I think many still do not appreciate the ins and outs of how companies distribute their cash flows. Our last post included a must read on dividends and buybacks, and below I thought I would include a simple table to illustrate my main point (that ignoring either dividends OR buybacks is a big mistake).

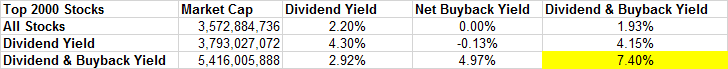

I screened the top 2000 stocks by market cap on Bloomy. All values are median values below, and I took the top 20% by dividend yield and the top 20% by dividend + net buyback yield. (I excluded debt for the final shareholder yield calc as I’m trying to keep this simple). Note that the overall dividend yield for the market is about 2.2%, and the highest yielders are at 4.3% – this is what attracts the bees to the honey. However, what is missed is the net buyback column. Note that the broad universe, the median stock isn’t buying back any shares, and the dividend stocks are actually net issuers! That is what I like to call sneaky dilution – they pay you dividends with one hand, but issue stock with the other hand. In fact, of the top dividend stocks, over half are net share issuers…25 over 4%…

Anyways, note the div & buyback column. These stocks are buying back around 5% of their shares, in addition to the nearly 3% dividend yield. When you add up all the numbers (which don’t add up exactly as these are median values for each column), you can see why the math makes much more sense when you approach the issue holistically….