This excerpt is from the book Global Asset Allocation now available on Amazon as an eBook. If you promise to write a review, go here and I’ll send you a free copy.

—-

I would classify both my mother and grandmother as traditional Southern cooks. Their style was very much of the “finger” variety. While they may have a broad recipe to go by, the food usually was sampled with many tastings and the adjusted to the individual’s preferences, etc. I spent a lot of time as a child in the kitchen making chocolate chip cookies with both of them (also known as my chunky years). That style of cooking often reminds me of asset allocation and investing. As long as you have some flour, baking soda, sugar, eggs, butter, and chocolate chips – the exact amount really doesn’t matter. Some people like vanilla in the recipe, other people nuts, and some even more chocolate. But as long as you have some of all of the main ingredients, the results are usually similar, and delicious. (I rarely made it to the final product as I was more of a cookie batter kid.)

Investing is similar. As long as you have some of the main ingredients –stocks, bonds, and real assets- the exact amount really doesn’t matter all that much. Does adding small allocations to emerging bonds (nuts), frontier markets (vanilla), or more chocolate chips (stocks) vastly change the outcome? Not really. The only thing that does really alter the outcome is if you go and mess with all the ingredients while they are cooking – a sure recipe for disaster. The single biggest take away from this book is to not ruin your allocation by paying too much in fees.

Below is a quick summary of the findings from this book. Many of the steps below are similar to the same suggestions we provided in our first book, – The Ivy Portfolio, back in 2009.

- Any asset by itself can experience catastrophic losses.

- Diversifying your portfolio by including uncorrelated assets is truly the only free lunch.

- 60/40 has been a decent benchmark, but due to current valuations, it is unlikely to deliver strong returns going forward.

- At a minimum, an investor should consider moving to a global 60/40 portfolio to reflect the global market capitalization, especially right now due to lower valuations in foreign markets.

- Consider including real assets such as commodities, real estate, and TIPS in your portfolio.

- While covered more extensively in our other three books and white papers, consider tilting the equity exposure to factors such as value and momentum. Trendfollowing approaches work great too.

- Once you have determined your asset allocation mix, or policy portfolio, stick with it.

- The exact percentage allocations don’t matter that much.

- Make sure to implement the portfolio with a focus on fees and taxes.

- Consider using an asset allocation ETF, advisor, or other automated investment service in order to make it easier to stick to the portfolio and rebalancing schedule. Yearly (or even every few years) rebalancing is just fine. Even better, rebalance based on tax considerations.

- Go live your life and don’t worry about your portfolio!

APPENDIX A – FAQs

Where can I find software or a website to backtest my own allocations and strategies?

We send out a basic Excel backtester to subscribers of The Idea Farm that will let you test all of the allocations in this book.

Below are a few free or low-cost options you can access on the web:

You can also download free data sources to Excel and test on your own.

What about other asset classes?

This book is meant to describe the main asset classes that comprise the majority of the global market portfolio. The allocations provided in this piece form the basis for a core portfolio. However, many asset classes are perfectly reasonable in an asset allocation framework to include in the core or perhaps as satellite allocations – MLPs, infrastructure, emerging market bonds, municipal bonds, frontier market stocks, global TIPs, or even catastrophe bonds.

What about “Smart Beta” strategies?

Smart beta is a phrase that refers to strategies that move away from the broad market cap portfolio. (So in U.S. stocks, think the S&P 500 versus a portfolio sorted on dividends or perhaps equally weighted.) The market cap portfolio is the market, and the returns of the market portfolio are the returns the population of investors receive before fees, transaction costs, etc. However, market cap weighting is problematic.

Market cap weighted indexes have only one variable – size – which is largely determined by price. (While not the topic of this book, market cap indexes often overweight expensive markets and bubbles – you can find more information in our book Global Value.) Many smart beta strategies weight their holdings by factors that have long shown outperformance, including value, momentum, quality, carry, and volatility.

Here is a fun interview with William Bernstein on factor tilts. We are big proponents of smart beta and factor tilts applied to a portfolio. Indeed, it is very difficult to beat a portfolio allocated one-third each to a) global equities with a value and momentum tilt, b) bonds, and c) managed futures or a similar trend strategy. We didn’t want to dive too deep into smart beta strategies in this book since we have covered them so extensively in the past.

What about tactical approaches to asset allocation?

We firmly believe there are a number of strategies that work well in tactically managing a portfolio. Our 2007 paper, “A Quantitative Approach to Tactical Asset Allocation,” lays out very simple momentum and trend-following strategies.

What about factors in sector or country rotation strategies?

There is evidence that these strategies can work as well. Our “Relative Strength Strategies for Investing” paper outlines a very simple sector rotation methodology based on momentum and trends. Our Global Value book looks at rotating countries based on value.

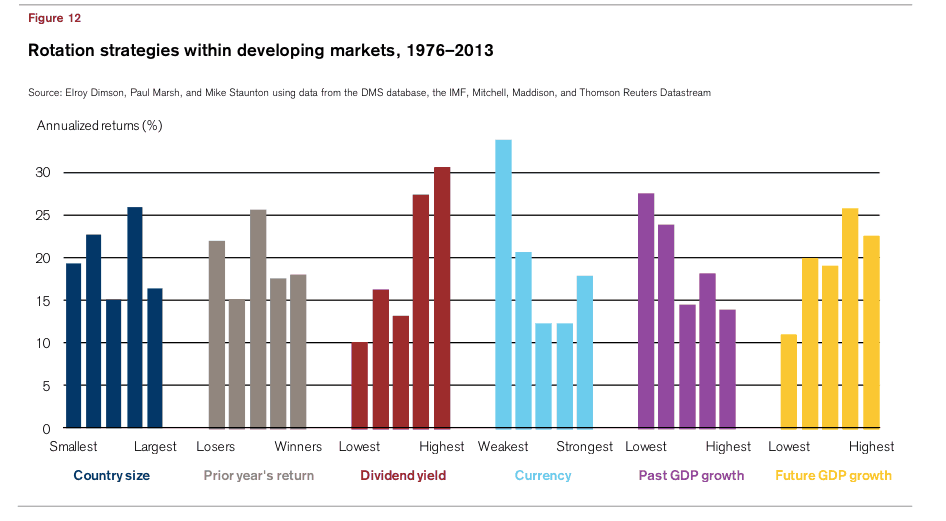

Figure 46 is a graph that looks at country stock rotation strategies based on various metrics. Note: You want the countries with the highest yield, worst trailing currency returns, and worst trailing GDP growth!!

FIGURE 46 – Rotation Strategies in Developed Markets

Source: Credit Suisse

Should I hedge foreign stocks?

We are actually agnostic on this topic, but once you decide on your choice to hedge or not, you should stick with it. Currencies go through periods of under and outperformance, but over time, real currency returns are very stable. The key words being over time.

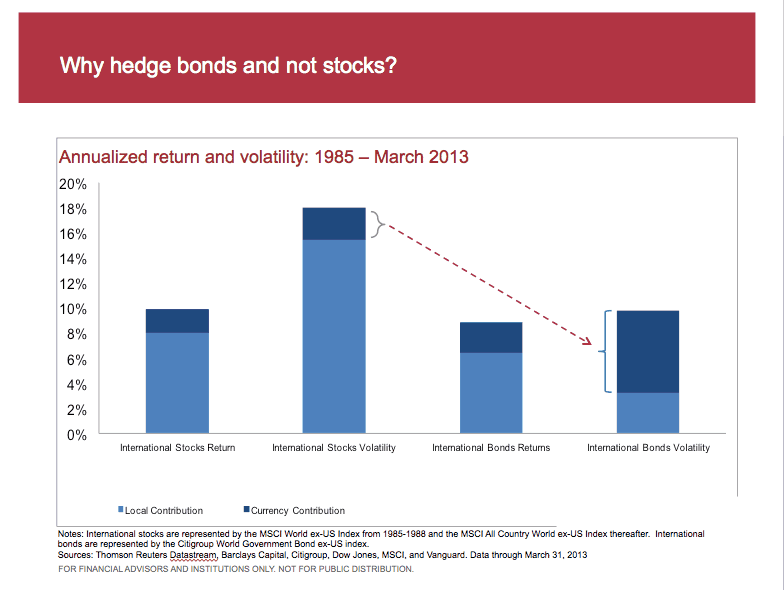

Should I hedge foreign bonds?

Bonds are a little different. Since sovereign bonds in general have lower volatility than stocks, adding the additional volatility of currency returns doesn’t make much sense and therefore hedging foreign sovereign bonds is reasonable. A good Vanguard paper on the topic is “Global Fixed Income: Considerations for U.S. Investors.”

FIGURE 47 – Hedging Foreign Bonds

Source: Vanguard

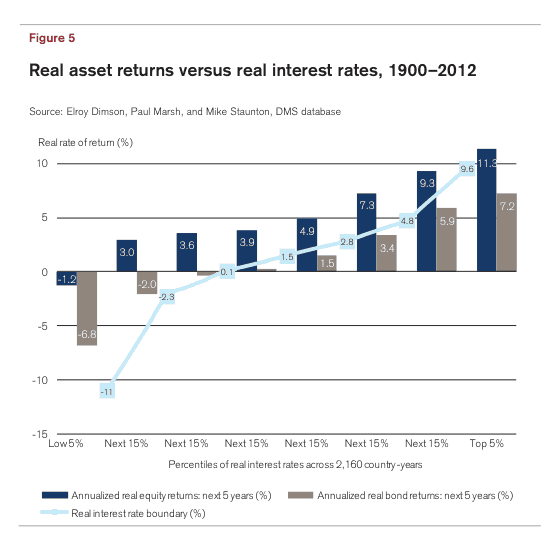

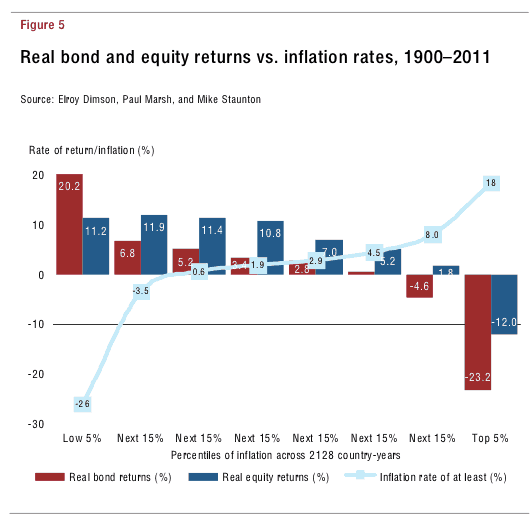

How do stocks and bonds perform relative to various inflation regimes? And what about real interest rates?

Stocks and bonds perform best when inflation is below about 3%. Above 5% inflation and returns fall off a cliff.

The opposite goes for real interest rates, stocks and bonds love rates above 3%. While stocks hold up okay with lower real interest rates, bonds get clobbered.

FIGURE 48 – Stock and Bond Real Returns vs. Inflation and Interest Rate Regimes

Source: Credit Suisse