wind conditions are high, when the underbrush is incredibly dry, when you’ve been in drought for several years, when the electrical power grid’s likely to go down, PG&E, like, the wires are breaking, you know, when wind speeds increase. When you see all these factors start to pick up on your screening model, then that’s maybe the time to put on put options. And the same thing for call options. So, you can trade kind of both wings, but you do it in a much more opportunistic fashion because you’re trying to reduce that bleed of just rolling those put options, like I talked about with tail risk.

Now, there are tradeoffs, right? We always to think about everything as you have, carry, certainty and convexity, and those are the three trade-offs. And you can pick one or two out of three, you never get three out of three. And by carry, I mean, just, you know, positive or negative carry over the life cycle the options. Certainty is, like, how certain are you of the payoff? And then convexity is obviously how convex is that payoff? So, you’re always giving trade-offs. So, when you had just the rolling put options, you have high convexity, high certainty, but negative carry. Now, if you move into long volatility and you’re just buying options, but you’re doing opportunistically. So, you might be in and out of the market, maybe only 40% to 60% of the time, you still have that convexity, but now you’re lessening your certainty because you might not be making the right call, but you may be improving the carry of that position. So, that’s the way to kind of look at those long volatility options.

So, when we’re constructing our book for long volatility, we primarily just want to be buying options. The vast bulk of our portfolio is just in managers that are buying options. Those puts or those calls because you know exactly what your bleeds going to be when you’re buying options, but you don’t know how large your returns are. Due to that convexity, but also the monetization heuristics and trying to time those monetization’s perfectly. But we love that way of thinking about the world is, like, I know what my bleed is, but I don’t know what my upside is, where most people don’t know…they might know what their upside is, but they don’t know what their downside is.

Meb: Is this the main target of these U.S. stocks?

Jason: Great question. So, then when you’re starting to build out that portfolio, it’s like, we are primarily using and attaching to the S&P 500 solely because the bulk of our clients are U.S.-based and are attached with the other parts of our portfolio or parts of the portfolio we construct that are attached to the S&P 500. As you know, it’s the 600-pound gorilla. So, that’s what we’re primarily attaching to. The problem is you also want to get a little bit away from that. So, for example, in March 2020, if you have that implied volatility expand on your options and you need to now protect against the second or third leg down after you monetize them and you’re rolling them, you’re going to pay up for that implied volatility on those options. Where if you have the ability to kind of search everywhere for convexity, if you can go into rates, FX, commodities, you can probably find some cheaper convexity after you’re paying up for that implied volatility on the S&P 500. But, by doing that, you’re taking basis risk away from the S&P 500, if that’s your primary hedge.

So, we try to incorporate a little bit of both of sprinkling in a little bit of basis risk around the perimeter. So that way we can find those cheap convexity options around there. That’s the primary bucket is just combining this opportunistically buying options on both tails, combining that with some rolling puts. Therefore, the bulk of the portfolio is just buying options. But then, as I said, you have carry, convexity, certainty is, like, okay, behaviorally, if people are unwilling to have that negative bleed of options, and we’ve seen this a million times, you know, the famous one’s CalPERS, right? Pulling their allocation to Spitznagel and Universa right before March 2020, because, for a decade, you be…

Meb: My nemesis, CalPERS.

Jason: Yeah, yeah, exactly. One of these days, they’re going to hire you for those IPAs.

Meb: I’m off IPAs now. I’m done with them. I’m convinced they make me feel terrible the next day. Maybe that’s my age, my station in life. But I’m now more of a hoppy pilsner guy. Love my porters, if they’re not too sweet. Love a lot of the Asian beers. But IPA, I’ll still drink them. If you give one, I’m not going to say no, but I will regret it tomorrow.

Jason: Next time you’re up here, I’ll have to go on the roadside in Petaluma. There’s a great roadside bar that looks like nothing. It’s like a dive bar called Ernie’s Tin Bar. And they have the best bars in Northern California, best beers. And my favorite does actually this one up here. I don’t think you can get it down by you. It’s called Moonlight Death & Taxes. And it’s a German black lager. So, it has the smells and everything of a stout, but then it’s really light like a lager. It’s just unbelievably drinkable.

Meb: Get your first Mutiny manager conference hoedown, and give me an excuse come up there. We’ll go. I would love to. And by the way, listeners, what Jason’s referring to is that I had offered publicly to all these big institutions that I would manage their portfolio for free, buy a bunch of ETFs, rebalance once a year, share a happy hour, some IPAs. And that’s it. Because I think most of these are endlessly complex fee-ridden way, just a hot mess. And CalPERS is like a soap opera, watching what they do. Anyway. Let’s not get off topic. So, you put together a lot of these ideas into one. What is the universe for you guys like? There can’t be that many of these managers, or are there? Is this the universe like a thousand, or is it like a hundred? And I assume they’re all private funds, for the most part. How do you go about cobbling together this group? And are they all slightly crazy? I feel like you have to have a screw loose to either be like a short seller, or anything that’s fighting against the consensus or running into the wind.

Jason: Oh, yeah. That’s basically my days talking to fellow weirdos all the time. Yeah. Because it’s…I always like to say is like, you talked about anybody that you’re long volatility when everybody else is short volatility, it doesn’t make sense to the average person in public. They’re like, “Why would you do that?” Right. You’re fighting against those headwinds. And then an event happens and you actually are able to monetize, and your clients treat you like an ATM without a thank you. So, you’re like, “Where am I going to get some joy out of this?” So, you come home, and you’re such a lunatic to be a long vol person anyway, either your significant other is not likely to pat you on the back. They’re like, “Congrats, you did your job.” So, there’s no winning in this game. You can just take the pride of artisanal craftsmanship. So, yeah, my daily basis, I’m talking to a bunch of long volatility and tail risk managers that are inherently weirdos, like you or I. I’ll round out. So, if you’re buying options, that’s one thing, but then you behaviorally have this bleed issue.

So, the way we try to mitigate or manage that is we added vol-relative value strategies, where if you’re trading that inter-market spread between SPY and VIX, or you’re trading calendar spread on VIX, any sort of pairs trade should have some sort of income to it. So, we’re trying to use some income from those to help cover the cost of the bleed on the option side. And then the third piece we added to it is intraday trend following. So, like I said, in March 2020, when that implied volatility expands, you want those Delta one contracts to just short those markets without paying up for implied volatility. So, we use intraday trend managers to trade the market indices around the world. So, that’s kind of like filling out that portfolio. But to your question is, we’re invested in 14 managers, we track probably 35 to 40 managers. And that’s, I would say 90% plus of the space. Besides, there might be in CTA land. Sometimes there might be two guys in a garage somewhere I don’t know about, but it’s doubtful. So, we track all the managers in the space. So, how do we put this together?

So, the other thing is, like, I’ve always been fascinated by the world of CTAs and managed futures, and I wish more people could learn about that space. That is, I’m sure you do as well. But part of it is, like, the capital efficiencies and the separately managed accounts. And that’s what really matters to me. And that’s how we were able to construct a product like this is we try to get separately managed accounts from our managers. What that means in practice, for people that don’t know is, they basically have power of attorney to trade your account. And so you get to see the trades in real-time. So, it helps mitigate any sort of made-off effects, like you get to see all the trades. If somebody was a long vol manager, and all of a sudden they went crazy and started trading short vol, you can just pull that money immediately.

Meb: Who’s the big admin or custodian? Or where does it sit these days?

Jason: You have, primarily of your FCMS. And we use several FCMS from StoneX to ADM to Wedbush. And then your big admins are like Nav, Sudrania, you know, those sorts of admins. And so the idea is, if I can get separately managed accounts with these different managers and I hold it at the FSCM, it’s incredibly capital efficient. What I mean by that is we only have to post margin and we can cross margin across our managers. And so it’s incredibly capital efficient, and it’s a way to really build a book around capital efficiency, where you can have a lot of offsetting trades that are actually negatively correlated instead of just uncorrelated. And that’s how we think about really building the book. Most of it is SMAs, a few commingled funds sprinkled in here, there, but we try as much as we can just to get SMAs.

Meb: This is going to be a hard question because you’re probably limited to what you can say, but give me some broad overview. The media loves to, when it hits the fan, loves to be like, “Oh, here’s a tail risk manager. They were up 75000% this month.” And then consistently, you read these. And you’re like, literally, like, “What in the world is this journalist writing about? Because they have no idea what they’re talking about.” And I feel like it’s obviously wrong, but misleading and unfortunate because these strategies, I think, very much have a home. What are your kind of broad expectations for a strategy similar to what you are doing? You know, if the S&P is down 20 in September of 2022, is it something you’re hoping like this is going to be up 20, 100, up 2? I know it depends, but.

Jason: Yeah, I can answer it in a way that, as you know, these are always tough from a compliance perspective, these questions. But I do want to touch on the one hard question because it’s going to make my brain explode. Was this terrible reporting about funds being up 4,000% or 5,000% in March of 2020? And that’s just completely erroneous reporting. As you and I know, what they were basing that on is the premium spent either that month or that quarter on those options. And that premium was up 4,000% or 5,000%. But the actual book, when it’s combined with both the long stock positions and the hedge positions, the book was flat. So, it wasn’t like these managers were up 4,000%, or 5,000%, or 7,000%, it was actually the premium spent. So, if you were going to report that, you should have said for every month and every quarter for the prior 11 years before that, they were down 100%.

Meb: Every month, right? But the weird juxtaposition, like, if you’re a manager, you’re like, “Well, I’m not going to correct them. If they want to write about me being up 4,000%, 40,000%, good for them, I’m not going to say anything.” It maybe showed up in three days later in the journal, like, a tiny byline, “By the way, we didn’t mean 40,000%.” Okay.

Jason: And obviously, did its job because I’ve gotten that question hundreds of times. So, going back to your question, like, how do you think about this protection? So, that’s obviously the hardest piece in the sense that, like I say, with options, you know what your bleed is, but you don’t know what your returns going to be. Because it always going to matter the path dependency to sell off, like what vol level are we coming from? How sharp is the sell-off? What’s the time horizon, the sell-off combined with what was the duration or tenor of your options? As you know, there’s so many factors involved that it’s hard to get an idea. So, what you try to do is you run shock tests based on all these different scenarios, but then, you know, shock tests, like everything, are kind of putting your finger up in the air and kind of hoping for the best. More importantly, even the harder part with these on, I was saying that convexity, I really want to stress the monetization heuristics. Because, like you’re saying, if you’re up 4,000%, if you don’t monetize there, it’s going to mean revert back down to 2,000% on that premium, or up to 8,000%.

So, you never know, are you monetizing right into the bulk of that move? Or could it run to a second or third leg down? You never know. So, the whole point is, like, this is why I believe an ensemble approach is you want all these overlaying and overlapping monetization heuristics. This is why we’re in 14 managers because I want people that do very different path dependencies but also monetize differently, to make sure we capture that move. Because, like we’re saying, if it happens once every 10 years, we need to make sure we monetize that as best we can. So, we may not monetize it perfectly, but across the ensemble, we’ll do well.

The way we try to talk about clients and the way we construct our portfolio is the idea is when you’re doing these sort of options, or long volatility or tail risk trades is anything less than a negative 10% move in the S&P is just noise. If you try to really hedge perfectly one for one against that, the bleed is going to be so high. It’s not going to really work for you unless maybe you could rebalance daily or intraday, it might work that way. But otherwise, the bleed on those at the money or close to the money options are going to be way too expensive.

So, what we try to do is we try to, once again, work behaviorally this negative 20% attachment point. If we’ve constructed an ensemble well, it would hopefully start to getting in close to that one-for-one coverage around a negative 20% move in the S&P, depending, once again, on the path dependencies, a varied move, and all the things we’ve talked about is because of that behavioral issue, that’s where we want to see it pick up. And then because of those convexity and options, they go from worth nothing, worth nothing, worth nothing to exploding when you’re starting to get that negative 20% attachment point. But then as soon as you start to move to negative 40%, negative 50%, negative 60% down in S&P, the convexity is going to really kick in, and your portfolio could be up 70%, 80%, 100%, like, it should have some convexity to it. So, there’s kind of an arc of that return profile. So, when you’re building a portfolio like ours, those are the heuristics that you’re trying to roughly cover. Whether you can do it in reality is a different story. And maybe we’ll get into what’s happened this year, and why a lot of people aren’t doing well this year, especially as we have those drawdowns.

Meb: Yeah. Let’s go ahead and get to it this year. I had a couple follow-up questions on this. But 2022, what’s the sitch?

Jason: So, this is also why I believe in ensemble approach. So, we have across our portfolio, trying to think what I could say. We have managers that are up quite large, and we have managers that are down quite large. So, the dispersion in 2022 has been enormous depending on what your trading strategy style is. But even if we look at like VXTH, which is long S&P and then buying 30 Delta calls on VIX, I believe it’s down about 18% on the year. And then P put, which is long SPY and then negative 5% put options on the S&P is down about 14% on the year. So, they’re both down more than the S&P’s down. And that’s supposed to be… The idea of those indices is that, that you would actually have coverage there. So, what can happen is when you have these slow grind downs, like we’ve seen this year, and you don’t really see that spike in realized volatility over implied, it’s really hard for a lot of these managers to make money, depending on what their strategy is.

But other strategies that I’ve done really well is looking at cross-asset volatility, we talked about before. If you want to get a little bit of basis away from the S&P and trading currency vol, rates vol, fixed income vol, those things have been doing really well this year. Other trades, like dispersion trades, gamma scalping that have a little bit of a re-striking component to them, those have done really well. But your classical tail risk or long volatility trades have really struggled in an environment like this. I mean, I think about the, and this is when we talk about the Cockroach, the idea of having that total portfolio solution is long volatility and tail risk are really great for liquidity events, like March of 2020. When you have those correlations go to one, you really want that structurally negative one correlated trade to have convexity to it. But if you have these more slower drawdowns like we’ve seen this year, or maybe even 2008, these are things that sometimes you want CTA commodity trend following for, those are going to do well. So, that’s why we have those in our book, too, because we try to think about all the different path dependencies, not just in vol space.

But to give the audience maybe a quick rough heuristic. When you’re looking at the VIX index, that spot VIX index is untradeable. And what really is tradeable is it has a term structure to it with the VIX futures or with options around that. But what spot VIX is telling you is the forward expected variance over the next month. And I say variance because it can be to the upside or downside. Even though calling it the fear index and volatility is a bit misleading, it’s just forward expected variance. So, if the VIX is at a 32, the rough heuristics is a rule of 16 is to expect then a 2% daily move, if the VIX says is at 32. That’s what the expected forward volatility or variance looks like.

So, if you have a day where the market tanks off, it’s down 1.8%, but the expectation was 2%, you’re still within expectations. You can actually have vol come in when you think the market’s selling off. And I think this is where it starts to get tricky for people. Because during those long risk on cycles, VIX is very low. And as soon as you have any sort of down move in S&P, we really see a spike in volatility. And so people think then it’s negatively correlated and it’s just for those down moves, where it’s really variance to the upside or downside. And it’s based on, as everything in life, what are the expectations? Did expectations come in higher or lower?

So, throughout this year, we’ve had a medium-sized VIX. And so, therefore, the expectations have been fairly midrange, and this drawdown has been within that range. So, every day that is bleeding or dripping down lower, it’s within that range. So, you’re not going to see a spike in volatility. And then the second part of that is, not to get too in the weeds, but the idea is the VIX index is what we call floating strike volatility, where everybody buys fixed strike volatility. So, I’ll give just a rough heuristic example is, let’s say the VIX is at 10%, and I’m buying a negative 5% out-of-the-money put, but I had to pay up 15% for my volatility on that position. So, okay. So, everybody goes, “Okay, VIX is at 10%. And then we walk forward in time. And let’s say two weeks from now, we’ve drifted down towards that negative 5% towards my strike, right?” And VIX, spot VIX, because it’s floating strike VIX, has gone from 10% to 14%. And you go, “Well, the VIX index is up 40%.” And you go, “Not so fast.” I paid 15% for my volatility on that put, and now it’s at 14%. So, I’m actually down 6.7% because that’s what fixed strike is. I’ve paid for this, it’s come down to my strike, but it’s really based on what I’ve paid for that. So, with the higher volatility we’ve seen that’s priced into these options this year, this is what the headwinds are when you’re buying put options in this kind of environment is even though people are looking at spot VIX and that VIX index, which is untradeable, that floating strike versus fixed strike is what are you actually paying? And then are expectations higher or lower?

Meb: So, as you think about, you mentioned 2022 being pretty across the board with some of these strategies, how do you think about position sizing the various strategies and managers? Is it kind of a back of the envelope? Look, we want to have 20% of these four categories, and we’ll rebalance when we feel like it. Is it more complicated than that? How do you kind of put that recipe together?

Jason: Yeah, it’s twofold. So, when we’re looking at just the buying options, I look at the path of moneyness. So, I want to have everything from at the money to out-of-the-money to deep out-of-the-money. So, I’m trying to cover a lot of those path of moneyness, as convexity starts to kick in. And then within those paths of moneyness, we may be overlaying strategies with different monetization heuristics, or slightly different wrinkles to their strategy to make sure we can cover it. And that’s the bulk of our portfolio. So, when we’re actually position sizing those, it’s thinking about that path of moneyness as the S&P starts to sell off, and we want to cover and overlay and overlap that path. But then when we add in these things like vol relative value or vol arbitrage, and then the intraday trend following on the short future side, we start risk-weighting them based on our own internal metrics. But it’s very similar to ulcer index, or what’s the…? Serenity index is the latest one. We’re more looking at downside, right? We’re looking at like Sortino ratios, we’re looking at downside vol, max drawdown, duration to draw down. We risk-weight our managers based on that, on those sides, because you can have better kind of data on that, where you need the path dependency on the option side. So it’s, you’re using a little bit of both heuristics.

But I’m curious, your take is like, what I always argue is like we may be attenuating those based on all of those risk metrics, but over a long arc of history, it always almost comes down to one over N. I mean, obviously, the volatility drawdown’s going to factor into there. But over a long arc history, it’s easy to almost argue one over N. Let’s say, you had, you know, 50% in five different vol arb managers or vol relative value, you could argue just allocate 10% to each and rebalance because, over time, it’s going to kind of equal out.

Meb: What tends to be the reason? And you may not have full enough history for this to be that relevant a question. But when you give people the boot, what tends to be the reason why? Is there not following the rules, getting divorced?

Jason: Yeah. So, this is the hardest question I think there is.

Meb: Buying Dogecoin.

Jason: Exactly. So, it would be super easy, like I was saying, with the SMAs and everything to see their trades in real-time. The easiest answer, everybody goes, “Oh, when they don’t stick to their knit and getaway.” So, if you have long vol manager and they start trading short vol options, obviously, kick them out. Like, that’s an easy cut, right? The other hard problem, though, that is actually even harder than that is what happens if they’re in drawdown and they’re exceeding their max drawdown previously, is the strategy broken? Is the manager broken? Or is it just out of vogue given the path dependency of the sell-off? I think those things are kind of impossible to manage. The other ones that are just kind of outside the box that we’ve had to deal with is if a manager’s in drawdown and their largest clients start redeeming, they might just go out of business. And so then we have to look for replacing them.

This is why, by the way, we follow 30 to 40 managers, and I built a ensemble approach with LEGO pieces, because it’s easy to replace those kind of LEGOs, as people move in and out. And then the only other thing that maybe is a little bit nebulous as well is, if they trade a particular strategy, and this environment has been really good for that strategy, and they are doing poorly, like beyond expected, then that would be a way to really reassess of whether you want this manager in the portfolio. So, I think this is one of the hardest questions. And everybody’s easy answer is always like, “Oh, when they go rogue and don’t say like…” Yeah, that’s an easy fire. The hard part is like, as you know, is, like, when people are struggling for years on end is, like, do you cut them? Or now you’re also… Most managers have high water marks. So, now you’re also crystallizing those losses in a way.

Meb: So, somebody calls you up. They’re like, “Look, I got 60/40, how should I think about position sizing this allocation to this strategy?”

Jason: So, this is always, as you know, this is the number one question. And I always like to say, don’t necessarily listen to what I say, watch what I do. And so when we constructed a portfolio, at a very high level, we’re combining equal amounts of offensive and defensive assets. So, you know, if 60/40 we view as offensive, we need equal amount of defensive assets. And the reason I say that is because these risk-on assets, like 60/40 stocks and bonds is they have huge left tails to them, they have a huge left skew. So, for a decade, they might be making single-digit or double-digit returns. But then also, in your experience, a 50% to 80% drawdown. That’s a huge amount of left tail.

Meb: And to put a bow on that comment, you know, we did a poll… Listeners, every time I say that you should have to drink. We did a poll and the poll was, you know, what do you think the max draw down on 60/40 real after inflation was? And everyone gets it wrong, they’re like 10% to 20%. I think that was even during a 14% drawdown. People were like 20%. And the answer was, I think over 50%.

Jason: I think in 1930s it would’ve been 60…I’ve seen 63% and 67%, but that was nominal, maybe not really.

Meb: Yeah. Two-thirds. I mean, there’s an old, I think, comment I used to make, which is, like, you can’t find a country in the world, there’s maybe one, that hasn’t had a two-thirds draw down for 60/40 real at some point. And maybe it’s Switzerland. There’s was like one that was, I think, 50%. But it’s not 20% is the point. And so I think a year, like this year, surprises a lot of people, not listeners of this show or yours, but other shows, it surprises a lot of people. So, tell me how much do they buy?

Jason: So, then the combination of those offensive and defensive, like I just said, offence has that huge left tail. Your defensive construction, right, has a huge right tail or right skew to it. This is why we want to pair those together. And so the idea that watch what we do, not necessarily what you say is like we’re combining equal amounts of offence and defense. And then below that, we use that Harry Browne four-quadrant model. So, if I have 25% stocks, 25% bonds, I believe we allocate 25% to long volatility and tail risk, and 25% commodity trend advisors. We also hold a little bit of gold and cryptocurrency for that like fiat hedge. But that’s the way we construct the portfolio.

Now, a lot of people are not going to like that, as you know, because it’s reducing that exposure to 60/40, that 25% each kind of model. And so a lot of people worry about that defensive side, reducing their offensive side. But what we can do, and this is why we build it as a commodity pool operator using managed futures and options is it allows us that an unbelievable capital efficiency and that cross margin ability, where we can kind of be offsetting these positions. So, it’s a lot easier for us to in-house apply some of that implicit leverage you get with futures and options contracts. Now, hopefully, you’ll push back to me on leverage. But the idea is, in-house, what we do then is we’re running 50% global stocks, 50% global bonds. Fifty percent are long volatility ensemble, 50% are commodity trend ensemble. And then we’d run 20% of the gold and cryptocurrencies positions. So, our total exposure is about 220% or 2.2X.

Meb: This is for Cockroach?

Jason: Yeah.

Meb: Okay. But let’s say, theoretically, someone is like targeting just for the long vol strategy fund, hedge fund. If someone came to you with 60/40, and says, “Look, I want to replace part of my current portfolio. I’m old. I’m not changing my ways now. I’m not adding gold. I’m not adding other things. I want you guys help me out here. How much should I give you? Is it like 10%?”

Jason: From what I just said with the four-quadrant model is like, okay, half your portfolio should be 60/40, and that’d be 25% in long vol. And that’d be 25% in commodity trend managers. Because you need the commodity trend to offset the bond side, and you want the long vol to offset the stock side.

Meb: Okay. So, they’re going to give you half their portfolio. I like it. You just upsold everyone on the listeners. I think that makes sense. And so many people reach out to me when they talk about something, like, the CTA and the trend. And they’re always asking, despite me, 100% of the time saying I can’t recommend funds. They say, “What do you think about these funds?” And I say, “You should buy multiple because that gets you away from the binary stress of being, like, why is AQR doing amazing or terrible? Why is this ETF doing amazing or terrible?” I feel like because most people will actually secretly want to gamble. Like, they don’t actually want the correct answer, which would be to buy six of them and just move on. They actually like the concept of perfectly picking the right choice. Tell me when to be in and out of stocks.

Jason: It’s ego-destroying. To actually admit that you don’t know the way you and I do and build ensemble approaches, it’s ego-destroying. Where we all want the hero trade, we want to be able to tell our golfing, our fishing buddies, or at a group dinner how great we’re doing, but we don’t talk about our losses. And that’s the way I think that ensemble, like you said, everybody really does actually want to bet because they want to be a hero. And to admit, you can’t predict the future and to broadly diversify is absolutely ego-destroying. And that’s why I don’t think people do it.

But also you kind of set me up in the way about what percentages I do because there’s two ways to look at that is, like, if I’m talking to a financial advisor, and I’m saying, “Give me half your portfolio,” as you know, that doesn’t really work. But if I say, “Give 10% of your portfolio.” They’re going to give that 10%. And then they’re going to forget about me, and I can clip that coupon indefinitely. So, that’s a good business decision. But if I’m honest, it’s not a good balance to the portfolio. It’s not going to be enough to really help you out when these liquidity events happen. So, I’m stuck in that conundrum of, like, “Look, this is what we build. This is what I believe in,” versus what’s a good business decision. And so that’s the other thing is, people always want to give like a tiny allocation to these strategies. Once again, everybody’s got to drink. Because another one of your Twitter polls is like, how many people are allocated to commodities or commodities trend followers? It’s always less than 10%. And what do you think that’s really going to do to your portfolio?

Meb: Way less. It’s something to talk about. There should be a show that’s just like the lie detector. Like, you ask some of these people real answer versus what you do. And the real answer is, like, look, business career risk. I want to be close to the mainstream because I’m going to get fired if I’m too far from the mainstream, but I’ll add these things that will probably help, but I’ll be honest and know that I don’t own enough of them. But if I own too much, I’ll probably get fired. So, there’s some sort of career efficient frontier of advisors that want to do the right things but want to stay employed as well, so.

Jason: There’s one thing… Sorry to cut you off. There’s one thing I do want to address about this portfolio construction and the capital efficiency and using leverage. You know, everybody likes to run away from leverage. But as long as you combine uncorrelated and negatively correlated assets, you can have a prudent use of leverage to make the returns a bit sexier because that’s what people don’t want, you know, in the cash basis of, like, permanent portfolios or portfolios like that, that you showed in the past. On a cash basis, you know, they may clip along at 4% to 5% real over decades, which people should be happy about because they’re outpacing inflation with their savings. So, they should be happy, but they want sexier stuff, as we talked about. The way we think about it is everybody goes, “Okay, in the 2010s, commodity trend followers didn’t do well or whatever.” And I go, “Okay, depending on what index you look at, they may have carried it like 2% CAGR over that timeframe. And I’m like, “If I can stack those in with the rest of my portfolio, then that’s fantastic.”