In a recent clip from Saturday Night Live , the show features a news segment titled “Really, with Seth and Amy”. The skit focuses on the recent law difficulties of Michael Vick (who has since been shown innocent). Its quite hilarious (with a nod to the JT skit _ in a box – timely for Valentines Day!), and reminded me of a couple market related items. . .

Momentum, and its trading cousin trend-following, plays a large role in many of the strategies I follow. One example is the current performance of REIT stocks (with today being an obvious exception). Many pundits will go on TV and claim that an asset class (or stock) can’t possibly go any higher (or lower, see 2000-2003 in stocks).

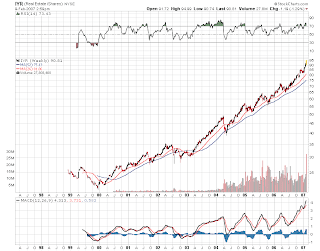

REALLY? How many times on the chart could you have said, REALLY?

Take a look at the chart for the IYR Real Estate i-shares. How many times has the front page of a magazine or newspaper exclaimed that housing is dead and the real estate market is in a massive bubble, etc etc. (FWIW, there is way too much talk of bubbles in general in my opinion. Ken Fisher says it best when he states “It’s not a bubble if people are calling it a bubble”.)

Take a look at the chart for the IYR Real Estate i-shares. How many times has the front page of a magazine or newspaper exclaimed that housing is dead and the real estate market is in a massive bubble, etc etc. (FWIW, there is way too much talk of bubbles in general in my opinion. Ken Fisher says it best when he states “It’s not a bubble if people are calling it a bubble”.)

On a somewhat variant note, billions of dollars have recently been allocated to equal weighted indexes. Are they coming on-line at the wrong time for investors? A look at the S&P 500 sorted by market cap decile reveals that the largest cap stocks are the cheapest by PE Ratios. . .