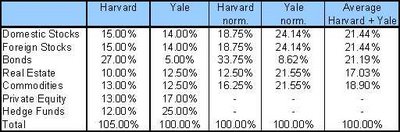

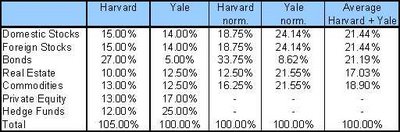

According to the latest updates from the two largest university endowments, Harvard and Yale, the percentages they allocate to various asset classes are located in table below. While the average retail investor does not have access to private equity and hedge funds, he can invest in the remaining five asset classes through publicly traded vehicles like ETF’s and mutual funds. After stripping out the hedge fund and private equity allocations, the remaining asset class allocations were normalized and then averaged between the two universities. The results are a near equal weighting across US Stocks, Foreign Stocks, Bonds, Real Estate, and Commodities.

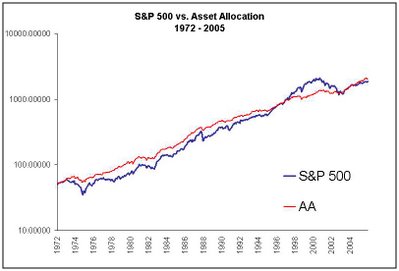

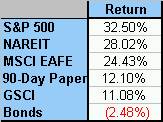

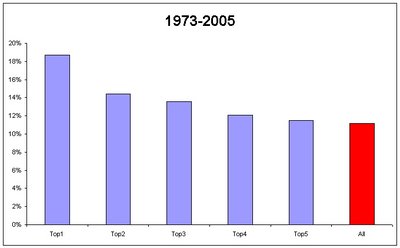

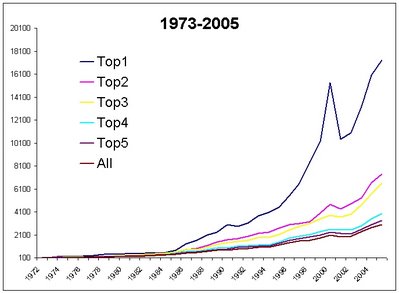

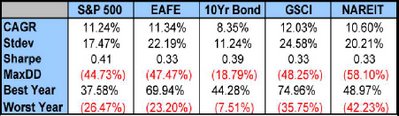

To investigate how a portfolio of these five asset classes would have performed historically, we assign each a 20% allocation, and rebalance the portfolio yearly. The indices used for backtesting are the S&P 500, Morgan Stanley Capital Markets EAFE Index, 10 Year US Government Bonds, National Association of Real Estate Investment Trusts Index, and Goldman Sachs Commodity Index. All are total return series that are updated monthly. The portfolio is referenced as Asset Allocation (AA), and 40 basis points are deducted for management fees to invest in a representative ETF or mutual fund.

As the table above illustrates, Harvard outperforms the AA portfolio by over 300 basis points, but is also more volatile. The higher volatility and subsequent higher returns are likely due to the inclusion of private equity and hedge funds in the portfolio. On a risk-adjusted basis, the AA portfolio is fairly close to the Harvard endowment with Sharpe ratios of .86 and .99, respectively (using 4% Rf). The S&P500 likewise unperformed the Harvard endowment, and was much more volatile. The worst drawdown for the AA portfolio was a pedestrian –11.24%, while for the S&P 500 it was a whopping –44.25%.

As the table above illustrates, Harvard outperforms the AA portfolio by over 300 basis points, but is also more volatile. The higher volatility and subsequent higher returns are likely due to the inclusion of private equity and hedge funds in the portfolio. On a risk-adjusted basis, the AA portfolio is fairly close to the Harvard endowment with Sharpe ratios of .86 and .99, respectively (using 4% Rf). The S&P500 likewise unperformed the Harvard endowment, and was much more volatile. The worst drawdown for the AA portfolio was a pedestrian –11.24%, while for the S&P 500 it was a whopping –44.25%.

To account for the inherent leverage in many of the hedge funds Harvard might invest in, it is instructional to examine what results of the AA portfolio would be if leverage was applied. Including the cost of leverage at the broker call rate, the returns of the AA portfolio leveraged 1.5 times are very close to the Harvard endowment. Volatility is slightly higher than the endowment, although still less that the S&P 500 and with drawdowns half of the S&P 500. A portfolio leveraged 2:1 would outperform the endowment on an absolute, but not risk-adjusted basis.

Sample ETFs to implement this allocation could be:

US Stocks (VTI, SPY)

Foreign Stocks (EFA)

US Bonds (AGG)

Real Estate (VNQ, IYR)

Commodities (GSP, DBC)

Example ET

Example ET

As the table above illustrates, Harvard outperforms the AA portfolio by over 300 basis points, but is also more volatile. The higher volatility and subsequent higher returns are likely due to the inclusion of private equity and hedge funds in the portfolio. On a risk-adjusted basis, the AA portfolio is fairly close to the Harvard endowment with Sharpe ratios of .86 and .99, respectively (using 4% Rf). The S&P500 likewise unperformed the Harvard endowment, and was much more volatile. The worst drawdown for the AA portfolio was a pedestrian –11.24%, while for the S&P 500 it was a whopping –44.25%.

As the table above illustrates, Harvard outperforms the AA portfolio by over 300 basis points, but is also more volatile. The higher volatility and subsequent higher returns are likely due to the inclusion of private equity and hedge funds in the portfolio. On a risk-adjusted basis, the AA portfolio is fairly close to the Harvard endowment with Sharpe ratios of .86 and .99, respectively (using 4% Rf). The S&P500 likewise unperformed the Harvard endowment, and was much more volatile. The worst drawdown for the AA portfolio was a pedestrian –11.24%, while for the S&P 500 it was a whopping –44.25%.