Reading old investment books is somewhat of a hobby of mine (I know probably need a better hobby). Glancing up on my bookshelf there are titles most have never heard of such as Once in Golconda, The Zurich Axioms, and Supermoney. I was flipping through another book new to me that I found when thinking about titles for my new book (coming in a week or so, promise!) It was called Diversify and was published in 1989.

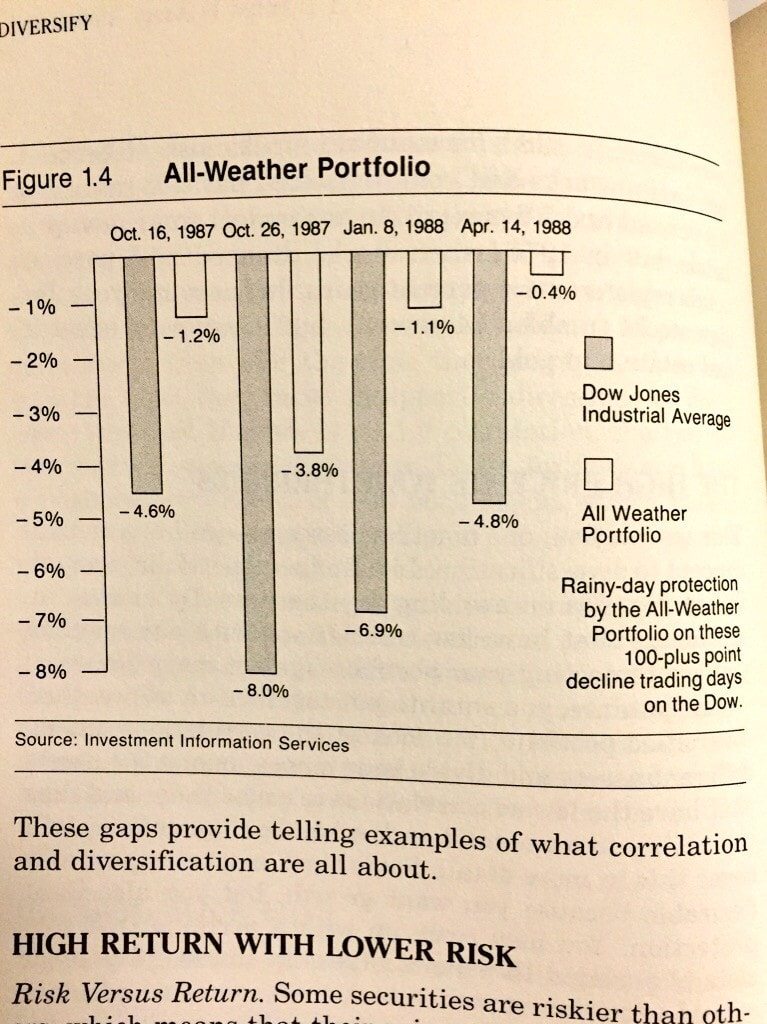

Anyways, I was surprised to see the author propose the “All-Weather Portfolio” that consisted of 30% stocks, 15% foreign stocks, 15% US bonds, 20% international bonds, 5% gold, and 15% T-bills. That portfolio obviously has the same name as Ray Dalio’s fund which launched five years later in 1994. I’m not suggesting Ray copied this book obviously, as it is a very common phrase, but I just thought it would be fun to compare Dalio’s recently suggested portfolio from Tony Robbin’s new book to this portfolio proposed over 25 years ago!

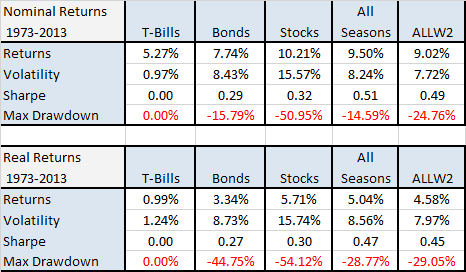

Below are the stats. I named the Diversify portfolio ALLW2. As you can see, they are near clones of each other. That is a good thing in my mind, as a solid diversified portfolio should be very “average” in a sense. But remember, if you’re only doing 5% real a year, fees are your greatest enemy. But what do you spend most of your time on? The asset allocation.