On of the popular celebrity magazines has a feature called “Stars, they’re just like us!” It shows photos of celebs doing such mundane activities as getting coffee at Starbucks and going on walks with their babies. There is a genuine fascination with celebrity culture (believe me I live in LA), mainly because many of these celebs have attained status, wealth and fame, what many are seeking. But reality is much more dull, and most celebs face the same struggles and life challenges as everyone else. And research has shown that in general, after a basic livable wage, happiness doesn’t increase that much with money (and especially fame).

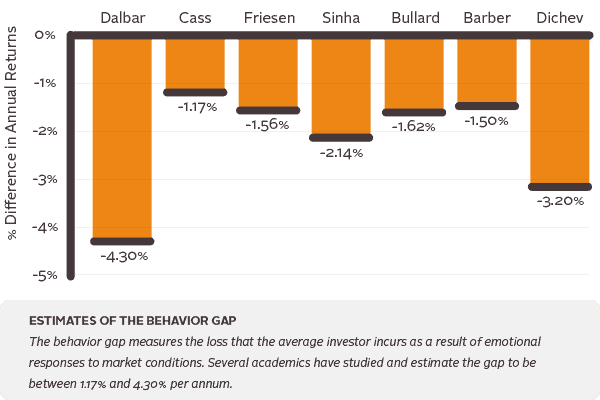

Retail investors get a terrible rap (though mostly deserved) for their terrible behavior. Graphics like the below from AdvicePeriod demonstrate that invdividuals are terrible at timing their investments largely due to emotions of fear and envy.

But are institutions any better? One of the biggest misconceptions in our industry is that investors with a lot of assets are better investors. They’re not. In fact, they often do similarly dumb things that retail investors do, just with fancier names and the backing of committiees and RFPs. Every journalist asks on every call “What is your AUM?” as if that acts as the final validator of your ability. If this were true, many shops that manage in the billions and charge 2% for nothing wouldn’t have any assets. Just try to find performance #s on some RIA sites, it is impossible. (And pro tip to journalists, you can look up any investors AUM online on sites like Brightscope.)

I goto a lot of institutional conferences and while the themes change there is one constant – herding and chasing performance. In the early 2000s it was moving away from market cap indexes (and tech!) and back toward value, in the mid 2000s it was allocating to real assets to protect against coming inflation and rising interest rates, in late 2000s it was tail risk and tactical strategies, in early 2010s it was risk parity, and then low vol and alternative yield assets and MLPs, followed by angel investing and FX hedging now. What’s next?

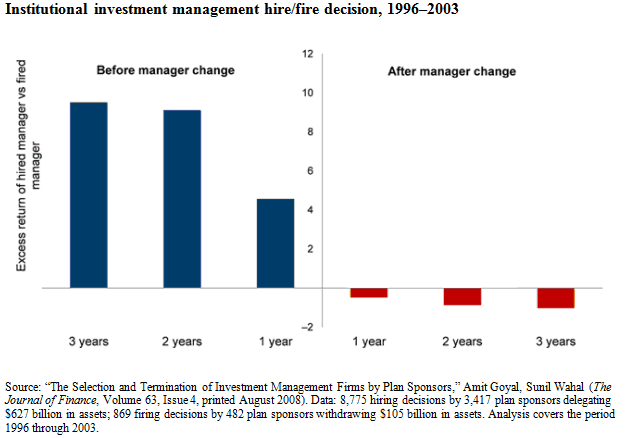

See a theme? If you don’t believe me, look at the below graphic (via Vanguard via A Wealth of Common Sense). It shows 8,800 hiring decisions by 3,400 plan sponsors. They just chase performance. They fire managers that do poorly, then allocate to managers that have done well, who then go on to do poorly. It is a never ending treadmill.

If you read my book Global Asset Allocation you know that your asset allocation doesn’t matter much over long periods. But it matters a ton over short periods. Meaning, it can diverge quite a bit over 5-10 years but over 40 all of the allocations grouped within 1% CAGR of each other. The best and worst strats from my book diverged by 50 percentage points in the 1970s. The worst allocation would have been fired, and the best garnered all the assets.

But what if you picked the top allocation per decade for the next decade, how would that do? (HT to Newfound for the idea.)

It would reduce your return by 1.5% per year, more than the spread of the best performing allocation vs. the worst. And if you remember in the book I said that fees matter more than anything, I’ll add sticking to your plan. Not paying a ton in fees and sticking to your plan contribute vastly more to your return than your asset allocation.

So don’t look to the talking heads and institutions for help, they’re just like us.