“I view diversification not only as a survival strategy but as an aggressive strategy because the next windfall might come from a surprising place.” – Peter Bernstein

What is the single most universally held belief in all of investing?

Think about it for a minute.

Our vote would be “Investors MUST own US stocks.”

It has been well established that US stocks have historically outperformed bonds over time, and likewise, US stocks have outperformed most foreign stock markets as well as other asset classes.

How many times have you seen a version of this chart?

Figure 1 – Asset Class Returns

It feels like US stocks have compounded at around 10% for just about forever, and the crazy math outcome is that if you compound an investment at 10% for 25 years, you 10x your money, and after 50 years you 100x your money.

$10,000 plunked down at age 20 would grow to $1,000,000 in retirement. Amazing!

For the past 15 years, it’s been even better than that. US stocks have compounded at around 15% per year since the bottom of the Global Financial Crisis, outperforming almost every asset over this period. This outstanding performance has led to a near universal belief that US stocks are “the only game in town.” Beliefs lead to real world behavior.

Now don’t get us wrong, Stocks for the Long Run is one of our all-time favorite books. Indeed, US stocks probably should be the bedrock starting point for most portfolios.

But it feels like everyone is “all in” on US stocks. A recent poll of Meb’s Twitter followers found that 94% of people said they hold US stocks. That’s no surprise. But when everyone is on the same side of the same trade, well, that’s usually not a recipe for long-term outperformance.

Despite US stocks accounting for roughly 64% of the global market cap, most US investors invest nearly all of their equity portfolio in US stocks. That is a big overweight bet on US stocks vs. the index allocation. (If this is you, pat yourself on the back, as US stocks have outperformed just about everything over the past 15 years, which feels like an entire career for many investors.)

We are currently at the highest point in history for stocks as a percentage of household assets. Even higher than in 2000.

Given the recent evidence, it seems like investors may be well served by putting all their money in US stocks…

So why are we about to question this sacred cow of investing?

We believe there are many paths to building wealth. Relying on a concentrated bet in just one asset class in just one country can be extremely risky. While we often hear investors describe their investment in US market cap indexes as “boring,” historically, that experience has been anything but.

Consider, US stocks declined by over 80% during the Great Depression. Many investors can recall the more recent Internet bust and Global Financial Crisis where stocks declined by around half during each bear market.

That doesn’t sound boring to us.

US stocks can also go very long periods without generating a positive return after inflation or even underperforming something as boring as cash and bonds. Does 68 years of stocks underperforming bonds sound like a lot? Most people struggle with only a few years of underperformance, try an entire lifetime!

So, let’s do something that no sane investor in the entire world would do.

Let’s get rid of your US stocks.

Say what?!

This move will likely doom any portfolio to failure. Investors will be eating cat food in retirement. Right?

Let’s check our biases at the door and try a few thought experiments.

We’ll examine one of our favorite portfolios, the global market portfolio (GAA). This portfolio tries to replicate a broad allocation where you own every public asset in the entire world. This total is over $200 trillion last we checked.

Today, if you round the portfolio allocation, it is approximately half bonds and half stocks, and roughly have US and half foreign. There’s a little bit of real estate and commodities thrown in too, but lots of real estate is privately held, as is farmland. (We examine various asset allocation models in my free book Global Asset Allocation.)

This portfolio could be called the true market portfolio or maybe “Asset Allocation for Dummies” since you don’t actually “do anything”; you just buy the market portfolio and go about your business. Shockingly, this asset allocation has historically been a fantastic portfolio. In the recent article, “Should CalPERS Fire Everyone and Just Buy Some ETFs?”, Meb even demonstrated that both the largest pension fund and the largest hedge fund in the US have a hard time beating this basic “do nothing” portfolio.

Now, what if you decided to eliminate US stocks from that portfolio and replace them with foreign stocks? Surely this insane decision would destroy the performance of the portfolio?!

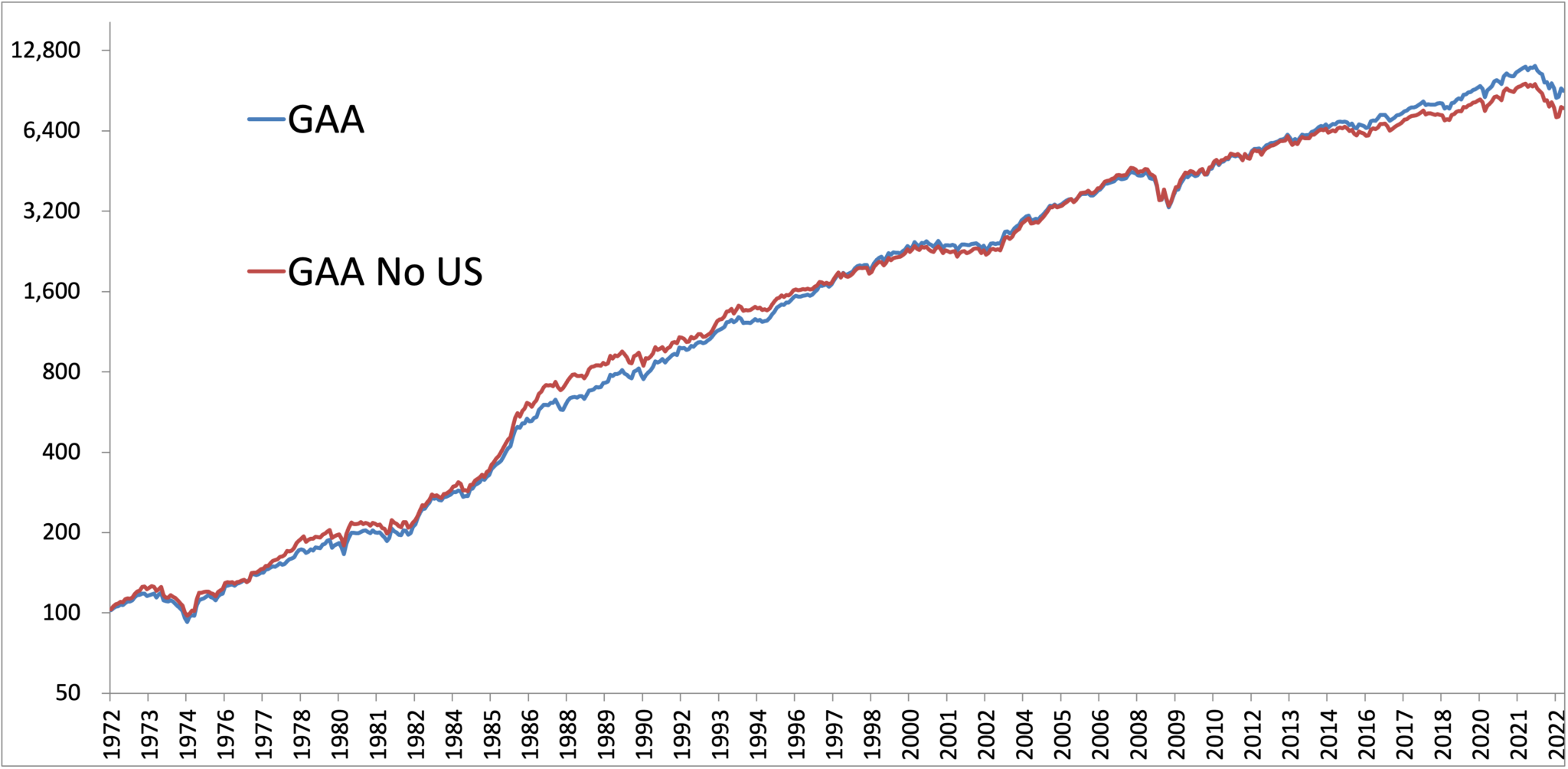

Here is the GAA portfolio and GAA portfolio ex US stocks with risk and return statistics back to 1972.

Figure 2 – Asset Allocation Portfolio Returns, With and Without US Stocks, 1972-2022

Source: GFD

Virtually no difference?! These results can’t be true!

You lose out on less than half of one percent in annual compound returns. Not optimal, but still totally fine. Anytime you reduce the universe of investment choices, the risk and return figures often decrease due to diminishing breadth.

When we have presented these findings to investors, the standard reaction is disbelief, followed by an assumption that we must have made a math error somewhere.

But there’s no error. You can barely tell the difference when you eyeball the equity curves of the two series.

Figure 3 – Asset Allocation Portfolio Returns, With and Without US Stocks, 1972-2022

Source: GFD

If you zoom out and run the simulation over the past 100 years, the results are consistent – about a 0.50% difference.

You likely don’t believe us, so let’s run another test.

Do you remember the old Coke vs. Pepsi taste tests?

Let’s run the investment equivalent to see just how biased you are. Below are two portfolios. Which would you prefer?

Figure 4 – Asset Allocation Portfolio Taste Test, 1972-2022

Source: GFD

It’s pretty hard to tell the difference, right?

This may surprise you, but column A is US stocks. Column B is a portfolio made up of foreign stocks, bonds, REITs, and gold, with a little leverage thrown in. (Our friends at Leuthold call the concept the Donut Portfolio.)

Both portfolios have near identical risk and return metrics.

The surprising conclusion – you can replicate the historical return stream of US stocks without owning any US stocks.

There’s no reason to stop here…

It is very simple to construct a historical backtest with much superior risk and return metrics than what you’d get investing in US stocks alone. Moving from market cap weighted US stocks to something like a shareholder yield approach historically has added a few percentage points of returns in simulations. Additions such as a trend following approach can be hugely additive over time in the areas of diversification and risk reduction. We believe that investors can achieve higher returns with lower volatility and drawdown with these additions. For more details, we’d direct you to our old Trinity Portfolio white paper…)

Despite not necessarily needing US stocks, for most of us, they’re the starting point. They’re nice to have but you don’t HAVE to own them, and certainly not with the entirety of your portfolio.

As the US stock market is showing some cracks while trading near record valuation territory, maybe it is time to reconsider the near universally held sacred belief…

“You have to be all in on US stocks.”