On the podcast with Research Affiliates’ Jim Masturzo, I said that the biggest head scratcher across the investing landscape for me is the fixed income space (the segment starts here).

I really don’t get why people are investing in risky and volatile fixed income markets like corporate bonds and junk when they don’t provide much, if any, yield over T-bills.

Here’s our old paper researching this curiosity, that would still have you 100% in T-bills……

“T-bills and Chill…Most of the Time“

Here is Vanguard on corporates and junk at 0 and 3 percentile spreads last 25 years:

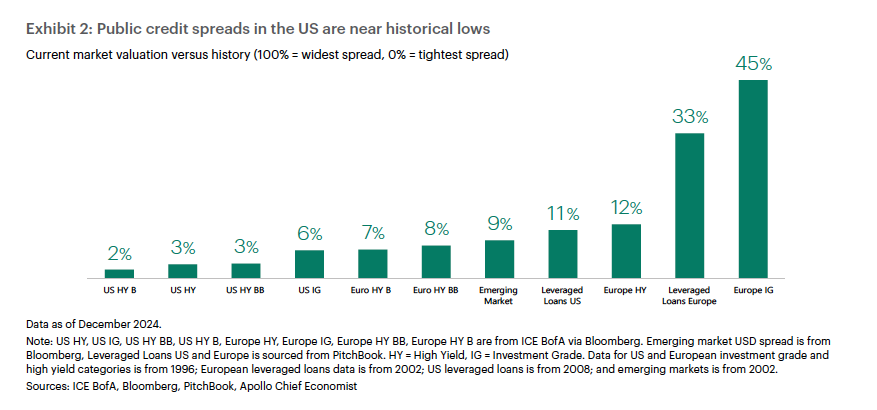

And Apollo too: